escobar-grafico_02.jpg

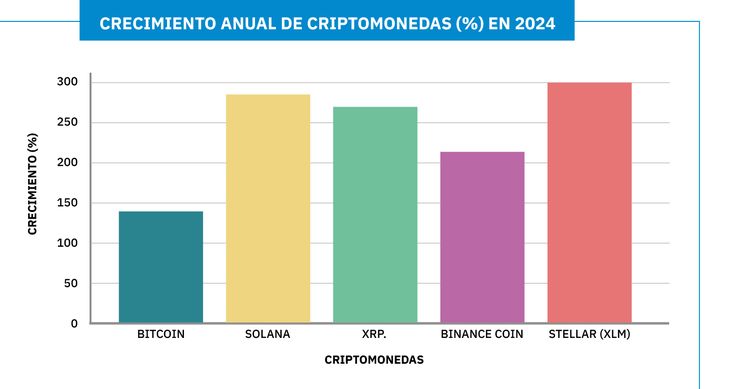

Own elaboration based on Sosovalue data.

Looking ahead to 2025, long-term projections indicate that Bitcoin could set new all-time highs before altcoins warm up for a new rally season. However, despite the optimism around these projections, it is essential to consider the volatile nature of the crypto market.

With 2024 already cooked up, you could say that it was an excellent year for the market. Pablo Montibrand manager for Europe and Latin America at BingXexplains in dialogue with Scope That in 2025, the cryptocurrency industry is poised for significant growth, driven by trends that highlight its maturing ecosystem and expanding adoption.

Monti hopes that next year the stablecoins take center stage in global payments, offering faster, more cost-effective and secure cross-border transactions, especially in regions with unstable currencies. He also anticipates that without a doubt “Bitcoin will maintain its dominancewith growing institutional interest, a possible adoption as an asset of national reserve in the US and its role as a gateway for new investors.”

The technologies that will mark 2025

It will also play a central role tokenization of real-world assets (RWA)such as real estate and raw materials, “a segment that is ready to gain strength” says Monti, which will generate fractional ownership and greater liquidity as regulatory frameworks become clearer, as this would unite “traditional finance with blockchain technology”.

This look coincides with that of Iñaki Apezteguiaco-founder and fundamental analyst of Crossing Capitalwho points out that facing 2025, “the crypto ecosystem is loaded with expectations.” From “stratospheric” projected prices for Bitcoin and Ethereum, to new trends like Artificial Intelligence (AI), RWA and Decentralized Physical Infrastructure Networks (DePIN)so the market promises sustained growth, “but not without challenges.”

Both experts agree that AI and blockchain integration will redefine the technology landscape. Apezteguia highlights projects such as the Artificial Superintelligence Alliance (FET), a collaboration between Fetch.ai, SingularityNET and Ocean Protocol, who are working on a Decentralized Artificial Superintelligence. “This project seeks to challenge the control of big technology companies over AI,” he slips.

For his part, Monti adds that the broader adoption of blockchain in sectors such as gaming, healthcare, logistics and supply chain management will create solutions to real-world challenges, “underscoring the versatility of the technology.” Thus, these trends mark 2025 as a decisive year for the cryptocurrency industry, “where fundamental technologies and revolutionary innovations will converge to reshape finance, technology and the global economy”, he comments.

Bitcoin and Ethereum price predictions

From GoodBit remember that this year the first Bitcoin ETFs. IBIT, the main one launched by BlackRockit took only 211 days to spend the US$40 billion under management of the fund. “It is an absolute record, taking into account that on average the largest ETFs on the US stock market take 1,300 days to reach that capitalization.”

That is why the explosive growth of ETFs suggests a path of consolidation by 2025, with a mix of expansion, innovation and regulation that will transform these instruments into a key component of the financial market linked to cryptocurrencies.

Ramiro Rodriguez of the operations area Finwind analyzes in statements to this medium that the cryptocurrency market shows an encouraging outlook for next year, driven by an adoption that shows no signs of wear, technological advances and “possible modifications in regulation.”

Rodríguez adds that with the arrival of Donald Trump to the White Houseregulatory policies are expected to become more flexible, which could facilitate the integration of cryptocurrencies with traditional banking and e-commerce.

Here is one of the main market catalysts for next year: the appointment of Paul Atkins as new head of the US Securities and Exchange Commission (SEC), replacing Gary Gensler fulfills one of Trump’s main campaign promises to the crypto community, consolidated during his speech at the Bitcoin 2024 conference in Nashville.

During the event, the then-candidate stated that the US must lead in the development of blockchain technology, which is why he promised them “a regulator that facilitates innovation instead of slowing it down“, in clear reference to Gensler and the government of Joe Biden, which was the public enemy number one for crypto market enthusiasts.

escobar-grafico_01.jpg

Own elaboration based on Sosovalue data.

Scope

Monti anticipates a solid 2025 for Bitcoin and Ethereum. “By surpassing the resistance of US$90,000 before the end of the year and establishing support at US$100,000, Bitcoin could fly. Ethereum, meanwhile, will take advantage of Ethereum 2.0 and advances in DeFi to improve its scalability and reduce costs, and regain ground against competitors such as Solarium”, he comments.

Apezteguia puts a price on it and bets on record values of up to US$200,000. The strategist justifies his projection in that the massive adoption of Bitcoin ETFs, which accumulate more than US$1 million of bitcoins and has injected more than US$100,000 million into the market, reinforces its legitimacy as a global financial asset. “This growth is comparable to that of the Gold ETFswhich quadrupled in value in less than a decade,” he points out.

The evolution of the Blockchain and the new use cases 2025

As well explained Ignacio Carballodirector of the Center for Alternative Finance at UCA and Payments and Commerce Market Intelligence, technology Blockchain proves to be much more than a tool linked to cryptoassets as an investment or its price volatility.

And its evolution in recent years is closely related to market cycles, which have been marked by rises and falls. Bitcoin, as the main asset of the crypto ecosystem, leads these dynamics: When its value rises, it drags down the rest of the market, and when it falls, the same thing happens.

Carballo remembers that since 2020, the sector has gone through key moments such as the COVID-19 pandemic, the rise and fall of the previous cycle, and the impact of the FTX crisiswhich generated a significant outflow of funds and a stabilization of the price of Bitcoin for a long time. However, during this period, the industry did not stop and evolved technologically.

“Large institutions such as Visa, MasterCard, JP Morgan, Citi and recently BlackRock They reaffirmed their commitment to Blockchaineven in the midst of adverse scenarios. Among the most notable developments are the initiatives of Visa and MasterCard in blockchain, as well as the introduction of cards linked to decentralized wallets,” explains the expert.

Carballo also highlights significant growth in stablecoins such as USDCwhich is backed by institutions such as Visa, and the recent launch of the PayPal stablecoin. Therefore, by 2025, Carballo hopes that Demand from companies for Blockchain-based solutions skyrockets for specific problems, such as improving settlement systems and optimizing liquidity in networks such as SWIFT.

“These needs highlight the disruptive use of technology to solve structural problems of the financial system. In this context, cross-border payment and the development of decentralized wallets with new functionalities, as crypto-based lines of creditemerge as areas with great potential,” he adds.

About the regulation of the crypto market

At the local level, the National Securities Commission (CNV) is working on a regulation that will be known in the first quarter of 2025. When thinking about it, Ezekiel Vinson, of the legal area of Finwindanalyzes that now that the public consultation period on General Resolution No. 1025 has ended, it is expected that the legal framework under which Virtual Asset Service Providers (PSAV) must operate will be established, assigning them a new category of agents regulated by the CNV, comparable to the ALyCS.

“The proposed regulations transfer to PSAVs various requirements that traditional agents currently meet,” adds Vinson, who highlights that since the end of March, PSAVs have already been regulated by the Financial Information Unit (UIF), particularly in relation to to the prevention of money laundering and the financing of terrorism.

When analyzing what is missing to advance on that path, he maintains that it remains to be determined If the Central Bank (BCRA) plans to establish regulations for virtual assets in relation to the payments vertical, an aspect that, for now, is not within the scope of the CNV.

For his part, Apezteguia indicates that despite the optimism, The crypto ecosystem faces challenges that cannot be ignored if mass and sustained adoption is to be achieved.

He points out that the lack of unified global regulation is maintained as one of the biggest obstaclessince the absence of clear standards limits the participation of large institutions and “generates uncertainty in the markets,” he says. Furthermore, we must accept that there is still a significant gap in cryptocurrency education. “Many people are unaware of the practical value these assets can offer, which delays their widespread acceptance,” he says.

Finally, Alejandro Estrin, country manager of OKX Argentina, notes that looking ahead to next year, macroeconomic uncertainty and the potential for more geopolitical shocks can generate volatility and setbacks. And the pronounced increases in the price of cryptocurrencies were characterized by setbacks, “and we need to be prepared for similar situations,” he says.

Therefore, In this market, falls are possible on the way to new historical highss, and it is up to the community to be vigilant. “The rapid advance of the market means that corrections could be pronounced, even with the general uptrend, so risk management is essential,” concludes Estrin.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.