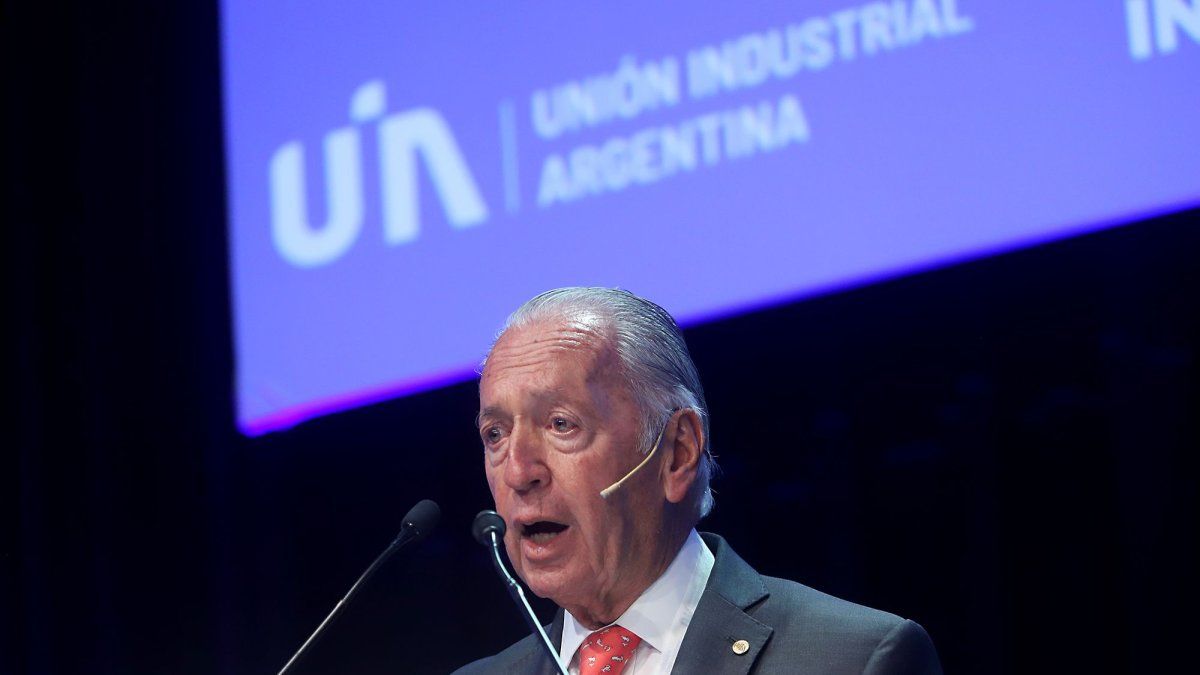

The Minister of Economy, Luis Caputo, and the head of the Argentine Industrial Union (UIA), Daniel Funes de Rioja, will have a fundamental meeting this Tuesday at the headquarters of the Palacio de Haciendawhere the Industrial Investment Incentive bill, which entered Congress this Thursday, will be analyzed. The businessmen ask that it be approved by consensus.

Although they suffered the vacuum that the president gave them Javier Milei at the last Industrial Conference, rather a gesture from the Government that it does not want to accept the slightest criticism of its management, the reality is that In exchange, they are offering them a project that meets the expectations of the industrialists and something more.

It must be remembered that the The gestation of the initiative began in February, when the government promoted the Bases Law and the fiscal package, which included the Large Investment Incentive Regime (RIGI). And the complaint was immediate. A claim for a “RIGI for SMEs”.

what is presented by the Secretary of Development, Juan Pazo, is not specific for small and medium-sized companies (SMEs), since it reaches all sizes of productive investment, but it does cover what the UIA requested and something more.

The labor reform and the RIGI for SMEs

What businessmen What they did not expect is that the Labor Reform that the Government intends to be included in the law. This chapter was tried to be imposed through DNU70/23 and the Justice system “rejected” it.

It is not a minor issue from a political point of view. If the businessmen ask that the law be voted on by consensus, it is not clear if the opposition of Unión por la Patria would be willing to support the idea, with the labor reform thrown out the window.

The initiative returns to the fray with the idea of replacing severance pay with a special fund whose owner is the worker. Also searched give flexibility to vacation periods, that the company could grant at any time of the year.

Also An attempt will be made to reinforce the commitment to the Occupational Risk Law, although this requires the adhesion of the provinces.since the labor jurisdiction belongs to them.

It will be sought that the The fees of those involved in a trial do not exceed 25% and a rate of the consumer price index (CPI) plus 3% will be set for the updating of judicial credits. Provincial judges are unaware of what the Occupational Risks Law establishes, which is national. The forensic bodies are not formed and therefore, the claims always surpass the administrative instance with the Occupational Risk Insurers (ART) and end up in judicialization, where the courts arbitrarily use mechanisms to update the sentences in the face of inflation and forensics end up “hooked” on a percentage of it.

productive investment

The other aspect is that The law will consider “productive investment” those that have a floor of US$350,000 in microUS$600,000 for small ones; the medium-sized section 1, US$3.5 million, those in section 2, US$9 million, and for the rest, US$30 million.

You will be able to access the accelerated amortization of capital assets which allows deduction from Income Tax, There will be accelerated refund of Value Added Tax (VAT) in the case of exporters. Also planned is a reduction of withholdings on exports, in the case of incremental sales abroad.

It is anticipated a tax bonus for new jobs for one year, on account of what is paid for social security. If former State employees are hired, the bonus would be two years.

With all this, Funes de Rioja will have a talk with Caputo. It is expected that the relationship, affected by the warnings from industrialists regarding the imprint to facilitate the entry of imports, without there being any counterweight.

“Inside the factories, we are competitive, from the outside the door is the problem,” point out businessmen from all sectors. They refer above all to the tax burden of the provincial and municipal treasuries.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.