The results emerge from the latest report on bilateral trade between both countries, prepared by the Argentine Chamber of Commerce and Services (CAC), that point to a strong boost in year-on-year terms in exports to Brazil: in November, national products were sold for US$2,468 million, a 27.9% higher than the same month in 2023, when sales had been for US$1,930 million.

On the other hand, in November 2023 the imports of Brazilian products They were for a total of US$1,275 million and in one year they went through a year-on-year growth of 30.9%. In this framework, the trade balance for Argentina was in deficit due to US$81 milliona panorama that becomes extensive throughout this year for a total of US$256 milliondespite the increase in Argentine exports (11.1% in the first eleven months of 2024) and the fall in imports from Brazil (20.7%).

Added to that is the general decrease in exchange between both countries by 17.2% in relation to October 2024considering a deterioration in exports of around 16.6% and of imports by 17.8%.

Ford automotive industry auto parts

The automotive industry supports a strong flow of commercial exchange between both nations.

Argentina – Brazil trade: main items

The main impulse of interannual growth of Argentine exports to Brazil correspond to the items of the agro (unshredded wheat and rye), automotive (motor vehicles for transporting goods, passenger motor vehicles, motor vehicles and liquefied propane and butane). Argentina is the third Brazilian global supplier, behind the conglomerate China, Hong Kong and Macau (US$5,513 million) and USA (US$3,046 million).

Likewise, the main Brazilian imports from our country come from the increase in passenger car vehiclesmotor vehicles for transporting goods, piston engines, road vehicles and parts and accessories of motor vehicles. Argentina is the fourth world buyer of Brazil’s industry. The first three are China (US$6,082 million), the United States (US$3,644 million) and the Netherlands (US$1,301 million).

Argentine companies analyze how to compete against Brazil with the backward dollar

The revaluation of the peso against the dollar complicates the equation, according to businessmen who point to the taxes and labor costs. In the case of salaries, a study carried out by the Techint group among its plants in the region reveals that, in Argentina, the labor cost of an hour of work in the steel sector is US$16.5while in Mexico, US$12.5 is paid, in Brazil, US$10.3 and, in Colombia, US$4.5.

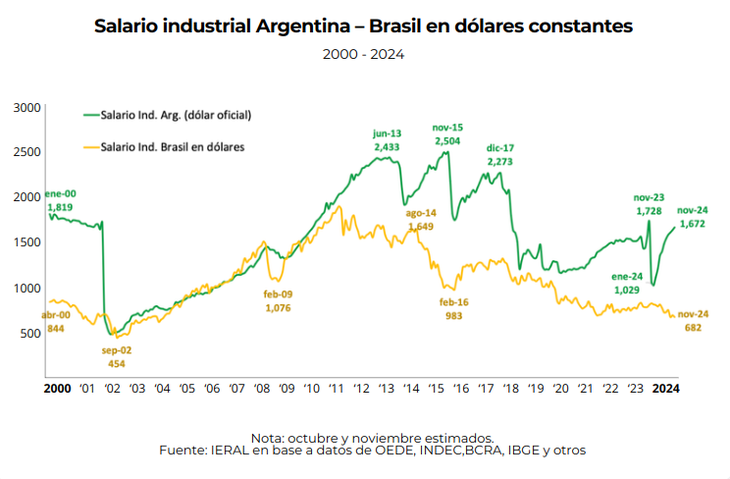

salaries industries.png

The difference against the main competitor in Mercosur, Brazil, is 60% in favor of the neighboring country. And it is detailed that in Argentina the person charges 67% of the total work cost. In that sense, according to the Mediterranean Foundation, Following its 2017 labor reform, Brazil not only reduced its labor costs, but also It made it possible to reduce labor informality, which went from 46% in 2016 to 39% in 2023.

The study says that, “when the evolution of industrial salaries in Argentina and Brazil is analyzed, in constant dollars, a marked contrast emerges, while Argentina experienced strong fluctuations, the industrial salary in Brazil maintained a more stable trend over time.”

“In particular, in recent years, Salaries in Argentina have shown a drop in dollar termsboth official and parallel, reflecting internal inflation and the devaluation of the peso against the dollar,” the study indicates. But, with the revaluation of the national currency, things changed.

The Mediterranean states that “The most recent panorama shows that, in November 2024, for every $1,000 of labor costs in Brazil, Argentina faces $2,840”. “This gap continues to grow, driven by the lack of deep reforms and the disconnection between the regulatory framework and market needs,” the report maintains.

In that sense, he points out that it would be necessary “a scheme that allows the microenterprises are exempt from applying sectoral agreements and only follow the Employment Contract Law and the Minimum Living and Mobile Wage.” That, he points out, “could be a first step.” “In addition, offering the possibility of disengaging SMEs from sectoral collective agreements to negotiate directly with their employees could improve working conditions and their competitiveness,” the study indicates.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.