While the last polls between international fund managers showed a certain Optimism about market prospects for this yearIt seems to intermingle some dose of caution and nervousness for The level achieved by actions, above all, in the United States. For example, a fact that went a bit unnoticed by the last Bofa survey, was that Almost 90% of respondents believe that US actions are historically overvaluedThis is the highest percentage of net positive responses since April 2001. It is worth noting that this feeling has remained during the last decade in an average of 81% of the fund managers, which regularly considers that US actions are overvalued.

In this regard, Analysts understand that the extreme overcompra levels reached in the main variable income rates have an important risk of corrections in the next days, either a simple correction to continue climbing or something deeper. Therefore, they not only worry over the overcompra levels but also overvaluation levels. “According to some measurements, American actions of great capitalization are negotiated with the highest premium, or close to the highest, with respect to fundamental factors such as sales and profits from the end of the Puntocom era”said Joseph Adinolfi, from Marketwatch. It happens that now that the outbreak of optimism that flooded financial markets after the electoral victory of President Trump has begun to fade, investors seem to be increasingly obsessed with this fact, according to several recent surveys to market participants. The concern is that excessive assessments could mark the beginning of a correction that some have long since necessary. For example, the Global Investment Manager S&P index, which follows the opinions of professional investors on the market, showed that their appetite for risk decreased in February one of the lowest levels observed since the launch of the survey in October 2020 .

“The mood among American shares investors has been grated and has become one of the most reluctant to the risk we have seen in the last five years”Said Chris Williamson, executive director of S&P Global Market Intelligence, in the February report.

Retail investors share concerns

Similarly, the latest survey of fund managers of Bank of America Global Research hinted a growing discomfort: 89% of the fund managers who responded considered that US actions were overvalued. Marketwatch points out that, to some extent, retail investors seem had increased to more than 47%; In fact, the bearish feeling had not been so high since the late 2023. At that time, the actions were just beginning to recover from a painful correction that made the S&P 500 fall 10% between the beginning of August 2023 and the end of October and the end of October of 2023.

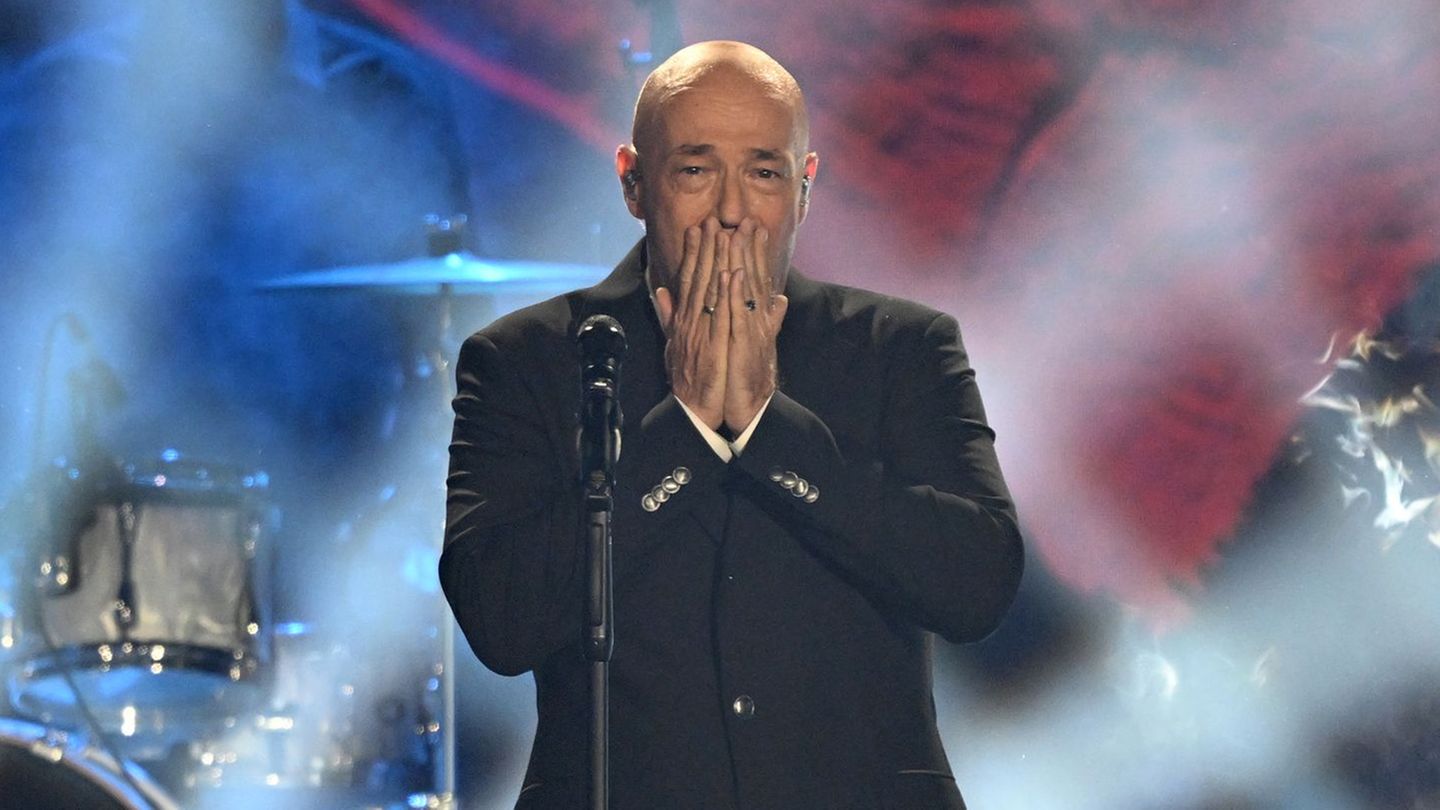

Trump Super Dollar Markets

Investors, with Trump, between optimism and caution.

But without a doubt, they warn, none of this must be interpreted as an unequivocal sign that the actions will go down, since Until now, high valuations are mainly limited to the shares of great capitalization of the US, while small and medium capitalization shares of that country seem to have much more reasonable prices. The same goes for foreign markets, said Bill Merz, director of capital market research and portfolio construction at Us Bank Asset Management Group to Marketwatch. While Wall Street’s expectations about the growth of corporate profits in 2025 have decreased since the beginning of the year, the foundations of great capitalization still look healthy, said Merz. Until now, it seems that corporate gain margins, together with the growth of profits and sales, remained solid during the fourth quarter, according to the latest lot of profit reports. “The foundations of US actions remain extremely good”he added.

Anyway, high valuations are increasingly in the spotlight, especially as The S&P 500 has seen how the rhythm of its advances has stagnated since mid -December. The index registered a new record closure for the first time from shortly after the investiture of Trump and Nasdaq-100, with a strong technological presence reached its first record of the year days ago. According to Dow Jones Market Data, the price-benefit ratio adjusted cyclically, calculated by the winning economist of the Nobel Prize Robert Shiller, stood at 38.5 at the close of last Friday’s markets. This is the highest figure since the end of 2021. Before 2021, the last time the CAPE index (compares the price of shares with its average earnings adjusted to inflation during the previous decade) of the S&P 500 was at its level current or above him was at the end of 2000. Analysts emphasize that the level of S&P 500 in relation to the expected income of companies during the next year seems even more adjusted. The Dow Jones Index showed that last Friday it stood at 3.03, which places it at levels similar to those observed for the last time during the summer of 2000, meanwhile, the price-benefit ratio of the future of the S&P 500 was placed In 22, above its average of 10 years of 19 times the expected benefits of companies.

Actions, uncertainty about Fed and Trump’s priorities

Although research banks of Wall Street demonstrate that high assessments are not an especially useful tool to anticipate where the actions will be directed in the coming months and weeks, when the valuations are high in relation to the history, the Recorents in the coming years tend to be inferior in relation to historical averages. However, some professionals who spoke with Marketwatch said that High prices could leave actions vulnerable to disappointing news, particularly with all the uncertainty surrounding the political agenda of the Federal Reserve (Fed) and Trump’s priorities. Other factors could also be weighing in the minds of investors, such as, for example, consumer inflation expectations have increased in recent weeks, while the Fed president, Jerome Powellhe insisted that he is in no hurry to continue cutting the rates after keeping the costs of loans in January unchanged. “The market is perfectly quoted and, instead of an imminent concern, there are a number of general factors that contribute to this mentality that it cannot improve”Said Brian Allen, CS McKee investment director during a telephone interview with Marketwatch. “People are a bit unbalanced.”

The resistance of actions against an infinity of risks

Apart from the gains metrics and feeling surveys, Other popular market indicators have been decidedly more mixed: on the one hand, Mutual funds of US actions and the ETF saw their first 2025 output last weekaccording to EPFR data. Meanwhile, Gold prices have reached historical maximums close to $ 3,000. Merz said that gold profits could reflect the concern of investors to the high levels of debt of the US government.

Of course, at the same time, investors have been reluctant to risk losing more profits, the classic Fomo Factor (fear of missing something). In addition to reflecting the belief of investors that US actions are overvalued, the latest Bofa Fund Manager surve 2010. In fact, investors continued to bet on the shares. For its part, Option operators have also been firmly optimistic: the 20-day mobile average of the CBOE Equity Put-Call ratio stood at 0.53 last Friday, its lowest level since July 2023, as Dow Jones shows. It is worth remembering that a low Put-Call relationship shows that the demand for purchasing options has been greater than that of bearish sales options. The volume of operations with options increased to a new monthly record in January, according to CBOE Global Markets and Options Clearing Corporation data.

According to Merz, the resistance of the shares against an infinity of risks, such as the massive sale of Deepseek at the end of last month, should be sufficient proof that the upward market that began at the end of 2022 has a lot of room to continue. Every time the shares have stumbled during the last year, investors have come to buy aggressively in the fall. That would indicate that the wind is still in favor of the actions. “If we look at the amount of potentially worrying holders of the last 18 months, there have been enough”Said Merz. “But over time, we have seen that this is not necessarily a fact in which it can be invested.”. We will see.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.