He PIT-CNT, single union center of workers Uruguay, will call for signing to submit to a plebiscite a constitutional reform on the social security system. Obviously, it is an initiative against key aspects of the recently approved reform, but – instead of proposing a repeal of the law, as several unions proposed – it was decided to go directly to change the law. Constitution, which has earned strong objections within the plant itself and even in the Broad Front, with some member groups that have rejected the initiative.

According to the retirement age, The proposal reverses the provisions of the recent law of reform of the social security system (law 20,130), while the prohibition of individual savings systems (which in the Uruguay manage the AFAP), It would not only repeal the last reform, but also the first, from 1996. The equation of the minimum retirement with the minimum wage can be understood as a deepening of the current constitutional provision, which establishes that retirements are adjusted to the wage index of the economy.

Stated in this way, the proposal removes key foundations that have given it more financial sustainability to the system of social Security. If approved, the social Security in Uruguay It will require an increase in expenses that is difficult to estimate, but undoubtedly gigantic. The proposal does not add any new specific taxes (more was missing…) and maintains financing through contributions, taxes affected by law and State assistance, as now.

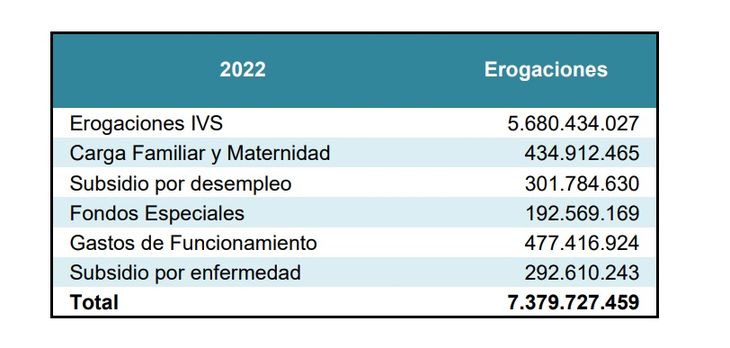

In this regard, it is worth remembering that the pensions and social benefits of the social security system –in its main pillar, that of distribution of BPS- They are financed only 50% with employer and worker contributions; the rest are assigned taxes (mainly 7 points of VAT and all IASS) and assistance from General Revenues (chart). In fact, every time someone buys a Milanese with bread, a computer, a T-shirt or a car, of the 22 points of VAT on invoice 7 they go directly to the BPS. All the proceeds from the tax also go there. IASS (tax on high retirements), whether from retirees from the BPS itself or from other funds or services, such as professionals, military, police or banking.

IMG-20230912-WA0116.jpg

IMG-20230912-WA0117.jpg

Resources and expenditures from the Social Security Bank (BPS) of Uruguay.

This scheme does not seem to be very fair. Professional retirees, for example, are proposing that the IASS they pay go to their fund, not to the BPS. On the other hand, that ordinary citizens, many with low resources, pay 7 points of VAT to finance pensions (low, medium or high) is not very equitable either.

To limit these imbalances, the individual savings pillar in the 1996 reform, mandatory from a certain amount and optional for all workers. With Monday’s newspaper, the initiative had virtues and defects. One of the most questioned was the commission charged by the AFAP, which – in the face of criticism – was substantially reduced. But in its essential effect, the individual savings pillar sought and managed to give greater financial sustainability to the system, through the basic – and fair – principle that the retiree collects what he saved. The new reform makes the individual pillar a mandatory component (although it limited it, moving the basic contribution from 7.5% to 5%) and for low pensions it adds a solidarity supplement. It seems like a reasonable, fair and sustainable scheme.

It is said, reiterated, hammered, that “AFAP retirements” are very low. It is a double error, because “AFAP retirements” do not exist: the system is mixed and retirees charge one amount for BPS and another for their individual savings; Furthermore, what the AFAP component pays is -simply- what was saved and what the savings earned, no more and no less. And the contribution to the AFAP is relatively low: it was a third of the total (for most cases) and now it drops to less than a quarter.

Many countries have incorporated individual savings into their social security systems. Uruguay He did it his way and it can obviously be modifiable. But it is important to be precise in your fundamentals.

On the other hand, the vast majority of countries increased the retirement age, for the simple – and auspicious – reason that people live longer and can work more. This is what is proposed in the reform approved this year; Now he proposes to go the other way.

Expropriation

Beyond the economic problems raised, there are legal; and very deep. In this regard, the criticism raised by the banking union towards the initiative has drawn particular attention. AEBU. In an extensive and detailed document raised inside the PIT-CNT, warns about the legal uncertainty generated by the initiative, and the risks of lawsuits against the State by workers, retirees and AFAP, given that the elimination of individual savings and their transfer to the BPS can constitute a expropriation.

In effect, the text of the initiative says that the funds of workers in the AFAP will go to a escrow, whose operation will be regulated by law. Like this, no more. How will that be handled? With what criteria? The limbo is gigantic, especially if one takes into account that the ballot with the proposal of the PIT-CNT proposes including in the constitution the following phrase: “the Social Security it’s a Fundamental Human Right, not susceptible to profit.” The risk that these funds will become extinct and lawsuits will fall is extremely high.

In its document, AEBU defends “the value of a lucrative management of fundsTo grant financial benefits in favor of the balance of the system or the savings of workers.” And he adds that the initiative “departs from the internal agreements of the union movement, expressed in the Congress of the PIT-CNT, that recognizes the existence of savings pillars.”

It must be remembered that the banks have already agreed on a solution for their deficit cash, part of which is tied to the validity of the current reform. That solution to Bank Cash has to be approved by the Parliament. It would have been a blatant contradiction for AEBU to support the initiative of the PIT-CNT. What was not expected was such a forceful and extensive criticism.

Today the AFAP have more than 1.5 million members and manage an amount of 840 billion pesos (more than 20 billion dollars), arranged in the individual accounts of each worker; Upon retirement, the accumulated savings are transferred to the Insurance Bank, which pays a lifetime retirement insurance. It is one of the few powerful tools that stimulates Public savings and investment in Uruguay. The AFAP invest their funds mainly in State securities and in multiple state and business initiatives for infrastructure and productive development. Everything indicates that dispensing with this mechanism would bring much more costs than benefits.

In the underlying vision that predominated in the initiative of the PIT-CNT there is a historical anti-capitalist and anti-market stance; She is not new. Underlying the idea is that – at some point and in some way – a greater contribution to the State will be imposed “on capital”. The problem is that, as things are set out, the weight of the anti-capitalist struggle, more than on capital or the current brave working class, would fall on the children and young people of today and tomorrow; to future workers.

Source: Ambito