This year ends as an exceptional cycle for the Argentine financial market, with a revaluation of stocks and bonds that, in many cases, exceeded 100% in dollars. And the country risk broke through 700 basis points and shows the potential to extend the decline. For its part, the S&P Merval in dollars (to the CCL) reached its highest point in history, exceeding 2,273.25 points. A stock market party, without a doubt.

Of course, for the bonanza to continue, some conditions must be met for 2025, which means that the Government can’t move an inch of its road map drawn up so far. Otherwise, problems could arise that will influence the mood of the market, which until now has been so satisfied with the economic plan.

To begin with, the main “drivers” that the market sees to follow in 2025 include the advance of the fiscal adjustmentthe orderly dismantling of the stocks and the result of the legislative elections. At the same time, the possibility of some black swans appearing on the horizon forces investors to remain alert and diversify risks.

2025 under the magnifying glass of experts

Ignacio Sniechowskihead of Equity of the Investing in the Stock Market Group (IEB) slide into dialogue with Scope that, according to his analysis, 2025 will once again be a good year for Argentine equities, although he expects more normal returns than those that occurred in 2024. The strategist highlights three key points to follow closely to avoid turbulence:

- Let the Government continue with its management: consolidate the fiscal surplusextend the decline in inflation and maintain the political management that it exhibits.

- Key: a potential agreement with the International Monetary Fund (IMF) -or some other international credit organization- that strengthens the reserves of the Central Bank (BCRA) to be able to get out of the trap. This will allow Argentina to once again be an emerging market, “which impacts equity” (sovereign debt runs on another track, that of rating). In addition, a more solid situation of international reserves would further support plus the drop in country risk, which feeds back into the potential rise in the variable income.

- The midterm elections: although the ruling party puts little at stake –only two seats in deputies– and, therefore, has more to gain than lose, “it will be important that he makes a good election to validate popular approval.”

For Sniechowski, if the scenario proposed in these three points is favorable and no external shock occurs –black swan effect– and that it is an imponderable, “the conditions for a good year in variable income returns are given from the macro and that will be transferred to the micro: sales, margins and profits of the companies,” concludes the expert.

PPI 2.jpeg

Source: Personal Investment Portfolio (PPI).

“Overweight”, on Argentine sovereign debt

And a rise of such magnitude as the one experienced by Argentine assets scares even the most seasoned investors. However, Melina Di Napoliproduct analyst at Balanz Capitalratifies the “Overweight” (OW) position for Argentina. This means, in a nutshell, that it recommends allocating greater exposure to the market due to its good performance or positive projection.

This is based on the fact that Argentina outperforms other emerging High Yield (HY) credits, or also known as high yield bonds, with solid foundations that support the broker’s OW position. And he adds that this occurs despite the meteoric rise of 2024. “We maintain OW due to four factors macroeconomics”, explains the analyst:

- May the fiscal anchor remain strong.

- An economic rebound in 2025 and a downward trajectory of inflation, which would likely consolidate the Government’s popularity ahead of the mid-term elections.

- The prospects for the accumulation of net reserves improve and the conditions for the relaxation of capital controls and the possible closing of an agreement with the IMF should also improve,” he explains.

- The expected boost in energy exports and mining Foreign Direct Investment (FDI) will imply lower external financing needs from 2026. “Our position is also based on our opinion that recovery values in a restructuring scenario would have a relatively high ground throughout the curve,” he indicates.

Stocks 2025: risks and opportunities

Martin D’Odoricodirector of Guardian Capitalagrees with the cited analysts and mentions as drivers “fundamental” that could influence both equities and fixed income to the fiscal surplus and the need for political support; the dismantling of the exchange rate; legislative elections and their impact on stability.

Regarding the disarmament of the stocks, the expert indicates that, although it is planned for 2025, “The challenge lies in implementing this opening without putting the health of the BCRA’s reserves at risk.”. It happens that “disorderly management could lead to an abrupt exchange rate jump, which would impact inflation and shake investor confidence,” which would imply the appearance of a black swan.

On the contrary, it analyzes that a gradual and planned exit from the stocks, accompanied by a consistent monetary and fiscal program, “could strengthen macroeconomic stability and consolidate the attractiveness of fixed income in local currency.”

D’Odorico recalls that one of the main drivers of optimism is the continuity of the fiscal surplus. “To sustain this course, it will be key for the Government to obtain support in Congress, which will allow deepening public sector adjustment policies,” he indicates.

And, according to his estimation, this commitment to fiscal balance could pave the way for a gradual reduction in taxes, encouraging private investment and economic reactivation. “However, the lack of political consensus or a brake on these measures could generate uncertainty and put pressure on financial markets,” he warns.

Wait until December passes and we’ll see.

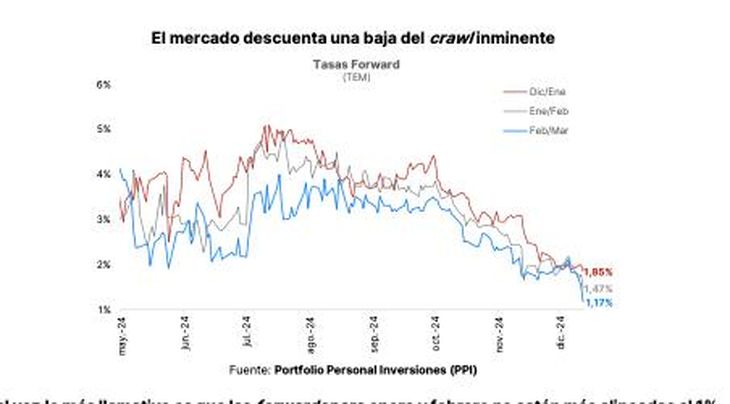

For Pablo LazzatiCEO of Insider Finance“the rate in pesos will be the main economic driver in the short term.” And, as he explains well, if the rate drops to 30% or 25%, it will be a clear sign that inflation continues to decline, which in turn allows a reduction of the “crawling peg” to 1% per month.

Lazzati recalls that it is projected that in 2025 the Consumer Price Index (CPI) will end up around 25%, with some estimates even below 20% annually, “which would show that a rate of 35% is high and should maintain its downward path.”

PPI 1.jpeg

Source: Personal Investment Portfolio (PPI).

However, for the strategist it is necessary to go through December to be able to see more clearly the decision of the economic team on the rate, since as he analyzes it is usually a month that seasonally drives the demand for dollars and puts pressure on the exchange rate (MEP in the range of $1,150-$1,175). “For this reason, it is unlikely that new rate cuts will be announced in the short term to avoid stimulating appetite for the dollar. However, if the Government maintains the current course, logic indicates that the rate reduction will resume in January,” he concludes.

Thus, 2025 is emerging as a key year to consolidate the progress of the financial market, with positive expectations but also significant challenges. And the scenario is not without risks. Factors such as a messy exit from the stocks, the lack of political consensus or external shocks —“black swans“—could alter current optimism and put pressure on markets.

Or as Di Napoli indicates, the main risk for this story It is a sharp decline in the popularity of the Governmentwhich would weaken the credibility of the fiscal anchor. “A political crisis that – in the context of a strong exchange rate – triggers a sharp exchange rate jump and derails inflation,” which, with a worsening of the fiscal situation, would imply greater probabilities of a debt restructuring.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.