In turn, the yield on public debt in Indexed Units showed a monthly decrease of 6% in February.

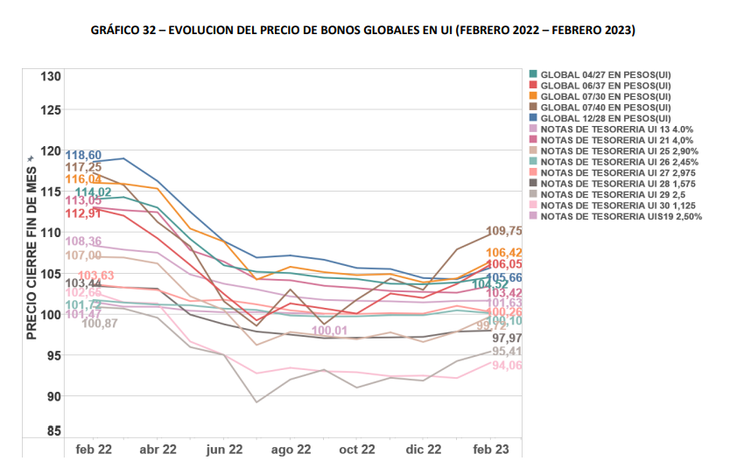

The price of the Uruguayan debt issued in Indexed Units (IU) registered a slight monthly increase of 0.11% in February, but if the last 12 months are taken into account, the values of some of these titles they plummeted as much as 11% year-on-year.

The content you want to access is exclusive to subscribers.

According to the latest Monthly Bulletin of the Electronic Stock Exchange of Uruguay (Bevsa)the price index started last month at 102.46 basis points and closed at 103.58 basis points.

In general, the prices of these debt securities presented slight upward variations, with notable evolutions in the cases of Overall 06/37 (2.29%), the Treasury Note UI 30 (2.05%) and the Overall 07/30 (1.98%). However, there were exceptions, such as Treasury Notes UI 26 and 27 who presented a slight drop of 0.35% and 0.73% respectively.

So far in 2023, the cumulative variations are all positive, from the 0.21% of the Treasury Note UI 13 until the 6.61% of the Overall 07/40.

image.png

However, in regards to YoY analysis, numbers are all in the red, with rates of 5, 6 or 8% in most cases. The worst crashes they occurred in the Treasury Note UI 21 (-8.52%) and in the Overall 12/28 (-10.91%)

The yield on public debt in Indexed Units fell 6% in February

In addition, the Bevsa bulletin reported that in February, El performance index of Uruguayan sovereign securities in indexed units (INDUI) began the month of February at 303.87 basic points and closed below 285.87 basic points.

Meanwhile, the decline for these financial instruments last month was 5.92%.

Source: Ambito