Stocks on Wall Street are in a good moment, with important returns in the S&P 500 and the Nasdaq, continuing the positive trail with which the market closed 2023.

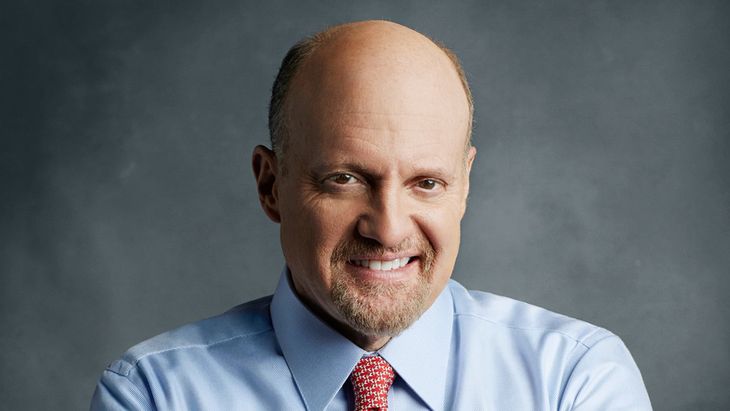

Cramer, who is the former hedge fund manager and current host of Mad Money, agrees with other specialists that what is possibly coming are some falls.

Depositphotos

The stocks on wall street They are in a good moment, with important returns in the S&P 500 and the Nasdaq, continuing the positive trail with which the market closed 2023. However, some experts raise doubts about the scenario.

The content you want to access is exclusive to subscribers.

“While I’m not a bear, we have too many stocks that have gone parabolic, meaning they’re going up, and they’re going straight up with nothing. They keep going up as one analyst after another raises their price targets and really nothing more,” held Jim Cramer, a very listening guru on Wall Street.

The thing is that in 2023, the S&P 500 rose 18% and now remains close to its record. Cramer, who is the former hedge fund manager and current host of Mad Money, agrees with other specialists that what is possibly coming are some falls.

“No matter what, you can’t let the same stocks go up and up on the same old news, and the way I see it, that’s what’s happening: momentum and multiple expansion. Any stock that has gone parabolic is a candidate to fall here,” he said.

Jim Cramer.jpg

What can happen on Wall Street in 2024?

For the guru, a large part of the stock rally is due to the decision of the Federal Reserve to pause interest rate increases, and even to give indications of upcoming cuts. The problem is that the monetary body still does not have inflation completely under control to make its policy more flexible.

Among his preferences for investing, he highlighted that some sectors are “acting reasonably”, such as banks and the financial, that are retreating at a moderate pace and eventually the rises in the stock markets will be restored.

These increases in the S&P 500 stocks, which for the analyst are baseless, would cause the market to go into a decline when the values adjust, which is why according to Cramer some stocks will go into “rest” mode and then, in the future, resume the climb.

While he objected to the technology sector since these companies grew a lot in 2023, but now there are no big news to push the shares higher.

Cramer placed emphasis mainly on technology companies, which registered growth during the last twelve months that still do not have enough news, according to this analyst, to promote new increases that are founded.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.