The authority preceded by Miguel Pesce sought to calm the MEP and the CCL through interventions that were accentuated in recent days.

He central bank has already used more than US$1 billion to contain the financial dollars. This is clear from several market reports that affirm that the authority preceded by Miguel Pescesought to calm the MEP and the CCL through interventions which have increased in recent days, even exceeding US$50 million a day, the highest figure since the primaries.

The content you want to access is exclusive to subscribers.

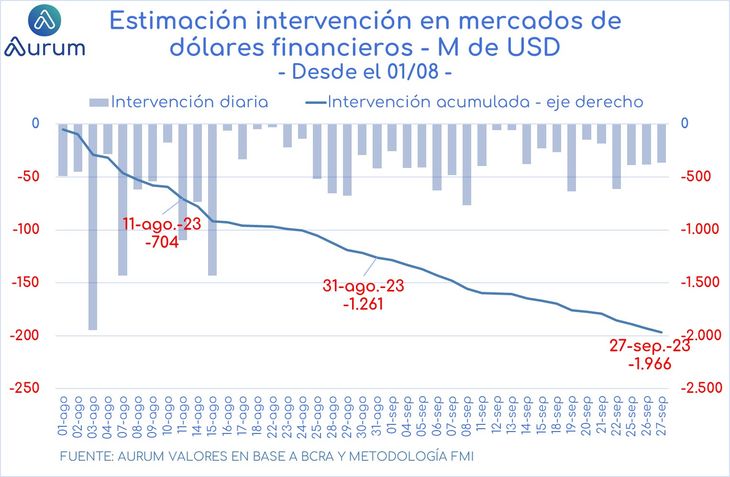

According Aurum Values“the intervention of the BCRA in the market of financial dollars It would be accumulating almost US$2,000 million since August 1. In the coming days, accompanying the strong increase in the volume operated in the 48-hour segment of AL30 and GD30 against D, we would expect to see a substantial increase in the loss of reserves due to this intervention.” This figure includes the devaluation which occurred on August 14, after the STEP elections in which the financiers soared that week to $144 (24.04%) in the case of the CCL and $117.59 (21.78%) for the MEP.

unnamed (5).jpg

In contrast, the shopping at the MULC They were used to contain the financial markets, managing to extend the purchasing series by 32 rounds and accumulating US$523 million throughout September. A figure that, for analysts, is meager to face the pre-election exchange rate volatility with the completion of soybean dollar 4.

According to PPI, despite the strong intervention on Wednesday, September 28, which reached US$52 million, the figure “is still below what was observed in the week before the primaries, when the daily average reached, according to our numbers, the US$97.2 million”.

On the other hand, he highlights that “the increase in the pace of intervention, although it seems to be fueled well in advance, also responds to the greater dollarization pressure after the sell-off of the debt in pesos”.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.