Moody’s warned in its latest report that credit quality of Argentina’s 24 qualified non-financial entities, infrastructure companies, and municipal and provincial governments will begin to recover by the end of 2025, “but macroeconomic risks remain acute“.

And for the rating agency, Argentina is experiencing a gradual economic recovery, while inflation decreases, and certain regulatory changes will favor the energy, utilities and oil and gas companies. The document maintains that “a gradual relaxation of capital controls under the presidency of Javier Milei allows large non-financial companies to strengthen their liquidity through liability management in international bond markets.”

However, small businesses will find it “more difficult to return to international capital markets in 2025“, along with local and regional governments and the sovereign himself.

The document is conclusive in ensuring that “Systemic risk will remain high in local and regional governments in Argentina due to economic difficulties, political uncertainty and foreign currency shortages.” Well, the risk of currency conversion and transfer will decrease in 2024-2025 as reserves stop depleting, but weak fiscal positions and the lack of alternative sources of financing will keep the liquidity of local and regional governments under pressure.

Likewise, it highlights that “international debt maturities will place a greater burden on local and regional governments as restructured bonds begin to be amortized, and debt in foreign currency remains a risk for most of them.”

Sector by sector: what analysis does Moody’s do?

The country’s oil and gas companies will benefit from the recent deregulation of fuel prices and recent policy changes. It stands out that Pan American Energy, SL (PAE, Caa1 stable) and the state oil company YPF (Caa3 stable) may face high risks in 2024-2025 as a result of weak macroeconomic conditions, the slowdown in local energy demand, the high needs of capital expenditures and the volatility of commodity prices.

“These companies have integrated business models, large market shares, access to capital and solid liquidity,” he highlights. They may also benefit from recent policy changes in the sector, including incentives for large investments and the deregulation of fuel prices. “Stable demand for telecommunications and pay TV amid economic difficulties will be favorable for operators, but intense competition could reduce profits as companies struggle to retain customers,” he analyzes.

Moody’s.png

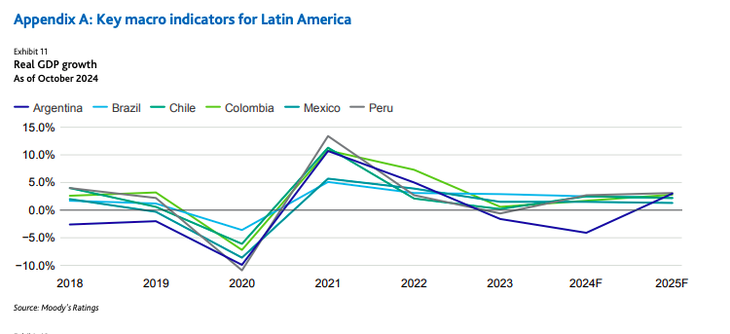

Moody’s forecasts a 4.1% contraction for Argentina in 2024.

For the risk rating agency, the regulatory framework for energy and public services continues to evolve. Therefore, many electric companies have completed initial investments to increase capacity and have begun to pay down the debt acquired to finance these investments.

The recent rate adjustment will significantly improve the operating margins of regulated utilities, a segment whose profits and cash generation had been eroded. “However, a historically volatile regulatory framework and political intervention make unexpected changes a persistent risk for the electricity sector“, he asserts.

For airport operators like AA2000 (Caa3 stable), difficult operating conditions and changing policies have not had a large effect on credit conditions, But aviation unions oppose President Milei’s plans to deregulate aviation operations.

What Moody’s says about Argentina’s growth

Moody’s forecasts a 4.1% contraction for Argentina in 2024before expanding by about 3% in 2025. It argues that domestic demand will decline sharply in 2024, offsetting a cyclical recovery in agricultural production and exports. Even so, companies’ credit indicators, including leverage and interest coverage, “will remain adequate, with oil and gas and energy companies leading the slight overall improvement in 2025-2026.”

“The fiscal adjustment under the Javier Milei Administration is based on extensive spending cuts, especially in public investment and discretionary transfers to state companies and provinces, subsidies for water, transportation and energy, public salaries and social spending,” the report indicates.

Moody’s 2.png

Fiscal surpluses allowed the Government to stop monetizing the deficit.

Fiscal surpluses allowed the government to stop monetizing the deficit, which has curbed inflation since January 2024. “Contracting economic activity will also contribute to reducing inflation, which has peaked,” he says.

On the other hand, it indicates that the reduction in public spending cooled domestic demand, causing a contraction in real Gross Domestic Product (GDP) of 5.1% in the first quarter of 2024 compared to the previous year.

A key point of the document, while recognizing the Government’s effort to maintain the good health of the Central Bank, is that “the reduction in monetary policy rates slowed the creation of money.” However, the growth of reserves from their minimum December 2023 will likely slow in 2024-25.

Source: Ambito