Parallel exchange rates rose sharply: the blue soared 18.7%, while the stocks were not far behind (MEP jumped 12.1%). However, variable income was the one that obtained the most returns last month since the S&P Merval climbed 22%.

It should be noted that inflation will be close to 8% (on Friday the CPI for April is known) which implies that any investment to be profitable would have to be above that figure in pesos. The fixed term was below since the last rate update had not yet been made and paid 6.4% per month (78% per year).

Money Market

In this frame, these funds captured 5% during April, a performance similar to the 5.5% in March. We can classify them as less yielded in April. “We hope that, in the short term, they will be able to ‘catch up’ with respect to the rest of the rates in the system, with which they should close May with a higher return. However, this would remain negative in real terms, but taking as a its main advantage liquidity and its volatility“They said from PPI.

moneymarket.jpg

equities

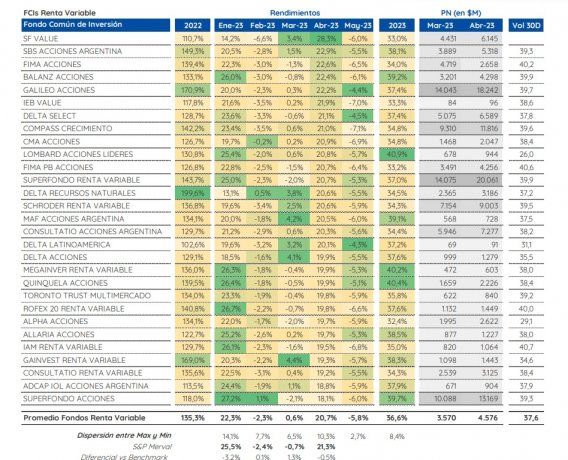

The big winners during April, in terms of returns, were variable income funds. Thus they managed to end the month with increases of 20.7% in averagefollowing -although slightly below- the trend of the S&P Merval which rose 22%.

variable income.jpg

Fixed rent

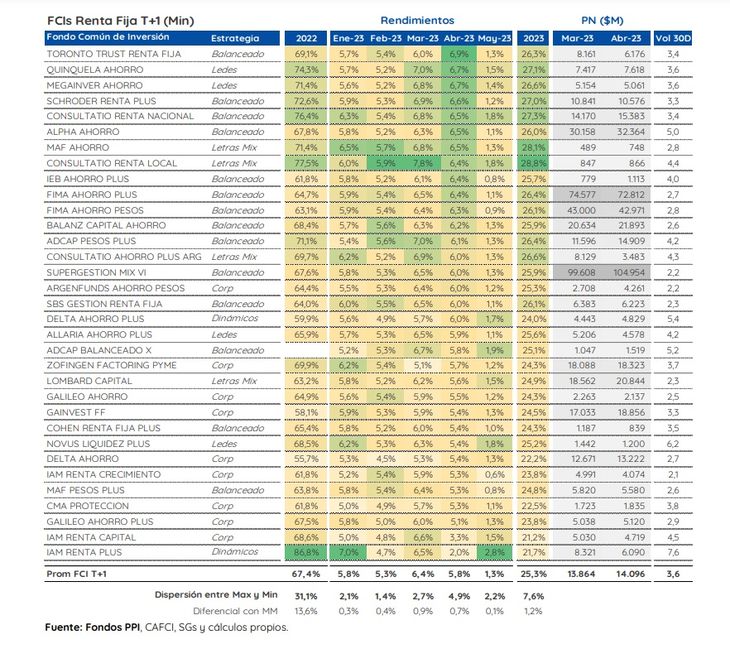

These funds gained 5.8%but “with a dispersion between the best and worst performance that widened by almost 2 percentage points compared to the previous month, reaching close to 5 points,” explained PPI.

fixed income.jpg

CER

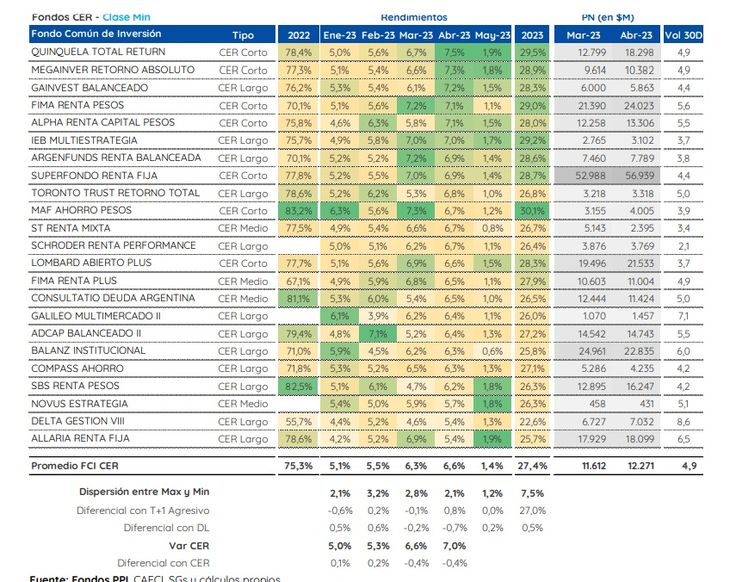

These funds seek to protect investors from inflation. Although April closed positive for these (+6.6%), in terms of yields it was not enough for them to exceed their objective. Specifically, the CER coefficient rose 7%.

CER.jpg

dollar linked

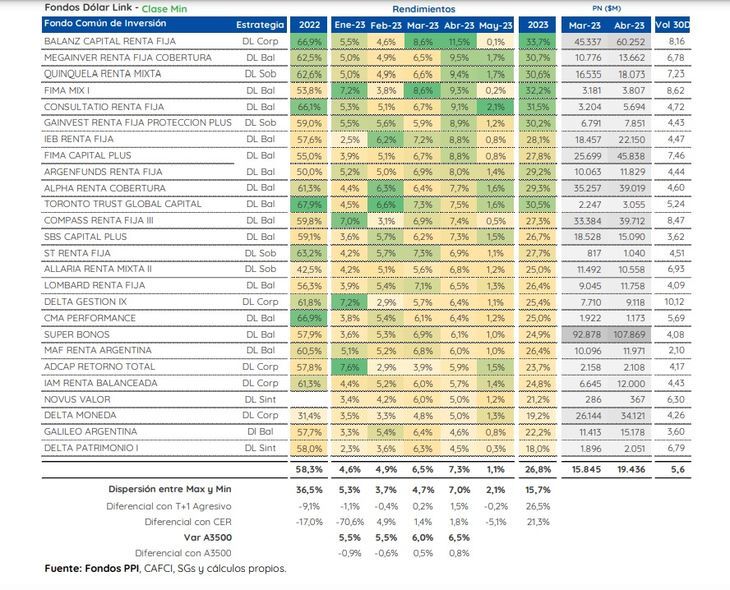

In particular, these funds advanced 7.3% during the month, and were above the movement of the official exchange rate -which rose just over 6.5% taking into account the acceleration of the BCRA crawling peg in April-.

“Thus they accumulate in the year (including the first days of May) a return of about 27%, in line with the BCRA 3500 that earns 25.7% in the same period,” they explained from PPI.

dollar linked.jpg

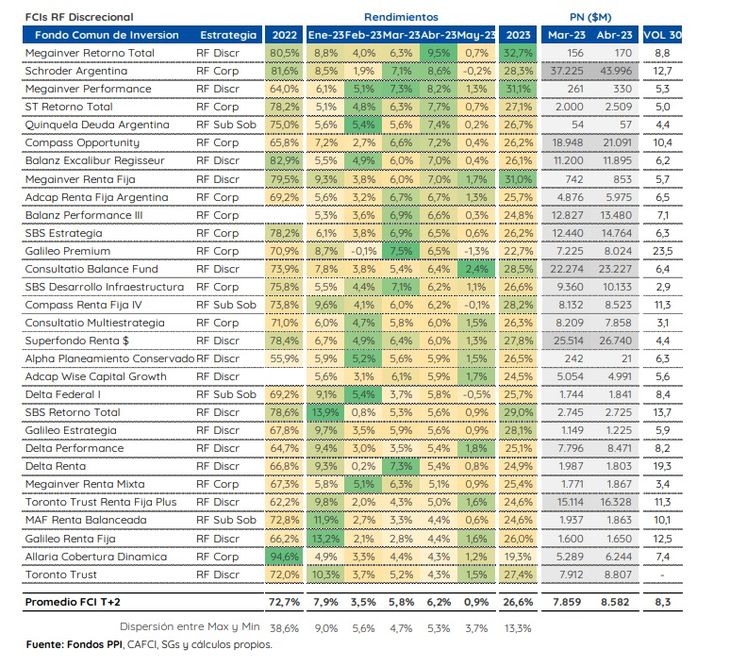

discretionary

These types of funds maintain different strategies, with which they can generally balance the risk of their portfolio between sovereign and private, or turn to only one. Now, on average, its performance was positive during the month of April (+6.2%).

discretionary.jpg

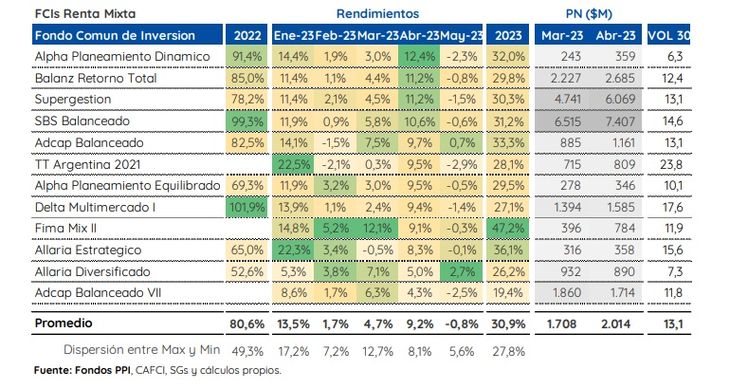

Mixed

Regarding returns, this segment doubled its performance, according to the PPI platform. It went from 4.7% of the previous month to an average of 9.2% in Apriland accumulate so far this year average yields of 31%.

mixed.jpg

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.