In less than three months, Uruguayans will have to vote in a plebiscite on the constitutional reform proposed by the PIT-CNT about social securitywhich eliminates the individual savings pillar (created in 1996), returns the minimum retirement age to 60 years (today it is 65, based on the recently approved law) and adjusts minimum pensions to the minimum wage.

Individual savings and a higher minimum retirement age are components that seek, at different levels, to give you more sustainability to the system. The Social Security Reform Act introduced other changes, among the main ones the long-term unification of the system.

Before going into the latest developments on this topic, it is worth noting that any minimally well-founded and coherent discussion on social security must incorporate three fundamental aspects. First, its scope, that is, the number of people benefiting from the system, in proportion to the total. Second, the adequacy of benefits (retirements and pensions) in their various forms, that is, that the amount is high enough to cover the beneficiary’s expenses. The third is the financial sustainability And this is where things get complicated: Uruguay It rates well in the first two aspects, although they can always be improved, but it has a serious problem of financial sustainability.

The social security system in Uruguay It is mixed, that is, it combines individual savings (5% of the contribution goes to the AFAP) and intergenerational solidarity. In the first case, there is no financial difficulty: what was contributed is returned and with a return on investment (something key in recent years, with the AFAPs financing multiple projects and the State). The problem is with the pillar of intergenerational solidarity or distribution: what is collected in contributions is not even close to financing the benefits. US$ 5,000 million are spent annually, US$ 3,000 million are collected, in rough figures. The gap is covered with taxes (7 percentage points of VAThe IASS) and contributions from the treasury. The reform proposal, by proposing to eliminate individual savings and lower the minimum retirement age, will seriously exacerbate the problem, making it surely unsustainable.

New data

Against this backdrop, new demographic data are setting off new alarm bells: births in 2023 marked a new historic low in more than a century, falling to 31,385 (chart). The demographic trends of the Uruguay were already clear about complicating the support of the pillar of intergenerational solidarity, because the life expectancy is increasing and births are becoming fewer. These demographic variables are key when making economic projections of the system (what is known as auditing). In fact, the president Luis Lacalle Pou had glimpsed that a reform could be established thinking about the medium and long term, without affecting the conditions of current workers, that is, reforming for future workers who were not yet in the market. But the parameters known until then were revised and the result was worse than expected; it was impossible not to affect those who were already developing their working life. Thus, the last reform, approved in the Parliament (Law 20,130) increased the retirement age, although very gradually to make the change as smooth as possible.

Annual births Uruguay.jpg

But even with the approval of the new law, it was recognized that a new reform or additional modifications would be necessary in any case, if the financial sustainability of the system was to be maintained. The latest data on births confirms this idea.

The fall in the birth rate This has been going on for several decades. But from 2016 onwards, a sharp and very worrying decline began, which – at least until last year – did not stop. Births fell from around 47,000 to almost 31,000, a 37% drop in less than 10 years. Demographic experts argue that this reflects, in part, an increase in the age of conception of the first child and that – therefore – a certain increase in the number of births could be expected in the coming years. But the recent decline is unlikely to be recovered.

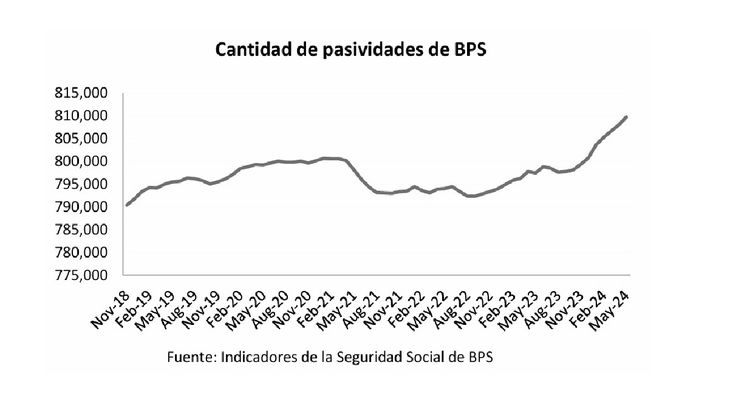

Thus, the population base is narrowing and – therefore – the support base of the intergenerational solidarity system is shrinking. The trunk is narrowing, and the tree is shaking. At the same time, due to provisions of recent years and the dynamics of decisions of people with the right to retire, the number of pensions paid by the BPS continues to increase.

Passivities of the BPS.jpg

According to the latest report of the CINVE Social Security Observatory (Center for Economic Research), the number of pensions paid in May was almost 810,000, a new historical high. Taken in isolation, this is a positive figure for the scope of the system. However, it seems clear that financial sustainability, especially in the long term, in the pillar of intergenerational solidarity will be increasingly difficult: there are more retirees, with longer life expectancy, and fewer young people. If these benefits are to be maintained, more contributions from the treasury will have to be used. And given the already very high levels of transfers of collection to the BPS, this path seems unsustainable, as it would imply taking resources away from other relevant areas, or an increase in the tax pressure which can complicate one’s own economywith the opposite result to that sought. The trade union has not made a clear statement on this matter.

Thus, for some time now – and even more so with the new data – the objective must be to improve the financial sustainability of the system in its own parameters, something that the latest law has done. And surely additional efforts will have to be made. The proposal of the PIT-CNT The bill that will be voted on in October is going in the diametrically opposite direction. And it would burden future Uruguayans with a crushing burden. A scenario of intergenerational lack of solidarity.

Source: Ambito