In December, the CAC’s Consumption Indicator (CI) showed a monthly increase of 2%; while in the interannual comparison there was a decline of 3.4%.

This indicator developed by the CAC reflects the evolution of household consumption of final goods and services on a monthly basis, expanding and complementing the information contributions made by the Chamber to the monitoring of trade and economic activity. In 2024, the IC accumulates a decrease of 7.4% compared to the previous year.

“This measurement is against artificially stimulated consumption in 2023 (“Plan Platita”) due to electoral incentives from the previous government, which tended up overheating demand, and due to protective reactions against the uncontrolled inflationary process“said the CAC.

image.png

This indicator developed by the CAC reflects the evolution of household consumption of final goods and services.

He added that “in December 2024, a negative interannual variation of a significantly smaller magnitude was recorded than that of November, reflecting a stabilization and an evident possible change in trend, which is seen in a considerable improvement in the consumption levels of households with compared to November of almost 2%”.

This occurs in an economic scenario in which inflation remains stable, with monthly variations of less than 3% during the last three months of the year. In December 2024, the monthly rate was 2.7%, with a year-on-year and/or accumulated annual rate of 117.8%.

Consumption: the performance of all sectors

When analyzing the performance of some particular items, a generalized dynamic of interannual decrease is observed compared to the values of December 2023, but with a clear decrease in the negative variation rate.

The clothing and footwear category showed an estimated decrease of 8.9% year-on-year in the last month of the year. The division continues to slow the decline it had experienced in previous months, improving its individual performance.

On the other hand, the The transportation and vehicles chapter showed an estimated decrease of 1.1% year-on-year in December. Despite a slight year-on-year increase in automobile registrations, gasoline use fell 5% year-on-year and pulled the index downward.

Recreation and culture showed a decrease of 12.3% year-on-year in December. A real income that continues at low levels and a relatively cheap dollar compared to last year that encourages trips abroad has explained the fall in the item.

Regarding the housing, rentals and public services section, this showed an estimated decrease of 1.6% year-on-year in December of this year. A relatively cool December decreased electricity demand and pulled the index downward.

Regarding the rest of the items, these experienced an estimated contraction of 2% year-on-year in December, positioning itself at levels 1.2% below pre-pandemic levels.

- Mass consumption experienced a sustained drop in sales since the beginning of the yearbut starting in October he managed to change the trend. In December, mass consumer goods fell again and showed a seasonally adjusted decrease of 1.9% compared to November.

- However, mass consumption is projected to rebound during 2025 and recover much of the lost ground, with a more genuine base than in 2023.

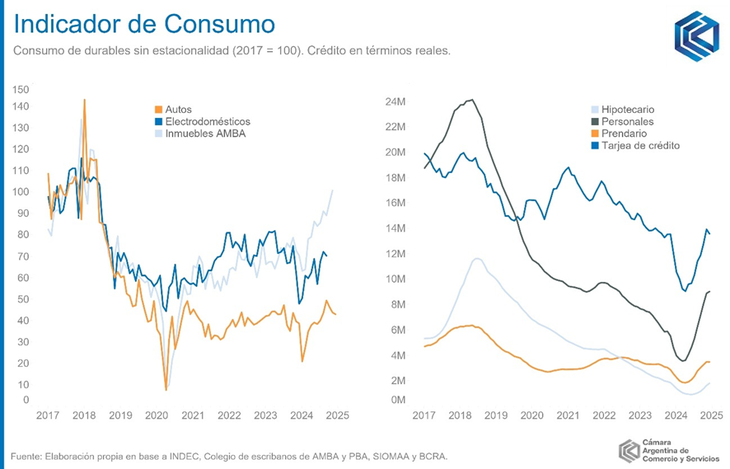

- After hitting a floor in April, credit in real terms managed to grow steadily during all the remaining months of the year. Credit card debt and personal and collateral credits managed to exceed the levels of December 2023, enabling the consumption of household appliances and cars.

- The sale of durable goods, unlike mass consumption, has already recovered what was lost at the beginning of the year and closed 2024 with the best numbers since 2018.

- Automobile registration managed to grow by 2.4% year-on-year in December 2024, while household appliances grew by 5.3% during September.

- Mortgage credit, for its part, also increased starting in the fourth month of the year and managed to boost deeds in AMBA, which are at their highest since 2018.

“In summary, for mass consumption its recovery is being monitored, while the consumption of durable goods is increasing strongly,” the report states.

image (1).png

“This dynamic,” he adds, “represents a change in the structure of household consumption, orienting more toward durable goods facilitated by credit than toward daily consumption goods. With a disposable income that will improve in 2025, the change in the consumption structure will be will go deeper.”

“ANDThe current economic model is not aimed at generating consumer booms but, rather, to create a strong increase in investment and conditions of macroeconomic stability that sustain growth in the medium and long term,” concluded the CAC.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.