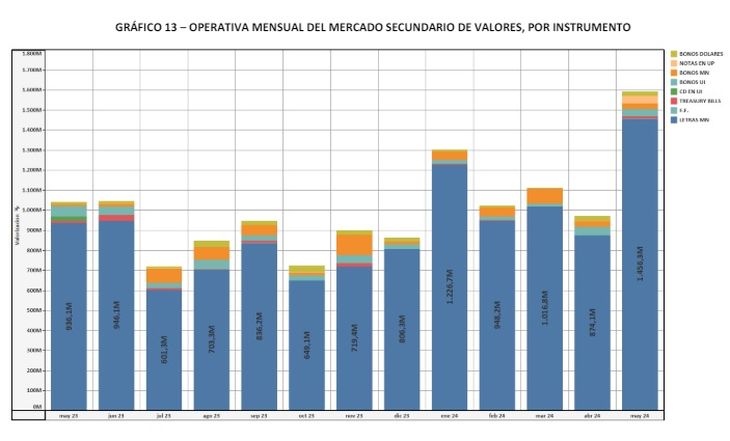

The operation of the Monetary Regulation Bills (LRM) broke its monthly record, totaling 1,456.3 million dollars in May, according to the bulletin published each month by the Uruguayan Electronic Stock Exchange (Bevsa).

With these data, it can be inferred that the securities issued by the Central Bank of Uruguay (BCU) captured the interest of investors, surpassing its previous high level, which was $1,434.7 million in mid-2017.

The LRM, which represented 96.1% of the amount of transactions in the secondary securities market, also had a strong monthly increase of 66.6% compared to the amount in April, which was 874.1 million dollars. In the year-on-year comparison, the increase was also significant, reaching 52.9%.

Operational graph.jpg

LRMs boosted secondary market transactions

The record trading of the securities of the BCU was fundamental for the secondary securities market, which with 1,590.8 million dollars reached its second historical maximum in May, surpassed only by the total negotiated in August 2017, for 1,625 million dollars.

The volume thus increased by 64% compared to April, when it was 970.2 million dollars, while, in the comparison with May 2023, the growth was 52.9% compared to 1,040.2 million May of that year.

Another notable operation in May was Notes in Forecast Units (UP), which went from 0.5 million to 37.5 million dollars, a record on Bevsa screens, according to the report.

mervalo.jpg

In turn, Bevsa highlighted in the bulletin that the total operated peso bonds It stood at 28.4 million dollars, just 1.1% below the April amount of 28.7 million.

Regarding the volume of bonds in Indexed Units (UI) went from 43.3 million at the end of March to 35.4 million in May, decreasing 18.3%.

Finally, the transactions of the dollar bonds It was for a total of 20.6 million, 3.1 million less than the previous month.

Source: Ambito