The appetite for the Mutual Investment Funds are at their peak. Investors during August sought to “hedge” against the uncertain electoral landscape and many of them opted for this simple but no less effective tool. With a growth of 19.2%, this sector exceeded $14 trillion at the end of AugustThus, the monthly average for the year doubled (8.5%) and projected inflation in the area of 10-11% for the month.

According to a report from Personal Portfolio Investments (PPI), the industry also set records for inflows (subscriptions net of redemptions) in nominal terms in August, and especially in the segment Dollar Link. Specific, almost $600,000 million were received, up from $580,000 million in July. These dollar-tied FCIs managed to total $113.9 billion in August, with segment equity of over $1.1 trillion.

There was also a revival of CER funds. “These were the most sought after STEP post, and although it was not enough to overcome the all-time highs of March last year -during the sovereign peso debt boom-, this managed to reverse a large part of the negative balance accumulated in the year. In fact, the nearly $100,000 receivedbrought the red of the year to just a little less than 7,000 million pesos,” they said from PPI.

It is worth noting at this point two important milestones that occurred in August before analyzing the performance of the various funds. On the one hand, the devaluation of the official exchange rate that jumped from $287.3 to $350 (+21.8%); and the rate hike by the BCRA by 21pp (up to 118%).

Finally, the FCIs that had the best performance were those of equities. Specifically, the funds in this segment advanced more than 41% -almost doubling the highs of January this yearwhen the segment had added an average 22%-, and above July last year when this segment jumped 37%.

Equities: record gain in 2023

variable august.jpg

These funds managed to close the month with increases of 41.8% -the highest so far this year-. A level similar to the cumulative rise in pesos (devaluation by means) of the S&P Merval. It should be noted, however, that these are the riskiest funds on the market. Details to take into account: the spread between the best and worst fund was around 12 points.

Since the beginning of 2023, closed only negative in a month (February)and accumulate positive returns of almost 200% -against a real accumulated inflation of at least 70%-. Although its volatility, it had an excellent performance in the last month: +40%.

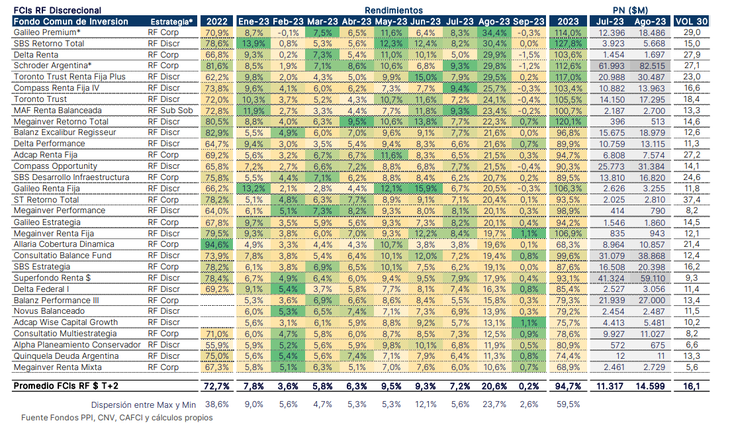

Variable income: sources profits with less exposure

image.png

August thus closed with average increases of 28.3% and accumulated an increase of 132.7% so far this year. year. “They have a volatility that remained (and will continue to be high) reaching today in the area of 21.7% average,” they explained from PPI. These funds are suitable for those who want to take advantage of the good performance of Argentine stocks but with less exposure.

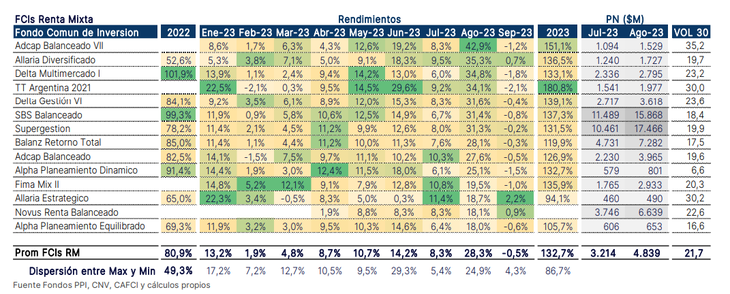

Linked dollar: devaluation had a strong impact

image.png

The dollar-linked FCI accumulated a return of 25.4% and, so far this year, they are already close to 100% (98.2%). The dispersion between the best and worst performers rose to 22pp. As reference, the one with the best performance won just over 41%and the worst 19%.

“The DLs were the protagonists this month. They managed to capture the largest amount of inflows in the year, and although they were affected after the devaluation, the sustained expectations of a higher jump we understand that the appetite for this coverage will remain“They said from PPI.

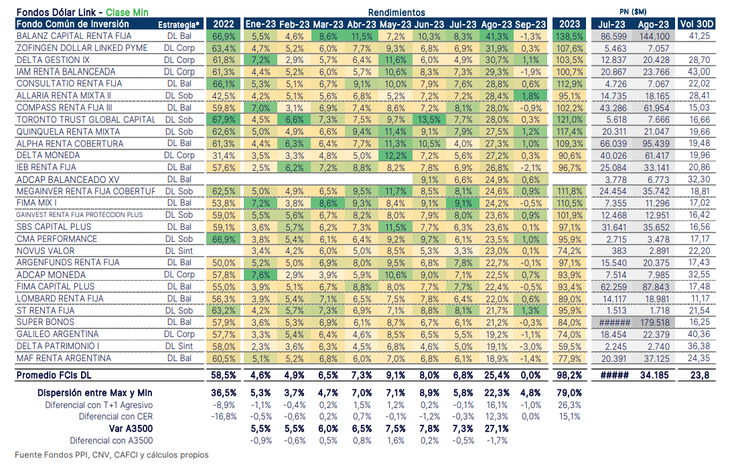

FCI discretionary: complete the winners podium

image.png

The T+2 Fixed Income funds had an average return of 20.6%, and were located on the podium below the Dollar Linked funds. “If we see it by strategy behind a general look, it is observed that those with the greatest holding of Sub-sovereign instruments stood out with 23.4%,” they said from PPI.

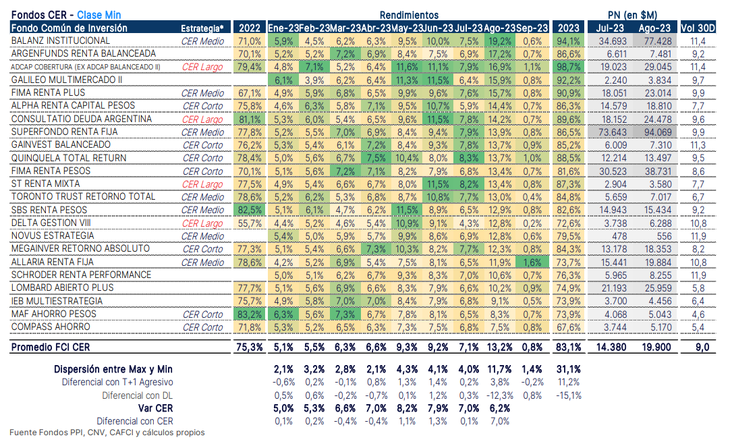

The appetite for the FCI tied to CER returned

image.png

These funds managed to reach 13.2% in August, ranking above the CER coefficient, which marked increases of 6.2% (and anticipating the inflationary pressure resulting from the jump in the exchange rate).

“Let’s remember that the coefficient has a 15-day delay, since it is calculated in the middle of the month with the publication of the CPI of the previous month – taking the average daily variation of that percentage, and it is applied from the 16th day of the current month until the 15 of the following month-“, they explained from PPI.

Thus, The data published from the August index will only be reflected from mid-September.

“These went from a negative average (that is, net redemptions) of about $1.6 billion daily average until the Friday before the PASO, to receiving (net subscriptions) more than $8.3 billion daily average from the Monday after until the end of the month,” highlighted in the report.

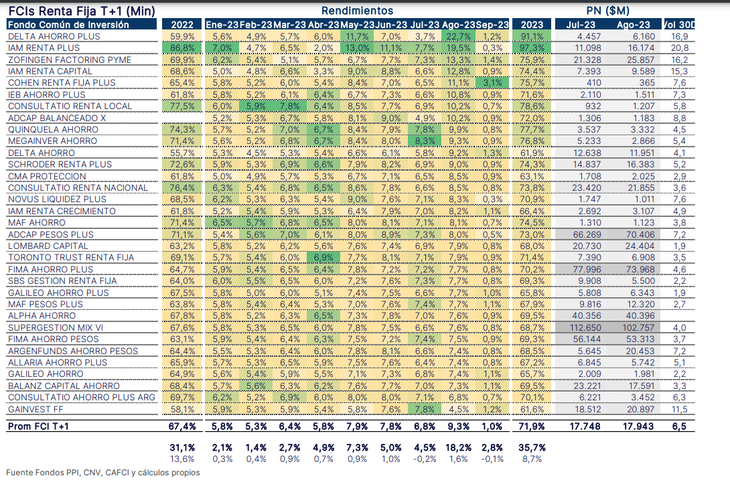

Fixed Income: Failed to Beat Inflation

image.png

In August they accumulated yields close to 9.3%where the dynamic options stood out above the rest, with average returns of 16.8%, In this case, they exceeded the August inflation projected by between 10 and 11%. Corporate options paid 9.2%, Balanced 8.4% and Leceres 7.9%.

“This segment adds options for short-term fixed-income securities denominated in pesos (sovereign and corporate). Let’s not forget that, within T+1, returns depend on the strategy behind each fund (balanced, corporate , dynamic and Leceres)”, they said from PPI.

In August the spread between the one with the best performance and the worst was 18.2pp (vs 4.5 the previous month).

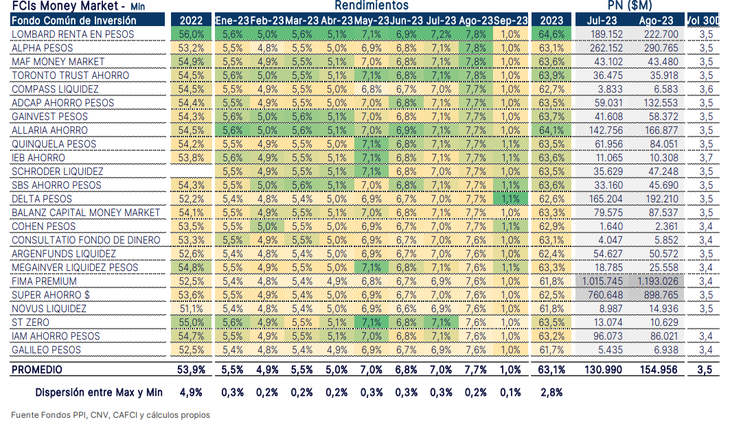

Money Market: how did it go before and after STEP

image.png

For PPI, “we can divide the month into two clear periods: before and after PASS. In the first part, they lost an average of $20,000 million daily affected, in part, due to the search for coverage; and in the second recovered with an average of 38,000 million pesos within the framework of a devaluation of just over 20%, a rise in the rate of several points and growing political uncertainty”.

Regarding returns, the new interest rate hike by the BCRA (of 21 percentage points), led them to close the month with an average of 7.6%.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.