Howard-Marks in 2021 equated bitcoin with gold as an investment instrument jpg.jpg

Today Howard Marks equates bitcoin with gold, as an investment instrument to hedge in times of uncertainty

Howard MarksPersonal fortune, US$2.2 billion. His fund, Oaktree Capital Management, controls assets of $205 billion.

Jamie Dimon. Personal fortune, $1.6 billion, as CEO of JPMorgan Chase he is responsible for assets of $4.21 billion.

Larry Fink. Personal fortune of around US$1.2 billion, as president and CEO of BlackRock he is responsible for assets of US$10 trillion.

Ken Griffin I was wrong.jpg

In 2019 Ken Griffin made a 180º turn and began betting on the crypto world. Your mistake: privileging Ethereum over Bitcoin

The truth is that the list could be longer, but these seven are enough. Their personal fortune amounts to more than US$285,000 million, and they command assets of more than US$15,697,000,000,000 (US$15.7 trillion).

They didn’t understand anything, or they didn’t want to understand it

Beyond their money, power and influence, what brings these men together is the horror and contempt they once showed for cryptocurrencies and in particular Bitcoin

JAmie Dimon opportunism.jpg

Jamie Dimon, after threatening to fire JPMorgan employees if they operated Bitcoins, ended up surrendering to the facts and today the Bank is one of the largest operators in the crypto world.

“One of the most speculative and volatile investment vehicles ever created.” “Bitcoin is just a greater fool theory type investment.” “Bitcoin is a fraud… worse than tulip bulbs.” “I am going to fire them in a second (anyone I find trading cryptocurrencies), for two reasons, it is against our rules and they are stupid, both are dangerous.” “They are a Ponzi mechanism.” “They are an index of money laundering.” “Let’s face it, it’s a cry from the Jihadists that we don’t believe in the dollar.” “Bitcoin is probably rat poison squared.” “Something like Bitcoin is a gambling token, and has no intrinsic value.” “It is basically speculative. People are thinking, ‘I can sell it at a higher price,’ so it’s a bubble,”….

ray dalio this year.jpg

Ray Dalio is another of those who denigrated Bitcoin and today they equip it with gold in the face of what they see is an uncertain scenario for risk and debt.

After all these diatribes and insults – it doesn’t matter who said what – some changed their minds… if they hadn’t already done so before their display of holy indignation. Others, more cunning, continue in the same way, but as soon as we scratch their wallets a little we find that their money does not follow their words and they have more than one crypto or investments in “ad hoc” companies.

In just 15 years, Bitcoin went from being worth US$0.09 (it appears on January 3, 2009, but has actually been listed since July 18, 2010) to exceeding US$107,700, with a capitalization that exceeds US$2,000,000,000,000 (half the value of the entire crypto market).

Larry Fink turned around.jpg

Larry Fink says he has become convinced of the benefits of crypto-instruments through study and analysis (do we believe him?).

This is seven times more than the fortune of those who once criticized the achievements of Satoshi Nakamotoand one thirteenth of all the money they control.

How can it be that the most powerful and informed men in the world “missed it” or “arrived late”?

If this proves anything, it is one of the “beauties” of the financial market, where we are all equal and the wealth and contacts – leaving aside that this does generate the possibility of entering into “unsanct” maneuvers -, especially in a truly free market As is the case with crypto, they do not guarantee anything.

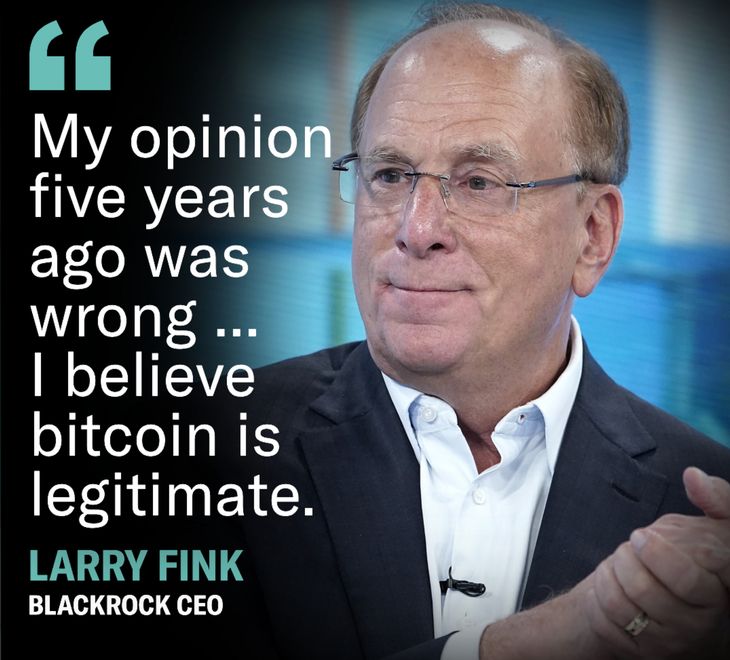

In 2024, bitcoin gained dominance over other cryptocurrencies. Ethereum gave way to Salana and others.jpg

Although many saw it in decline, in 2024 Bitcoin gained ground (Dominance) compared to other cryptocurrencies. Ethereum, gave way to Salana, which is today the second most “popular”

Sharpening the pencil we see that Fink, Buffet, Gates, Marks and Dimon have publicly declared themselves as Democrats, while it could be said that Dalio always played for both sides and only Griffin is a Republican. The political trend could then explain – even if only in part – the horror that the former have expressed for an instrument that neither they nor the state can control, to the point of clouding their vision as businessmen (they made a mistake with BTC, they erred with Trump).

Although there is no precise information, Nakamoto – who still remains anonymous – would have about 1,100,000 bitcoins in his “wallet”, which as far as is known has not moved since 2010. At today’s values this is more than $117 billion, which would place him as the twelfth richest person on the planet.

00Buffett-Gates-dairy-articleLarge.wbuffet and bill gates.webp

Warren Buffet and his friend Bill Gates are among the few who never recognized that cryptocurrencies have a place in the world of investment (“The Old Man,” however, has invested money in the activity)

If the promises that are accompanying the assumption of donald trump are fulfilled, the bubble has not yet been burst – the price of bitcoin seems to grow through speculative bubbles – and next year bitcoin exceeds US$140,000, let us not be surprised if Sakamoto -whoever it is-, displace one of his fiercest critics from sixth place among the richest in the world: Warren Buffet.

Idols with feet of clay

Since we are in the season of the Christmas holidays, a biblical reference is in order. In passage 2:26:45 of the Book of Daniel, in the Old Testament, the prophet relates that King Nebuchadnezzar had had a dream, in which a gigantic statue with a head made of gold, a torso made of tin, hips in bronze, the legs of iron and the feet of baked clay, it was hit in its lower part by a small stone that was rolling, delaying it and breaking it into a thousand pieces.

bitcoin A peer to peer electronic cash system.pdf

Entering the Crypto world, without at least doing the basic homework such as analyzing the work of Satoshi Nakamoto that gave rise to everything, only guarantees that in the long or short term, we will lose money. Doing your homework barely improves your chances, but it doesn’t guarantee anything.

The figures we mentioned before are followed almost religiously – I can include here other local critics of cryptocurrencies such as Juan Carlos de Pablo, Ricardo López Murphy, Claudio Zuchovicki, Ricardo Arriazu, Carlos Melconian, etc. -, in some cases, such as the of Warren Buffet, with a fanaticism that surpasses that of the jihadists.

Untitled-5.jpg

Although he never revealed who he is, Satoshi Nakamoto, the twelfth richest man on the planet, was active during the first years of Bitcoin, supporting its creation, leaving a whole series of clarifications and teachings.

Except for “The Oracle of Omaha” and his friend “The Party Boy” Gates, the others have ended up publicly acknowledging their mistake in despising bitcoin and associated financial instruments (being partly responsible for the current crypto rally).

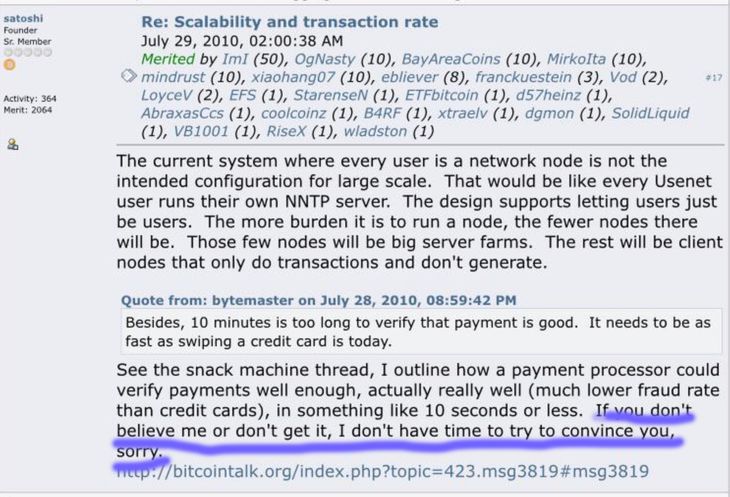

These “mea culpas” try to hide the fact that their vision of the market and society is outdated; They were never more than idols with feet of clay. As Satoshi Nakamoto warned some time ago: “If you don’t believe me or understand it, I don’t have the time to try to convince you… forgive me.”

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.