The papers in dollars, UI and pesos registered increases. The country risk rose 3 points compared to last week.

He risk country up three points over the past week, while the global bonds In dollars, Indexed Units (UI) and pesos registered, for the most part, increases, showed the Weekly Monitor of the Republic AFAP, in a period where there was also a good market response to the placements of the Central Bank of Uruguay (BCU).

The content you want to access is exclusive to subscribers.

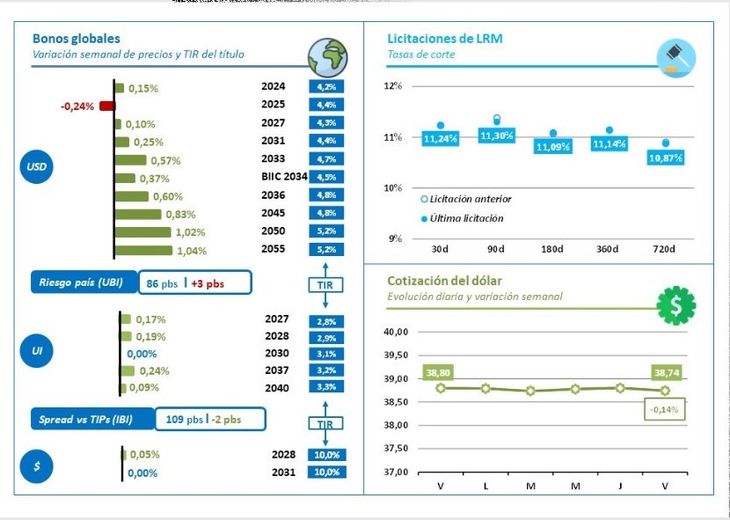

The Uruguayan dollar bonds showed an increase in almost all. The 2024 bond had an increase of 0.15%, that of 2027 0.10%. From there, the increases begin to be more considerable with 2031 with an increase of 0.25% – with an Internal Rate of Return (IRR) of 4.4% – the 2033 bond with 0.57% and 2055 with a growth of 1.04%, being the one that achieved the most increase with an Internal Rate of Return of 5.2%.

country risk.jpg

AFAP Republic

The bonds in Indexed Units (UI) they were all upward in the week that was from Monday, May 29 to Friday, June 2. The one that matures in 2027 –IRR of 2.8%– rose 0.17%; while in 2028 –IRR of 2.9%–, 0.19%; and in 2037 –IRR 3.2%–, 0.24%. For its part, the one that expires in 2023 remained the same, while the 2040 had an increase of 0.9%, with an Internal Rate of Return of 3.3%.

For his part, he sovereign spread who measures his own risk country with its Uruguay Bond Index (UBI) rose 3 bps achieving a rise to 86 bps

Meanwhile, the country risk calculated by República AFAP for these titles (IBI), which measures the average spread between the yield of the bonds issued in UI by the Uruguayan State and the yield of the TIPS (Treasury Inflation Protected Securities) of the United States government, dropped 2 bps until staying in the 109 bps.

For their part, the bonds in pesos an increase in its variations since the price of the global bond 2028 –IRR of 10.0%– increased by 0.05%, while that of the global bond 2031 –IRR of 10%– remained the same.

Source: Ambito