As pointed out Scopeanalysts consider that it is still early to know and that it will depend on how the dollar moves in the coming days. Although they point out that the recent rate cut leaves less room to get excited about returns in hard currency. “The rise in the CCL erased almost four months of carry trade gains, making it clear, once again, that carry trade investment strategies have these risks. Yes ok This does not mean that profits can no longer be made with carry trade positions, what happened serves to show that the strategy carries risks.”warned the SBS Group in a report for your clients.

The dollar and official intervention

Thus, the Government decided to go out and mark the field. After a November without intervention and after a couple of wheels in which he let the contributions run, The BCRA put some US$200 million on Wednesday to contain the escalation of the MEP dollar and the CCL. From then on, the tension eased in the next two wheels.

image.png

“We believe that the recent rise in the CCL (which took the gap with the spot from 5% to 12% at the close of Wednesday) is not out of script nor does it substantially change the macro outlook, as long as it does not extend over time. AND “We assume that the Government will seek to prevent it from spreading so that inflation expectations are not affected.”said the consulting firm 1816.

Although net reserves remain in very negative territory, there is agreement among analysts that, due to recent foreign currency purchases, the BCRA has the liquidity to sustain the intervention. For example, 1816 proposed that the entity chaired by Santiago Bausili can take advantage of the fact that the emission derived from these purchases took the broad monetary base to exceed $48 billion (the ceiling set by the monetary policy framework is $47.7 billion) to continue selling reserves in the MEP (and sterilizing pesos) until returning it to the determined target level.

Pablo Moldovandirector of the consulting firm CP, hopes that the BCRA remains active to try to prevent the financial cycle cycle from reversing abruptly. In dialogue with Ámbito he indicated that Interventions on parallel dollars will ensure that tensions do not lead to “contagion to the official market”which reverses the currency purchase cycle.

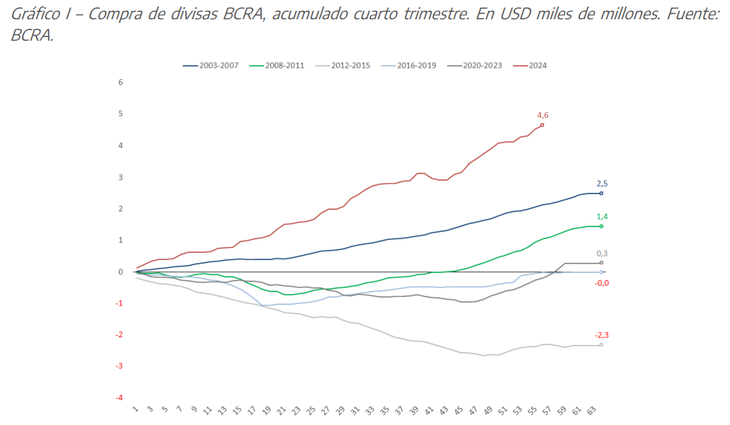

For the moment, the purchasing balance was not affected. In the last week, the BCRA earned US$533 million and in December it accumulated US$1,675 milliona very high volume for this time of year. The determining factor of these purchases was the boom in financing for companies in foreign currency (via bank credit and placement of negotiable obligations) leveraged on the increase in dollar deposits derived from laundering. The settlement of these currencies is what made it possible to more than compensate for the current exchange account red (exports less imports of goods and services) in the second part of the year derived from the appreciation of the exchange rate.

“The potential for foreign currency credit remains enormous.”considering that since mid-August 2024, deposits have grown by US$13,000 million and loans by US$3,300 million,” he noted. 1816. He SBS Group calculated that there is “room for an expansion of around 65-80% in loans”. The point to monitor is the drainage of dollar deposits: although they remain at historically high levels (US$31,547 million), since October 31 they have already fallen to US$3,064 million.

In this framework, private banks with national capital promote a flexibility of access to credit in foreign currency. Since the 2001 crisis, it is only enabled for exporters or foreign currency generating firms. As this media reported, the Government is analyzing this measure, which would imply removing a macroprudential regulation that was key to rebuilding confidence in the financial system after the outbreak of convertibility and the corralito experience. Private banks with foreign capital and public banks generally maintain a position against the initiative.

The rise of the dollar and the pressures from the external front

The truth is that The rebound in the dollar occurred despite the continuity of the BCRA’s purchasing balance. What did he respond to? Minister Luis Caputo attributed this to the demand for foreign currency prior to the holiday period, which as a result of Argentina’s rising price in dollars will bring a boom in tourism abroad. Analysts add other factors, ranging from the recent lowering of rates of interest in pesos and the persistent red net reserves until external front pressuresabove all, the devaluation of the real.

image.png

Source: Economic Studies Management of Banco Provincia

A report from the Economic Studies Management of the Province Bank stood out two central factors: the reserves, which cannot take off, and the adverse international climate. Regarding the first point, he highlighted that, despite the fact that the BCRA bought US$4,650 million since the beginning of October, which constitutes a maximum for this stage of the year, and that reserve requirements grew US$1,900 million, ” “gross reserves grew by just over US$3 billion in the period” due to debt payments, the fall in the price of the yuan and possible interventions on financial dollars. And he calculated that net reserves remain in negative territory for about US$2.9 billion.

“Considering that next year more than US$25,000 million of debt in foreign currency between the National Public Sector, the Provinces and companies will expire, these numbers raise some warning signs. Although it is likely that the private sector will continue to take credit in dollars, and that will strengthen the Reserves – between September and December 2024, almost US$9,000 million entered in this way -, solvency is not guaranteed. Paradoxically, the eventual recovery of activity would play against us on this front: the greater the growth in domestic demand, the greater the need for imports and dollars, consequently,” the Bapro analysts maintained.

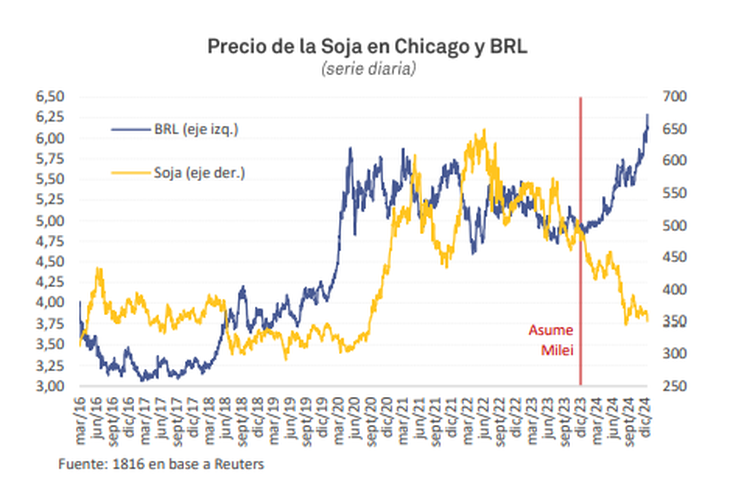

Regarding the causes, the SBS Group He remarked: “The sudden rise in the CCL occurred, we believe, for both domestic and external reasons. On the local side, we believe that there may have been some pressure from investors who wanted to realize their ‘carry trade’ profits, although we consider that the external context weighed more. As we highlight elsewhere in the report, the real one comes pressing hardwith an acceleration in its devaluation rate that led the Bank of Brazil to intervene with reserves. Likewise, in Wednesday’s conference, financial conditions worsened markedly after it was learned that the Fed expects fewer rate cuts. Finally, other exogenous factors, such as an international price of soybeans that this week hit 2006 lows in real terms (adjusted for US inflation), they didn’t help either.”

The truth is that The dollar touched 6.3 reais for the first time since there are recordsdespite the strong interventions of the Brazilian central bank. “Besides, The average price of our export commodities fell 1.8% in the weekdriven by soybean oil (-7.1%), but contained by flour (+3.2%),” calculated the Banco Provincia report. These are two determining variables for the Argentine economy, whose movements have an impact on the exchange front.

image.png

Scenario 2025

With this panorama, the city is drawing up scenarios for next year. A report of Adcapthe first of his new research team that he accessed Scopefocused on the strategy used by the Government to slow down prices: “Inflation decreased due to the fall in demand due to the liquefaction of salaries, pensions and savings, and the exchange rate anchor. As a result, the peso is perceived as overvalued, making it difficult to end the stocks and deterring investment – without which, the recovery will likely be short-lived.”

Thus, he raised his projections: “For 2025we see the inflation falling to 36%, depreciation of 18%, the investment rebounding 3% after falling 29% in 2024, the trade balance deteriorating to US$17,000 million and the growth at 4.4%, leaving GDP per capita 11% below the 2011 maximum (and 1% below 2023).”

What will happen to the exchange rate scheme? The Adcap report, signed by Eduardo Levy Yeyati, Federico Filippini and Javier Casabalnoted that they do not expect changes “until after the midterm elections.” Focusing on the official objective of keeping inflation low, projects a slowdown of the “crawling peg” to 1% during the first quarter (in line with what Caputo advanced), “that the blend is preserved (lowering the weight of the CCL if net reserves do not rebound) and that the gradual lifting of the stocks continues with the exchange rate unification postponed until after the elections.”

Regarding this base scenario, he analyzed factors that could improve or worsen conditions for the market. Among the first, he mentioned the eventuality of a successful debt swap (in foreign currency), which reduces maturities for the next six years and compresses spreads, and an agreement with the IMF at the beginning of 2025.

On the contrary, Adcap listed the following downside risks for its base scenario: an exchange rate normalization with an overvalued peso and limited reserves; an eventual relaxation of the fiscal anchor (the Government needs to shore it up on the revenue side); a strengthening of the dollar on a global scale and a deterioration in Chinese growth that reduce commodity prices beyond expectations; a political strengthening of the opposition ahead of the elections; a materialization of inflationary risks given the triumph of Donald Trump in the United States; and an eventual delay of the agreement with the Fund, since the market discounts it for the first quarter of 2025.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.