And they say that, In the tests carried out, 9 out of 10 transfers fail and they cannot comply with the change in processes required by the measure in two months. Consequently, they assure that this BCRA decision generates “inconveniences in the experience by forcing users to go through multiple steps in their home banking, and even to go to an ATM to be able to operate.” For this reason, they affirm that discontinuing this tool that has been working for years since December 1 is negative.

The monetary regulator came out to respond through a statement. He explained that The virtual wallet had accepted the change in regulations at the beginning of the year and that its implementation was “consensus” with all market players, since it was previously agreed with the Interbank Commission for Payment Methods of the Argentine Republic (CIMPRA). This body is the commission that leads the BCRA and where these technical issues are discussed. The Argentine Chamber of Fintech (sector to which Mercado Pago belongs) is part of it.

DEBIN vs. Pull transfers: what they are

It is important to detail that retail payments can be made with electronic fund transfers, which can be immediate “push” (also known as “money transfers” or, simply, immediate transfers); immediate “pull” transfers (also known as money orders); transfer payments (also known as cash payments, which include those originated by reading a QR code); debit, credit and prepaid cards; direct debits; immediate debits (DEBIN); paper or electronic checks (ECHEQ).

There are many modalities available, but Immediate Debit began to be used to deposit money in Mercado Pago almost three years ago and the company highlights that it is the funding channel most valued by peoplefor its “simplicity and security”.

However, experts on the subject remember that, initially, DEBINs were for payments and not for transfers or funding and explain that, in many cases, this use other than that for which it was intended also generated problems for users, who, In many cases, they were scammed.

payment market

He Immediate debit (DEBIN) It is a way to transfer money to accounts.

Payment Market

Consequently, in truth, it could be said that the measure aims to ensure that each instrument is used for what it was created, that is, it could be defined as a step towards the organization of the payment system. The BCRA seeks to correct the misuse of Immediate Debits. And this responds to the fact that there were many scams with electronic payment methods and, in most cases, they were carried out with the use of the DEBIN mechanism.

The DEBIN is a means of payment that debits an amount from an account immediately, requesting prior authorization from its owner.. The person receives a request for permission from the recipient of the funds (collector or service provider), rejects it or grants it and, if the answer is affirmative, his or her account is debited and the amount is credited at the time to the beneficiary’s account. required. Operations can be in pesos and dollars, every day, 24 hours a day with Alias or CBU/CVU.

The risks of DEBIN

The problem is that Most fraud cases originate from errors made by users. For this reason, there have been many cases, for example, of people who pose as the buyer of a good or service and then ask the supplier for authorization to make the payment using the DEBIN method and, once the seller Authorizes the payment, the scammer withdraws the funds from the victim’s account.

Another is that the scammer sends you the authorization request to make the immediate debit “by email or by message” with a legend that reflects that he is going to make the payment through DEBIN, but in reality it is a charge for that modality.

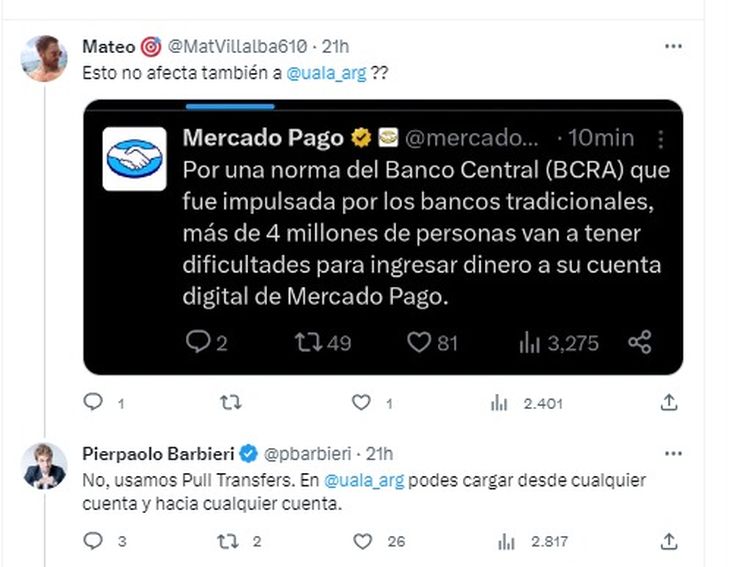

In fact, many wallets, in the face of these cases of theft that have been seen, already only use the Pull transfer modality. Such is the case of Ualá. In fact, a user of the social network anchoring from before.

WhatsApp Image 2023-09-26 at 13.56.06.jpeg

Thus, it is confirmed, with the experience of the users of that popular wallet that This change requires more than anything an adaptation of the service provider’s systems, but should not imply any difficulties for the client..

A change that affects the user?

“It will continue to be done in a simple way. Each user will be able to manage their funds between their financial service providers with total freedom and greater security.“, indicates a source from the financial sector, who also points out that it is an equitable standard for banks and fintech, for everyone alike.

In short, the Immediate debit (DEBIN) It is an online transfer in which the person collecting initiates the process and the person paying only has to accept it (with an operation-by-operation authorization called “spot DEBIN” or with a general authorization in the case of “recurring DEBIN”).

Meanwhile, the immediate “pull” transfers They are requests or requests for funds that allow, by debiting the account – demand or payment – of the client receiving the request and prior authorization or consent, the immediate crediting of funds to the applicant’s account.

Galperin vs. BCRA: a fight that has already been going on for several rounds

The mechanism already exists and experts point out that adapting the system should not be very complex, but the key to all this conflict seems to be in an old feud. And it is that Mercado Pago’s complaint is part of a long-standing confrontation between Galperin’s company and the BCRA and the banks.

Let us remember that a few days ago there had been a controversy over the wallet’s refusal to move forward with the interoperability of the use of QR with cards. Which caused the BCRA to have to postpone the validity of the measure.

Let us remember that the entry into force of the interoperability of QR codes to charge with credit cards, as provided in Communication “A” 7769 of the BCRA. The standard established that businesses that display a QR code to charge with credit cards must accept that customers can make payments with any interoperable virtual wallet, regardless of the brand of the code.

It turns out that, until now, interoperability is limited to payments by transfer (PCT). Meanwhile, when the new measure is implemented, after reading a QR code, the user will be able to choose whether to pay using PCT or a credit card, without having to change digital wallets to make the payment.

However, The measure was postponed for 45 consecutive days (until October 16) because Mercado Pago alleged difficulties to comply with standard implementation times and to resolve operational problems.

In fact, this whole situation had generated a controversy at the beginning of April of this year following a letter made public by banking associations and chambers in which they reported the need to simplify credit card payments through the virtual wallets. For its part, Mercado Pago had responded to the note saying that banks only give benefits (such as promos or discounts) to customers if they use the MODO app.

And, in July of this year, Galperín had also launched a strong criticism against the BCRA measure that prohibits virtual wallets from carrying out or facilitating cryptocurrency operations to their users.

Prior to that, he had complained about the decision of the Central Board of Directors that established that financial entities must establish a reserve of 100% of the funds deposited by virtual wallets. (called payment service providers that offer payment accounts) “to protect them from contingencies and guarantee that they are always available to savers.”

AND Galperín’s list of anger with the BCRA continues and goes back to years of criticism of local financial regulation. In this context, this new confrontation takes place, which seeks to stop a new step in the digital payments regulations that the Central wants to take.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.