The Asian equities faced a challenging day on Tuesday, approaching levels close to almost one-year lows. This decline was largely due to disappointing manufacturing activity data from China. Besides, the yen weakened considerably, surpassing the 150 percent mark dollaras a result of changes in the policy of the Bank of Japan.

In particular, The yen suffered a fall of 0.7% against the dollarr, reaching a session low of 150.12. This came after the central bank kept its target for the 10-year government bond yield around 0%, as part of its yield curve control (YCC) strategy. However, the Bank of Japan redefined 1.0% as a flexible “upper limit” instead of a hard capwhich generated this impact on the currency market.

The Bank of Japan had been criticized previously for maintaining a rigid maximum limit, which was causing market distortions and an unwanted drop in the value of the yen. In July, the de facto yield cap had been raised to 1.0% from 0.5%.

Saxo market strategist Charu Chanana noted that this new reference range suggests the Bank of Japan will allow yields to rise above 1% while trying to apply changes in its monetary policy gradually. Chanana also mentioned that the 150 level in the dollar/yen pair is no longer an unbreakable line, which could lead to a test of 152.

China: data clouded prospects for recovery

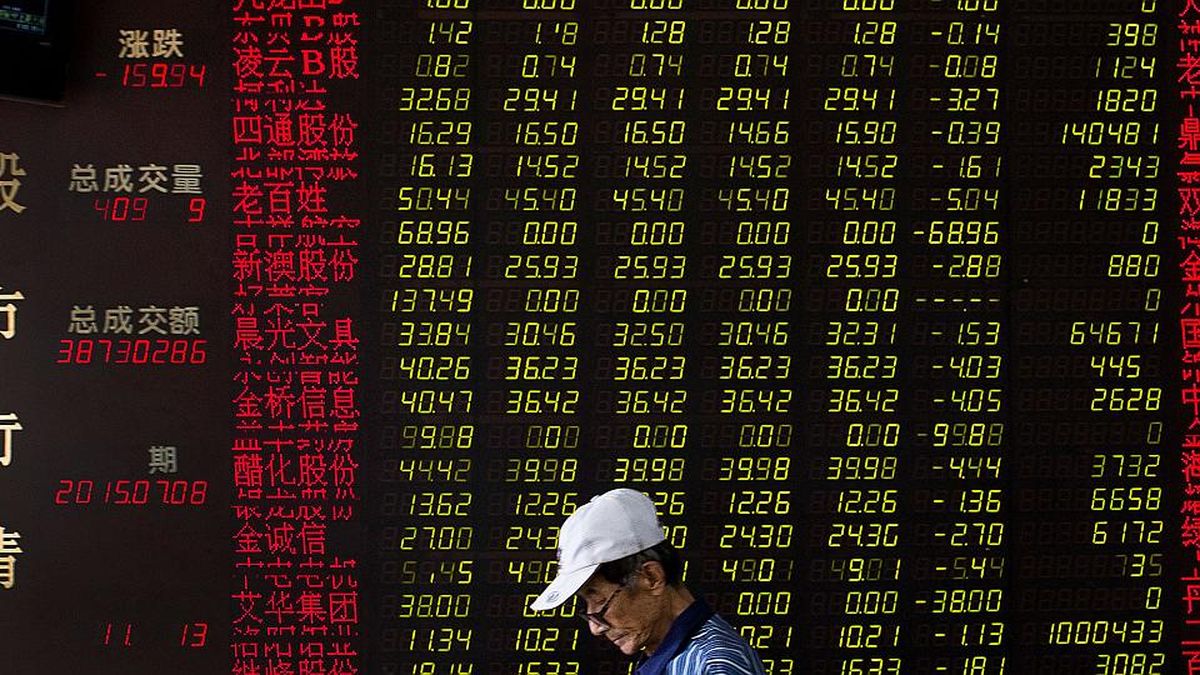

Asian markets, affected by these changes, suffered declines, with MSCI’s broadest index of Asia-Pacific shares, excluding Japan, declining 0.86%, approaching its one-year low recorded the previous week. The Shanghai Composite Index fell 0.38%while Hong Kong’s Hang Seng lost 1.77%, after manufacturing activity data in China surprisingly returns to contraction in Octoberaccording to an official survey of factories.

These Chinese data clouded prospects for a recovery in the world’s second-largest economy. Investors’ attention this week will focus on the meetings of the main central banksincluding the US Federal Reserve and the Bank of Englandin addition to the Bank of Japan.

The Fed will begin a two-day policy meeting, and is expected to keep its benchmark interest rates unchanged at 5.25% – 5.50%. The Fed Chairman’s comments, Jerome Powellwill be carefully examined to assess how long high interest rates will remain.

In summary, the US economy continues to show resilience, and movements in financial markets are expected in response to central bank decisions and economic data.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.