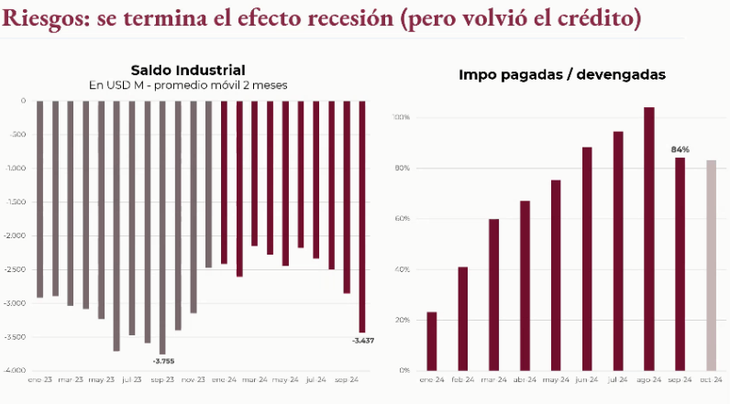

When everyone expected there to be greater pressure on the price of the dollar accumulation of import payments in October, the reality is that this did not happen. It was supposed that in the tenth month of the year the value equivalent to 125% of the accrued imports would be settled, but term paying 84%.

This is revealed by data from the stock exchange company Cohen Argentina that were presented this Wednesday to private investors. This decrease in pressure on official dollars It was possible thanks to the laundering dollars, which generated an increase in loans from companies.

This explains part of the dollar surplus that Argentina is having, at least from a commercial point of view, when in the first half of the year it was thought that the Central Bank’s purchase of foreign currency would stop in the second half of the year.

Milagros Gismondi, economist at Cohen Argentina, pointed out that “when in October we thought that import payments were going to jump to 125% due to the schedule, which included accrued imports plus what remained of previous quotas, the payment ratio dropped to 84%, that is say, that “Credit returned to importers.”

cohen-impos.png

It should be remembered that the Government began in February of this year to implement a schedule for importers of four monthly payments, which was reduced in September to two payments of 50% and then to one of 30 days. In that scheme they began to overlap maturities of the 4 and 2 payment scheme. Last month was the most pressured. But instead of buying the dollars in the official market, the companies went to look for dollars lent to the banks, which now have some new US$14 billion from laundering.

Recession, energy balance and surplus

That, more the recession itself that generates fewer imports, added to the unexpected increase in energy balance at US$5 billion this year, as a product of lower energy imports from Bolivia, generated a combo that resulted an accumulated surplus this year of about US$22,000 million.

Gismondi points out that some US$10,000 million were contributed by agriculture. But he also warns that a large part of the dollars that are being earned through Vaca Muerta are going towards tourism outings.

“What happens is that “The exchange rate appreciation generates greater pressure on the balance of services, especially due to tourism,” he explained. In a normal season, he points out that Argentina can have a negative balance of US$10,000 million in tourism.

Point out that “Of the 900 million surplus in October, US$600 million were from energy, but we had tourism outflows for US$500 million”. This implies that although there are new sectors that contribute that were not previously taken into account, new expenses also appear. “All this is due to exchange rate appreciation,” explained the economist who anticipated that “possibly we will go to a more appreciated exchange rate” even next year.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.