He Central Bank of Uruguay (BCU) announced the tentative schedule for the placement of domestic public debt securities for the next two weeks, which includes the series of treasury notes as well as other instruments in Uruguayan pesos.

Between Monday, March 6, and Friday, March 17, there will be seven placements issued by the financial institution, one of which is a Treasury Note. These are the dates.

Dates for the second week of March

This Monday 6th of March 2:00 p.m. the first title in pesos will be tendered for 3,300 million pesos -84.3 million dollars, at today’s values-, with integration that same day and with a term of 28 days. That is, with an expiration date of Monday, April 3 of this year. Of that total, 660 million pesos –16.8 million dollars– were non-competitive placements.

He Wednesday March 8also at 2:00 p.m., a title will be tendered for 1,700 million pesos, equivalent to about 43.4 million dollars, with integration that same day and with a maturity period of 98 days. In other words, it has an expiration date of June 14 of this year. Of this total 340 million pesos, some 86.8 million dollars were considered non-competitive placements.

For his part, he Thursday March 9 at 2:00 p.m. the auction will open for another placement in pesos with a term of 357 days and for 5,000 million pesos –127.7 million dollars–, of which 1,000 million pesos–25.6 million dollars– will be in non-competitive placements. The integration will be the next day and the expiration will be on March 1, 2024.

Uruguay Stock Exchange 1.jpg

the second period

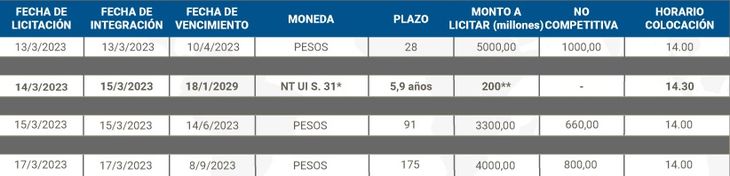

He monday march 13 at 2:00 p.m. a tender will be opened for a title by 5,000 million pesos –127.7 million dollars–, of which 1,000 million pesos–25.6 million dollars– will be in non-competitive placements. The term is 28 days, that is, it expires on April 10 of this year and the integration date is the same day.

He March 14 at 2:30 p.m., a tender will be Treasury Note Series 31 in NT, which will have a term of 5.9 years, maturing on January 18, 2029. The amount to be bid is 200 million in NT. The integration date would be the following day.

He Wednesday March 15 at 2:00 p.m. a title will be tendered for 3,300 million pesos –84.3 million dollars, at today’s values– with integration that same day and with a maturity period of 91 days. In other words, it has an expiration date of June 14 of this year. Of this total 660 million pesos, some 16.8 million dollars were considered non-competitive placements.

Lastly, the friday march 17 at 2:00 p.m. the auction will open for another placement in pesos with a term of 175 days and for 4,000 million pesos –102.2 million dollars–, of which 800 million pesos–20.4 million dollars– will be in non-competitive placements. Integration that same day and expiration, on September 8 of this year.

Uruguay Stock Exchange 1.jpg

Source: Ambito