After a work that took several months and required the consensus of several actors, the Voluntary Debt Restructuring Program, driven by the Association of Private Banks of Uruguay (ABPU) and the National Association of Credit Management Companies (ANEAC), with the support of the Consumer Defense Unit of Ministry of Economy and Finance (MEF) and the articulation of the Central Bank of Uruguay (BCU).

It is intended for people who fell into credit category 5 of the Central Bank. (uncollectible, in financial jargon) to the month of April 2022 (when the pandemic) and remain in that category currently. Debtors in these conditions in institutions that do not report to the BCU are also included. The plan basically covers Consumer credit (excludes mortgages, automobiles and collateral loans).

Specifically, for debts With a principal balance of less than $5,000, creditors cancel the entire debt, without the debtor having to pay anything or do anything. The program works for each debt (if an individual has 3 debts of 3,000 pesos, in three different places, they are all canceled). For debts whose principal balance is between 5,000 pesos and up to 100,000 pesos, the debt can be restructured in fixed rates at 0% rate (more installments and term the higher the debt). Details are on the website debtsolution.com.uy where you can start the process right there.

It should be noted that the cancellation and/or the restructures are made on the initial capital, That is to say, if an individual took out a loan of 4,000 pesos and today (with interest and surcharges) that debt is $10,000 or $15,000, it is all cancelled. If he initially took out a debt for an amount greater than 5,000 pesos (for example 15,000) and today the accumulated debt is much greater, due to the interest and late payment, The criterion is the same: everything can be restructured by paying only the initial capital, for example in three installments of 5,000 pesos each. Obviously, this is a significant reduction, an issue that caused a lot of discussion when implementing the Plan, since there is a asymmetry (injustice) with the good payers; it was agreed that the general benefit was greater. The program has its reasons and virtues.

Debt, calculator, taxes.jpg

Photo: Freepik

Truth and consequence

For quite some time now, the situation of thousands of Uruguayans in its credit position was almost scandalous: according to the data of the promoters of the program, there are more than 780,000 in bad debt status. For a country Investment Grade and which aims at economic stability, with low inflation, It is difficult to understand. In part, the situation can be explained by the great expansion of credit during the boom years of the economy (2010 to 2016) and the subsequent difficulties, when the growth and the employment decreased. But it was the pandemic that – obviously – made the situation much worse. So the program is specifically targeting those who were in category 5 in April 2022 (when the end of the pandemic was officially declared) and remain there to this day. There is a sense of opportunity in this regard.

Being voluntary, the new program preserves contracts and seeks (here is another objective) to reintegrate people into the workforce. credit market, which has again had a significant expansion. For this -among other things- the actors (BCU, banks, credit houses) are in dialogue with the Clearing Reports (Equifax) so that the debt cancellations that are carried out in the program are reflected in an effective improvement in the person’s credit report. Of course, a debtor with several defaults will not change his record much by canceling one debt of many, but the program is aiming to have an impact in this area; specifically, debts of up to 5,000 pesos that are cancelled will appear as a cancelled transaction. The higher ones, as a refinanced transaction.

As of yesterday, 35,991 people made 46,109 pre-agreements in the new program, and it continues at a very good pace. In total, there were 328,721 entries on the website. debtsolution.com.uy. It should be added that in addition to the main banks and credit administrators, three of the main Collection Studies in the country were able to participate in the Program: Mercurius, Fabraler and Viemventura. When debtors default, banks and credit managers sell these debts (bad debt portfolios) to these firms, which seek to recover them, aiming for a profit on the cost of the purchased portfolio. This recovery task is -in general- arduous and aggressive, and the debtors who receive the communications and calls do not have very comfortable experiences. This has also been CA’s motivation for its initiative.

WhatsApp Image 2024-07-23 at 19.48.27.jpeg

Possible contribution to lowering interest rates

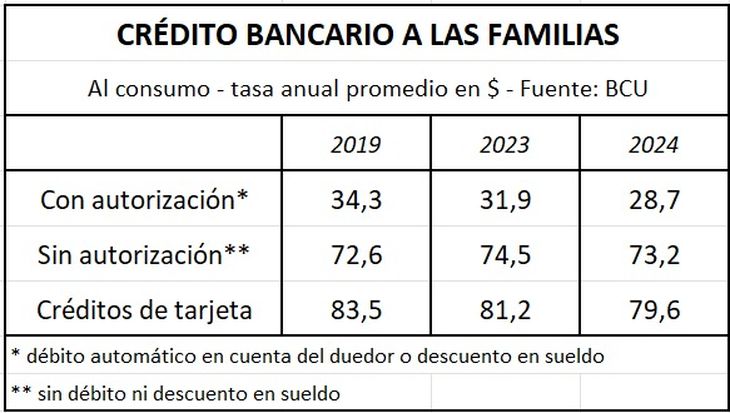

All indications are that the program will have a considerable reach, which is very positive. If so, it could contribute to making access to credit more dynamic and reducing the interest rates, which are high for a country with 5% inflation (table). But this does not mean that they are unjustified; if you want to access a credit with a single signature, the company that offers the credit has a base cost of money of 10%. On top of that you have to add the cost of administration, the cost effectiveness expected (it is a risky business) and -of course- incorporate the expected default. So reaching rates of 60% or more should not be surprising. It is different when the creditor can deduct from an account, salary or has other guarantees.

The Voluntary Debt Restructuring Program involves the following banks: BBVA, Banco República, Heritage, HSBC, Itaú, Santander and Scotiabank, and the credit administrators Creditel, ANDA, Crédito Naranja, República Microfinanzas, Crédito de Valor, Pronto, OCA, Cash, Fucac Verde, Crédito de la Casa, Crediton, Credisol, Crédito Uruguayo, and Volvé, in addition to the aforementioned Collection Firms. In addition to the website, a telephone line and WhatsApp will also be enabled starting August 9. It is valid until November 15, 2024.

Source: Ambito