In a few days it will be known if the PIT-CNT manages to obtain enough signatures to call a plebiscite that proposes to repeal -with modification to the Constitution– not only the recent transformations in the social security system promoted by the ruling coalition, but to eliminate key pillars of the system that had been functioning before, which – as can be seen – had a broad consensus, to the extent that it was in force from 1996 until now, without the governments of the different parties They made major changes to it.

If the signatures are reached, an intense and profound political discussion will open, if things are told as they are. The first is that, obviously, repealing the current reform as proposed by the union initiative would imply benefits for many Uruguayans in the short term. Without going any further, those citizens who, due to the reform implemented now, are obliged to extend their working life until age 65, can benefit from a retirement earlier (even though the implementation of the current regime is very gradual). Some – a minority – may argue that they have contributed enough to access a retirement at age 60 and enjoy their years of passivity. They are exceptions that confirm the rule: overall, the contribution made by workers and employers, the total retirement contributions, is not nearly enough to cover all spending on retirements and pensions.

So the short and medium-term benefits that certain citizens may receive from the repeal of the current system will be financed by future generations, particularly children and adolescents who do not vote today and will, with their contributions or taxes, , their work or their companies, finance the increased pensions proposed by the repeal. From the union center it is argued – without much detail – that this could be corrected with more taxation. It’s the same: it will be the future companies, their employees and entrepreneurs, who will solve the maneuver. The idea of diverting the discussion from a generational contrast to a contrast between capital and labor loses its footing as soon as it leaves the shore: be that as it may, future generations will be the ones harmed.

To avoid a conflict between generations, good politics must act, assuming short-term costs to have achievements in the future; and it has done so with the recent reform, beyond the discussions and diverse approaches that the different ideas motivate. Recognized by his own and opponents, the president Luis Lacalle Pou decided -despite the blows of the pandemic and other difficulties – go ahead with a social security reform essential. He did it with the limitations that the ruling coalition has, with intricate internal negotiations and with good advice from various technical groups, led by Rodolfo Saldain. He Wide Front did not accompany, but in public and private they have not raised a fierce opposition but rather some discrepancies or differences in political strategy. The FA’s initiative has involved many more difficulties PIT-CNTdividing its internal.

individual savings

The plebiscite initiative aims with special emphasis on eliminating individual savings. I still have doubts about which of the two words is more negative to those who promote it; but it is clear that the path is precisely the opposite.

That an economy must have good levels of savings is basic and the savings component in the current mixed social security system of Uruguayhas been very important in promoting it, by establishing individual accounts in the Afaps, which – in turn – are a source of investment and financing for the State and companies. This virtue is highlighted, even better than the official spokespersons, by the report released by AEBU (the banking union), rejecting the initiative of the PIT-CNT.

On the other hand, individual concern about retirement is natural, especially as the years advance. Modern systems make retirement contributions compulsory, but including an individual component gives greater sustainability and justice to the system, especially as life expectancy increases significantly. Living longer is good news, but that comes with an obvious cost that it is unfair to burden on future generations. Individual savings are a logical component of any pension system, despite the fact that for decades it was excluded in the Uruguay. That’s how it went for us.

Relying solely on individual savings is also not viable because it is well known that thousands of workers would have meager withdrawals. That is where the State subsidizes and supports, with schemes that the recent reform has improved, targeting those most in need. That is why Uruguay has a mixed system with many virtues; The recent reform made the individual savings pillar mandatory, although it reduced its amount (in my opinion a setback).

Individual savings can be established in very different ways. In Uruguay Fund administrators (Afaps) have been established that capture these savings and place them in individual accounts. For this reason, they charge a commission that has been discussed and modified, and decreased over time; It is a system that can be improved, for example in how that market is articulated, how the state Afap operates, etc. But it is virtuous. In other countries there is simply a general fund of individual retirement savings accounts, which is managed by the State. There are other examples.

That is not talked about

The discussion to approve the latest reform was extensive and it was recognized that, despite progress, new adjustments will be required in the medium term, particularly if demographic trends (more life expectancy and fewer births) continue.

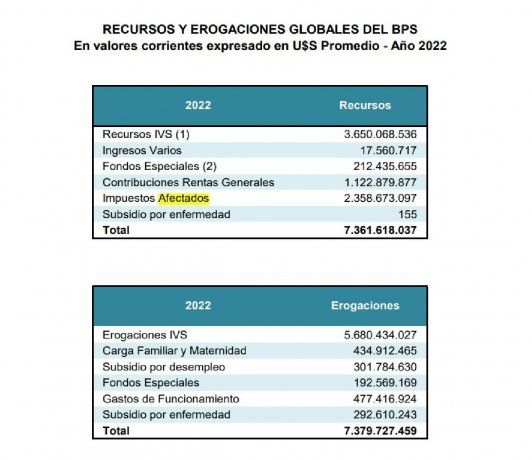

In the last yearbook of BPS (Social Security Bank) The evolution of income and expenses due to liabilities is presented, with an enormous deficit already known, but no less impressive (graph). In 2022, the deficit The retirement component (retirements and pensions paid, less contributions from employees and companies) was US$2,030 million (more than 3% of GDP).

BPS retirements income and expenses.jpg

BPS pensions income and expenses.

To finance it, there are certain “affected taxes”: 7 points of the VAT They go directly to the BPS (US$ 1,950 million in 2022); also goes to the BPS all the time IASS paid by retirees, whether from the BPS or other funds (US$ 392 million). Not in vain, since Professional Box -which has its own serious problems- have proposed that the IASS of its retirees remain in that Fund, which would seem logical. But given the magnitude of the deficit in the BPS, the idea is not viable. It should be added that the deficit of the social security system also implies expenses for social benefits (sickness insurance, unemployment benefits, etc.) (table).

Global resources and expenditures of the BPS.jpg

Resources and global expenditures of the BPS

Part of the “affected taxes” were established in times when – to give short-term competitiveness to the economy – contribution exemptions were made (at the expense of the BPS). Part of those exonerations were reversed along with the Tax reform of 2007, which the FA promoted. Continuing to review that and make sensible modifications should also be on the agenda, as part of a strategy to formalize and improve employment. Always being clear, obviously, that the salary is not only the liquid, but also includes contributions.

Having part of the pre-allocated collection – such as the seven points of VAT – not only illustrates the gigantic volume of the deficit but also restricts the maneuvering capacity of the State and governments to implement other policies, and that is the underlying issue: in the electoral campaign we will hear initiatives of various kinds, with the best intentions, but that require a budget: care system, education, more police, etc. But if a good part of the collection goes to pensions, the possibility of fulfilling those promises is very limited. And if the plebiscite of the PIT-CNT, The problem will worsen, to the detriment of the entire economy, and especially of the next generations.

Source: Ambito