The cost effectiveness of the exporters accumulates a drop of 14% since 2022 and could worsen, according to a study by CPA Ferrere, based on the synthetic indicator prepared by the Central Bank of Uruguay (BCU).

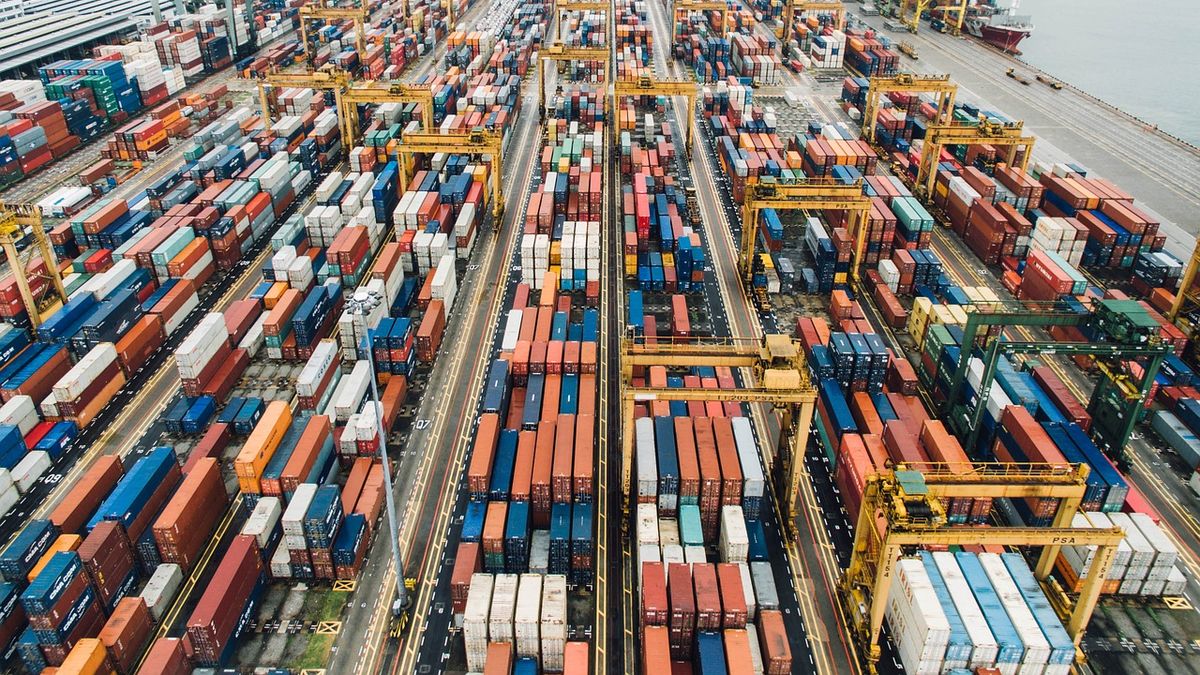

The report admitted the recovery of the exports of goods at the beginning of the year, linked to the reversal of the effect produced by the drought and the highest sales of the forestry sector for the launch of UPM 2, but he pointed out that towards 2025 “the difficulties in terms of competitiveness and its impact on production”.

The CPA economist Ferrere, Alfonso Capurro, He warned in this regard about “a double shock that deteriorates its economic equation” and gave as an example that since 2022 the prices of the 5 main export products accumulate a drop of 4%.

“On the other side of the production equation, some key inputs increased 27% in the case of gasoil (measured in dollars), 35% the general costs (inflation in dollars) and 45% the labour (salaries in dollars),” Capurro noted.

“If this equation is not recomposed, the balance towards 2025 closes with less production, investment and employment, just as happened between 2016 and 2019,” the expert anticipated.

cpa.jfif board

Exporters demand measures to improve competitiveness

In this context, from the Union of Exporters of Uruguay (UEU) insist on the importance of improving competitiveness, which includes correcting the exchange delay, a fundamental factor for the sector.

María Laura Rodríguez, responsible for Economic Advisory of the UEU, asked Ambit weeks ago that “in 2022 a significant gap was seen when the dollar fell and in other countries it increased, but not in Uruguay”, pointing out that “since then a gap was generated that could not be recovered.”

“This affects the exporter because he receives fewer pesos for each dollar he exports and those pesos he uses to pay salaries, fees or taxes they yield less,” warned Rodríguez, who clarified that the exchange rate is not the only axis.

In that sense, he advocated “improving some internal costs and access to more markets and trade agreements to pay fewer tariffs,” among which he mentioned moving forward with the pending agreement between the Mercosur and the European Union and even evaluate possibilities of flexibility “in the event that Mercosur does not advance at the speed we need.”

Source: Ambito