After going through the worst drought in a century, the country will have to face this meteorological phenomenon.

The phenomenon of The boy will reach the Uruguay and the country would have to be prepared for the economic effects that it could generate, such as the demand for public spending and the increase in borrowing costs.

The content you want to access is exclusive to subscribers.

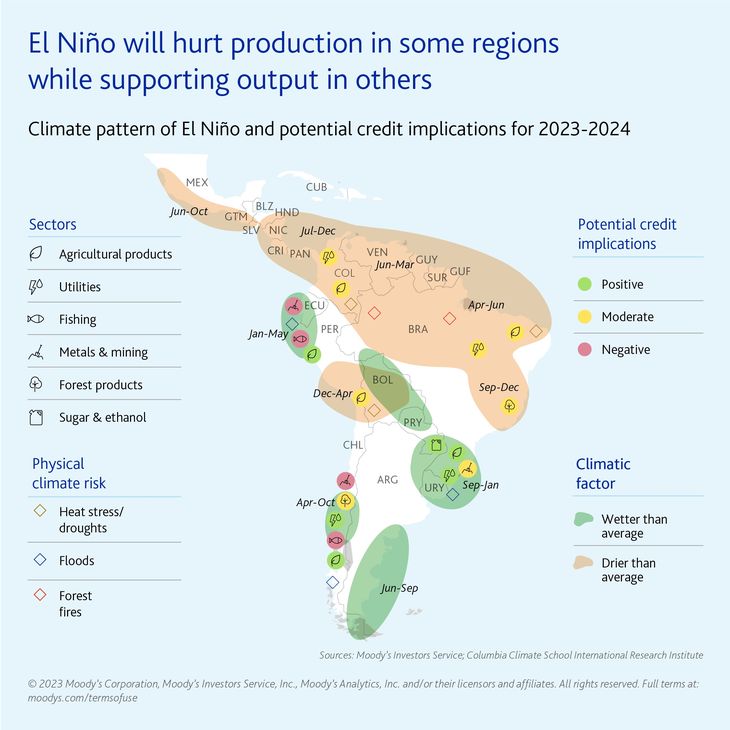

Earlier this month, the rating agency Moody’s alerted about the economic impact that the meteorological phenomenon of El Niño in Latin America, whose effect on Uruguay it will be decisive for the possibilities of agriculture, after going through the worst drought of the century.

According to the agency, El Niño raises two particular risks for governments. On the one hand, spending demand in stimulus and reconstruction of infrastructure. On the other, the rising borrowing costs if the increase in food prices delays or slows down the easing of monetary policy.

In this sense, it would be necessary to be prepared for the economic impact that it could generate in Uruguay. According to the meteorologist and climate change specialist, Mario Bidegan, El Niño will peak later this year.

https://publish.twitter.com/oembed?url=https%3A%2F%2Ftwitter.com%2Fmario_bidegain%2Fstatus%2F1694674243684872668%3Fs%3D20&partner=&hide_thread=false

Everything indicates that #The boy it will reach its maximum point, at the end of 2023. The atmospheric response, measured by the Southern Oscillation Index (SOI), has been slowly progressing towards El Niño. The positive signal from the Indian Ocean Dipole can help the SOI towards negative values. pic.twitter.com/qmmEU0SdBG

— Mario Bidegain (@mario_bidegain) August 24, 2023

The effects of El Niño in Uruguay and Latin America

According to the rating agency’s report, the climatic phenomenon “will affect the natural resource industries of South America” and analyzed: “The predominance of Latin America in the global agricultural and mining markets means that any shock to domestic supply will inevitably influence prices. world commodity prices.

Moodys chart.jpg

For the rating agency, “the Crop disruptions in Brazil may increase food prices, while heaviest rains in Argentina they have the potential to boost production”, by focusing on the global panorama. In addition, the report warned that “energy prices will be less predictable in regions that rely primarily on renewable energy, which poses risks for utilities that lack protection contracts.”

Finally, Moody`s pointed out that, if it were a phenomenon intense, “it would compromise the loan repayment capacity contracted by the agriculture, livestock, fishing and mining sectors”.

Source: Ambito