The “Santa Claus rally” or Christmas rally is a well-documented trend in the stock market in which prices tend to rise from December 26 to January 2. With the S&P 500 historically scoring an average of 1.3% during this period, stock prices have risen about 79% of the time, making it a closely watched event.

Although it does not guarantee future performance, the Santa Claus rally offers one more opportunity for traders to observe market movements and learn about seasonal patterns. However, the stock market was up 27% ahead of the last Federal Reserve meeting of the year, so the question that arises is whether a correction is coming.

Is it the Grinch’s fault? Wall Street is increasingly skeptical about year-end holiday enthusiasm, with the stock rally taking a breather last week as markets prepare for the Federal Reserve’s final meeting of 2024.

Investors Expecting Tech-Led Bull Market to Drive More Stocks in December They have been mostly disappointedraising concerns about possible market fragility and leaving value stocks in the S&P 500 index on a record losing streak.

The Dow Jones Index recorded its seventh consecutive session of declines on Fridayits longest losing streak since February 2020. Talk of a “delayed” correction also resurfaced, especially with the Federal Reserve expected to approve another small interest rate cut this week, before shifting to a faster pace. slow monetary easing next year.

“I would love to see a significant correction in stocks,” said Talley Leger, chief market strategist at Wealth Consulting Group. Leger still expects stocks to experience the typical year-end rally due to holiday shopping and seasonal sentiment, but believes “we could have some turbulence in 2025.”

Correction Monitoring The S&P 500 Index closed virtually flat on Friday, but still on track to achieve consecutive annual gains of more than 20% in 2024 and 2023an impressive feat considering Wall Street’s widespread recession fears at the start of the year.

I activated thems do not always rise continuously in bull marketsbut this has not registered declines of at least 15% since October 2022, according to data from Dow Jones Market Data. The last time there was a period of more than two years without a drop of that magnitude was between 2011 and 2018.

What’s more, for every dollar invested in the stock market’s SPDR S&P 500 ETF Trust – SPY in November, 31 cents would be allocated to the small group of powerful mega-cap tech stocks known as the “Magnificent Seven,” underscoring the unbalanced nature of this bull market. “I would prefer to be opportunistic,” said Laut, about his strategy for 2025.

Signs of the 90s

Wall Street expects the Federal Reserve to cut its benchmark interest rate by another 25 basis points on Wednesday following a two-day policy meeting. Federal Reserve Chairman Jerome Powell has made efforts not to surprise markets during his tenure at the helm of the central bank since 2018. Powell has also made fighting inflation and encouraging a soft landing for the economy a priority. the pillars of his second term at the Federal Reserve, which will not end until mid-2026.

“This environment feels a lot like the mid-1990s,” said Wealth Consulting Group’s Leger, noting the “preparation for technology mania 1.0” and when the Federal Reserve was cutting rates in a “fairly favorable economic environment.” In that sense, Leger believes the Federal Reserve will take a more selective approach to cutting rates at its meetings next year, especially if inflation continues to look “sticky” or “persistent.”

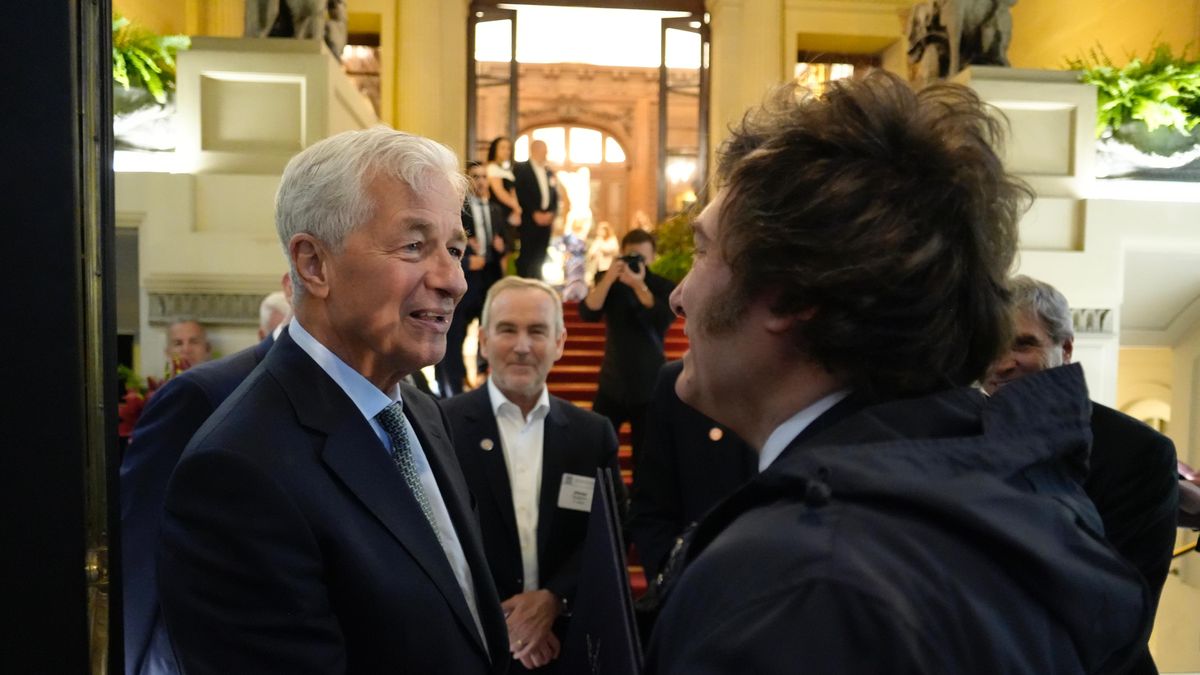

wall street markets bags usa

Correction in sight? The Santa Claus rally and the market’s uncertain future ahead of the latest Federal Reserve meeting.

Reuters

The odds favor the Federal Reserve cutting its short-term rate to a range of 4.25% to 4.5% this week, about 1% above the range it many on Wall Street now think it will become their “terminal range”. While the central bank under Chairman Alan Greenspan cut rates in 1998 after the collapse of Long-Term Capital Management, it also quickly raised them to 6.5% in a failed attempt to cool the dot-com bubble.

“There are certain indicators that show that inflation is not going as fast as expected,” Cipolloni said. “The market wants flexibility, it wants cuts, but the problem for all this is going to be yields,” he added. “Everyone wants lower returns, but, man, it’s going to be tough.”

On the agenda, the Federal Reserve’s rate decision on Wednesday will be the main event of the week, followed by the central bank’s preferred inflation index, the November PCE, on Friday. There will also be updates on the manufacturing sector of the economy on Monday, followed by retail sales on Tuesday and construction permits on Wednesday. Revised second quarter GDP will be released on Thursday.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.