In the month of January, the National Institute of Statistics and Census (INDEC) reported an inflation of 2.2% nationwide and 2% in Greater Buenos Aires (GBA). However, the Institute of Statistics and Census of the City of Buenos Aires (IDECBA) registered 3.1% for its region, which represents a significant difference of 40% and 55%, respectively.

At the interannual level, the gap is also significant: while INDEC reports an increase of 84.5% for the country and 89.6% in GBA, IDECBA estimates 100.6% for the city of Buenos Aires, a Difference of between 11 and 16 percentage points.

Buteler.png graph

This discrepancy is not less and has concrete consequences in making economic and financial decisions. Inflation data not only impact on monetary and fiscal policy, but also on the indexing of contracts, salary adjustment and bond valuation tied to inflation. Understanding the root of these differences is key to evaluating the accuracy of measurements and their applicability in economic analysis.

A methodological issue: outdated baskets

He Consumer Price Index (CPI) measures the evolution of the prices of a basket of goods and services representative of household spending. However, the composition and weighting of these goods is not static, since consumption behavior varies over time. Here lies the central problem: while the measurement of INDEC is based on the survey of expenses and income of the households of 2004/2005, the IDECBA has updated its basket with data from 2017/2018.

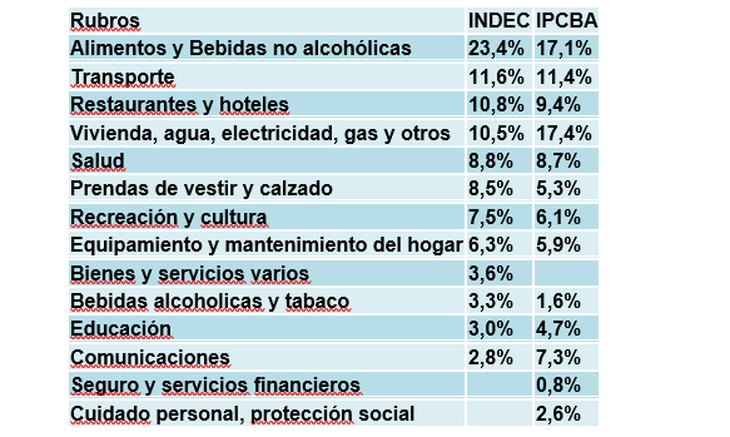

This methodological lag generates distortions. According to IDECBA, the relative weight of services In the consumer structure it has increased significantly in the 13 years that passed between the samples. The lack of update of the INDEC basket implies that prices with weights that reflect consumption habits of two decades are being measured. To illustrate it, let’s see how weights vary in different key areas:

Buteler graph 2.png

The divergence in the weights explains in part why the indices differ. For example, The item “housing, water, electricity, gas and others” has a weight of 17.4% in IDECBA, while in INDEC is 10.5%. Since the service rates have suffered pronounced increases in the last year, well above the rest of the goods, a greater weighting of this item generates a higher impact on the price index of the City of Buenos Aires.

Economic consequences of a outdated measurement

While INDEC does not “measure badly” from the methodological point of view, the lack of updating of its consumption basket introduces significant distortion. Indeed, the new basket of goods and services was already designed and tested by INDEC, and its implementation was scheduled for last year, But the government decided to postpone it.

The implications of these differences are deep. An example is that according to inflation measured by INDEC, wages would have already recovered the level of November 2023. However, if we take inflation calculated by IDECBA, real income would still be below that threshold. The same goes for indexed contracts and the debt adjusted by CER, whose valuation depends on official inflation data.

The key question is: Why does the government not allow to update the INDEC basket? A possible answer is that there are still pending adjustments in public services rates. A new weighting would give more weight to these increases, impacting the measurement of official inflation and, consequently, market expectations and economic policy decisions.

In a context of high inflation and loss of purchasing power, having precise and updated statistics is not only a technical issue, but an imperative need for proper economic and financial decision making.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.