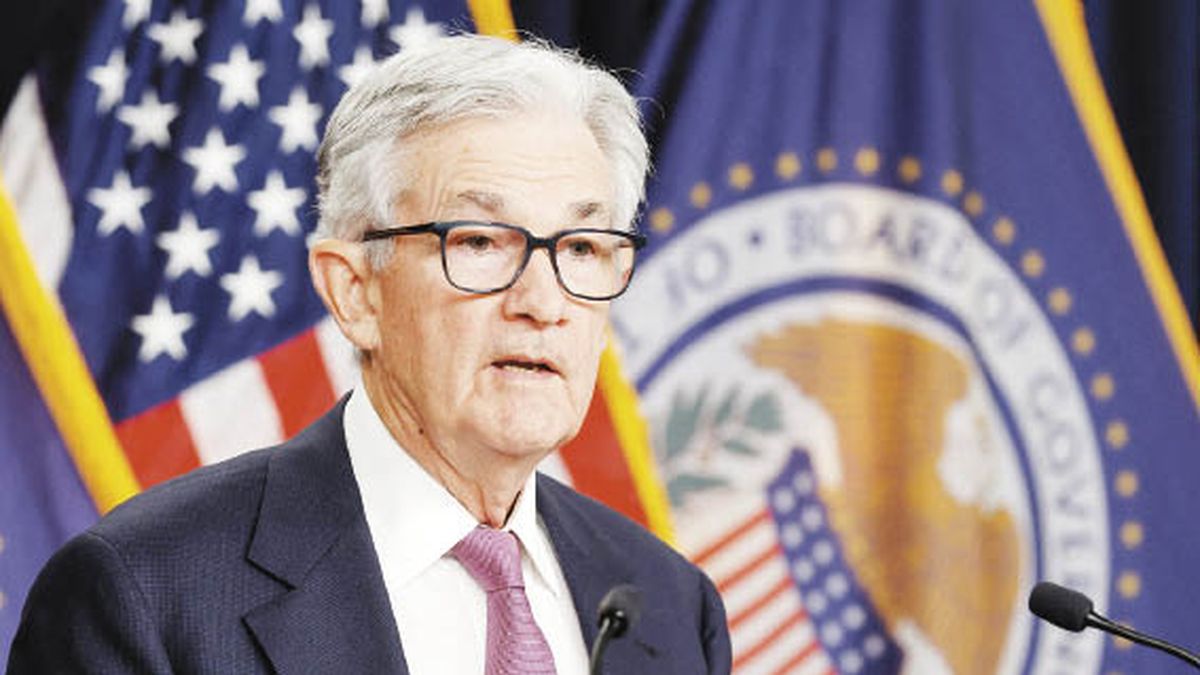

The main rate of the US Federal Reservewhich has risen for a year to try to contain inflation, could continue increasing beyond 5.1%the ceiling expected so far, the president of the central bank warned on Tuesday, Jerome Powell.

The inflation in the US in January it was higher than expected, although lower than the previous month. In this way, inflation in the interannual comparison rose to 6.4%, above the expected 6.2% and below the 6.5% in December, which continues to confirm the slowdown in price risesbut not at the desired rate.

“The latest economic data is stronger than expected, suggesting that the final level of interest rates could be higher than expected“Powell told a Senate committee.

He further anticipated that “there is a long way to reduce inflation” and that “the path will be uneven”. He also pointed out that “history warns against prematurely relaxing monetary policy” and ratified that the current course will be maintained until “the job is completed.”

He added that his portfolio is prepared “to increase rates of rate hikes if the totality of incoming data indicates that faster monetary tightening is warranted” and assured that monetary policy decisions will continue to be made “meeting by meeting based on incoming data and the implications for the outlook for growth and inflation.”

“There are few signs so far of disinflation in the underlying services data, excluding housing,” said the head of the Fed and ratified the objective of “bring inflation back to 2%“.

Powell also warned that core inflation has not come down as quickly as expected and that it still has a long way to go. He also asked the United States Congress to raise the ceiling on debt because, of not doing it, “the consequences will be extraordinarily adverse”.

The futures traders linked to official Federal Reserve interest rates forecast a rise in rates of half a percentage point when the central bank meets in two weeks, after Powell’s remarks.

Implied returns on federal funds futures contracts fell, aiming for a probability over 50% that the central bank will raise its reference target range for its monetary policy rate to between 5% to 5.25%from the current range of 4.5% to 4.75%, versus a probability of around 30% seen before the speech.

The prices of the futures contracts point to higher expectations that the interest rate will rise to the range of between 5.25% and 5.5% in June

The Fed will update its economic forecasts on March 21 and 22.

Stocks on Wall Street were already reacting to Powell’s statements and the main New York stock market indices were trading with widespread declines.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.