Dollar futures contracts closed lower across the entire curve on Mondayalthough the most significant falls occurred between October and December, which is why various operators argued that the market discounts two new exchange rate jumps in November and December. However, The Government made official this Tuesday a new version of the soybean dollar and this could attenuate expectations of devaluation.

According to a Delphos report, the most significant falls on Monday were among the maturities of October (-2.6% to $407) and December (-1.2% to $685).

So, “the futures market discounts two important exchange rate jumps in November (27%) and December (32%)”they specified, and, in this case, the cause was attributed to the speech of who would be Patricia Bullrich’s economy minister, Carlos Melconián, in which makes it explicit that partial capital control would be maintained.

This Tuesday, the October contract fell 0.7% to $403.6, the November one fell 2.1% and $508.8 was agreed, and the December one fell 3.4% to $660.

image.png

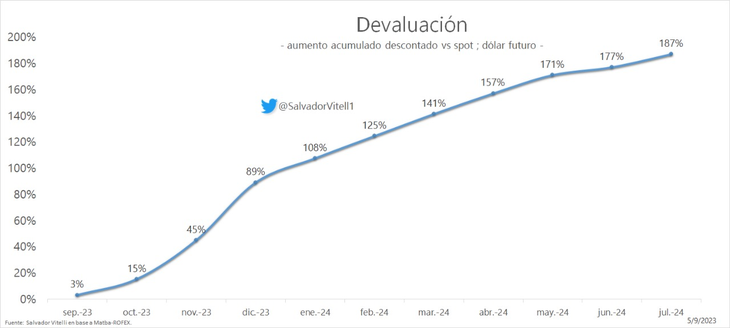

“This is the monthly exchange rate jump that the futures market discounts”he told Ambit, Salvador Vitelli, head of research at Romano Group. In this graph it can be seen how in November and December the percentages jumped 25.7% and 31.5%, respectively.

“There is exchange stress on those dates, especially due to the minister’s words to leave the exchange rate fixed until October, which, however, they view with suspicion, since the October position closed today at $404”He clarified the reasons.

image.png

“In addition, this is the increase that they discount. The accumulated versus the official dollar of today. As seen there, for December they discount an increase in the exchange rate of 89%”Vitelli added.

For his part, Nicholas Rivas of Bavsa, said “what you have to look at are the monthly implicit rates or the forwards. The jump is priced for December. Now the futures are still loosening, but December is still seen as a hinge.”

As to whether the new soybean dollar version could ease devaluation expectationsVitelli said: “That is why today they relaxed the implicit ones (also the product of a narrowing of the gap)”.

according to Decree 443/2023the measure announced by the Government will reach producers of soybeans and their derivatives, such as soybeans or oil, in what will be the Fifth edition of the Export Increase Program.

Unlike previous schemes, this new version will not have a fixed exchange rate: he 75% of the counter value of the export of merchandise, it must be entered in foreign currency and negotiated through the Free Exchange MarketMeanwhile he 25% remaining will be “free availability”.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.