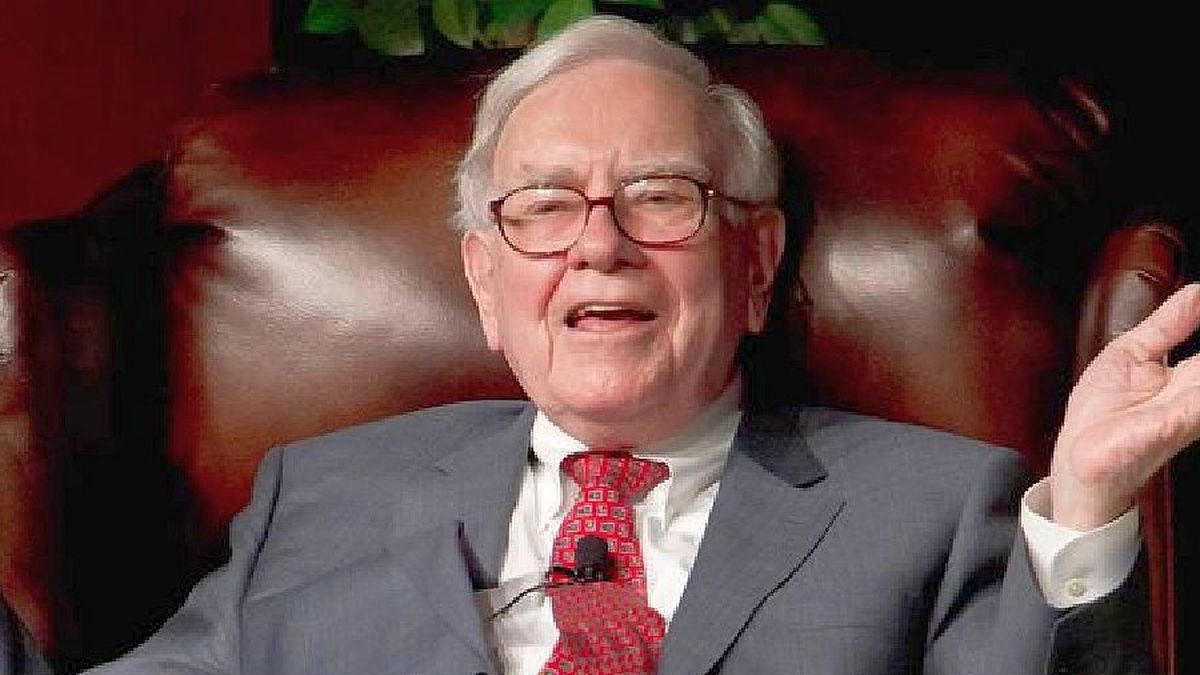

Warren Buffettone of the world’s most famous American investors and entrepreneurs, revealed his way to success in the world of finance and the Actions: what is the main strategy of the man who knew how to be the richest investor in the world?

Buffett, nicknamed the “Oracle of Omaha” he became the richest person in the world in 2008, but for years his fortune was surpassed by businessmen in the technology sector. At 77, Warren Buffett was considered the largest investor in the United States and the richest man in the world, with a fortune estimated at US$62 billion, according to the list released today by Forbes magazine.

At the moment he is the fifth richest man in the world, with a fortune of more than $106. 000 million according to the latest ranking of billionaires, in addition to being considered one of the best investors in history, he is also recognized for his effective advice on the world of finance.

Besides, your investment portfolio is insurance against financial crisis: “We believe Berkshire’s decentralized business model, broad business diversification, high cash generation capabilities and unmatched balance sheet strength are true differentiators for the company,” Warren said of Berkshire Hathaway’s success.

Warren Buffett 3.jpg

What is Warren Buffet’s strategy?

But what is the key to success? Buffet recently revealed that his main strategy focuses on dividend-paying stocks, that is, those companies that return a portion of their profits to shareholders.

According to an analysis of Dow Jones Market Data, Berkshire Hathaway will raise about $5.7 billion this year due to its dividend strategy, which includes companies such as Chevron, Coca Cola, Apple, Bank of America, Kraft Heinz and American Express.

Todd Finkle, professor of entrepreneurship at Gonzaga Universitygave an interview to The Wall Street Journal and revealed the strategy: “That’s what he loves: dividends and buybacks.”

In this way, Finkle argues, Buffett has the ability to select businesses that resist different economic cycles over time. Chevron, for example, has increased its dividends in 36 consecutive years and a fifth of the income comes from the oil company.

However, according to Finkle, dividends They are not “the secret formula, but they are part of it” in Buffett’s strategy.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.