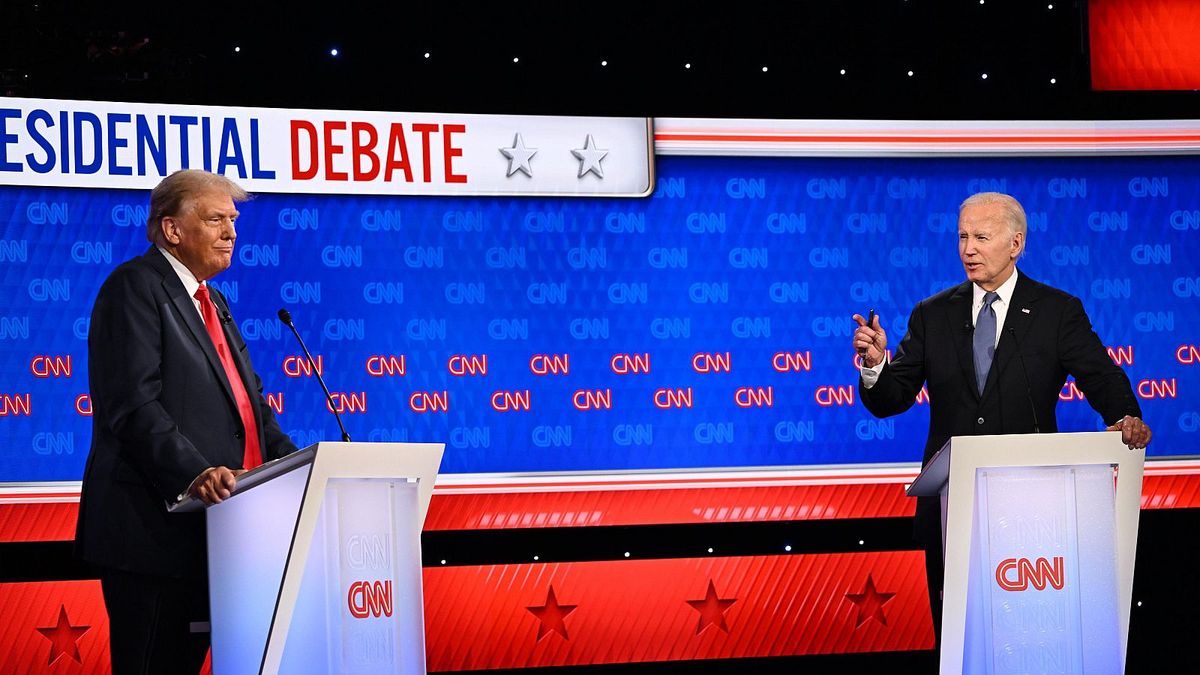

About three and a half months from now US elections, The campaign entered a turbulent period after the attack on Donald Trump, candidate of the Republican Party and favorite in the polls, to which was added in recent days the growing pressure in the Democratic Party for the president Joe Biden abandon the idea of running for re-election.

Forecasts of a Trump victory and the currently weakened Biden candidacy are beginning to have their impact on the market, with a dollar which is strengthened, but also has its influence on the behavior of the bonds.

Trump strengthens his chances and Biden loses support

After having overcome the open case against him for alleged mismanagement of classified documents after leaving the White House In January 2021, Trump survived an attack and his image after the attack, with his face bloodied and a fist raised while being removed by agents of the Secret Service, He reinforced his image as a strong man.

After the attempt, He was confirmed as the Republican candidate and obtained the support of his party’s leaders, including his former rivals in the primary, ahead of the November 5 elections, for which he leads Biden by about 5 points, according to the latest CBS poll.

Meanwhile, the president has made several missteps that put at risk not only his reelection but also the support of Democratic leaders for his candidacy. A lackluster debate and repeated gaffes in public appearances have led at least 35 congressmen from that group, representing more than 10% of the party’s members in Congress, to ask him to decline his nomination.

While Biden said he will continue campaigning next week, this crisis of confidence put the vice president in the spotlight Kamala Harris, widely considered the most likely replacement. Her fundraising events are even beginning to generate interest from donors.

Donald Trump, attempted assassination.jpg

The market is already feeling the effects of the campaign

The campaign is beginning to be felt in the market, to the point that Trump himself spoke out against a cut in the interest rate of the Federal Reserve (Fed) in the run-up to the elections, at a time when the monetary authority would have in mind to move forward with the reduction in September.

Although this expectation should drag the US currency down, the bill recovered 0.26% this week and seems to be gaining momentum globally. According to the statement made to Ambit the economist of the Center for Development Studies (CED), Ignacio Umpiérrez, There is “a certain deterioration in financial conditions for emerging countries, which may be a foreshadowing of what will happen if Trump’s victory is consolidated.”

As for the yield on US bonds, they rose on Friday, although investors are awaiting the decision of the Fed and analysts believe that a possible Trump victory could lead to an inversion of the yield curve.

“We are seeing the favorite operation in the case of a Trump presidency, which is a steepening of the curve,” he told Bloomberg. Fredrik Repton, Senior portfolio manager for global fixed income and foreign exchange Neuberger Berman and warned: “It looks like we will see more term premiums in the markets going forward.”

Finally, the shares fell at the close of the week, although doubts and speculations about the campaign were added to the global cyber blackout, which generated greater uncertainty among investors.

Source: Ambito