tesla presented its quarterly results and the market had no mercy. Their Actions They fell 12%, marking the worst daily record in 21 months. Is it a good purchasing idea?

Let’s start with the stock chart:

boggiano 1.jpg

Tesla shares have not stopped falling for almost a month. They have already accumulated a return of -30% since the end of December 2023.

To make matters worse, the balance accelerated its downward path. Because? Because she disappointed the market. Results were weaker than expected, highlighting a sharp drop in the company’s margins.

Tesla’s adjusted profit was 71 cents per share, slightly below estimates for 73 cents. Sales also fell short of expectations, reaching a total of USD 25.17 billion, 2.3% lower than forecasts.

The poor sales data suggests that demand for Tesla’s vehicles is declining more than expected, facing growing competition from both traditional automakers and Chinese electric vehicle companies.

Outside the vehicle sector, there were notable items. In 2023, the Energy sector saw an impressive growth of 54%, while the Services segment also showed a solid increase of 37%. This year it is projected that both sectors will surpass the vehicle business in growth rates. Both, Energy and Services, already contribute 15% to total sales and are profitable.

Is it a good idea to buy now?

Looking at the Tesla chart, it seems like it wouldn’t be a good idea to invest right now. A basic rule in investing is “don’t try to catch falling knives,” which means we shouldn’t buy something that’s falling, simply because we don’t know how much further it may fall.

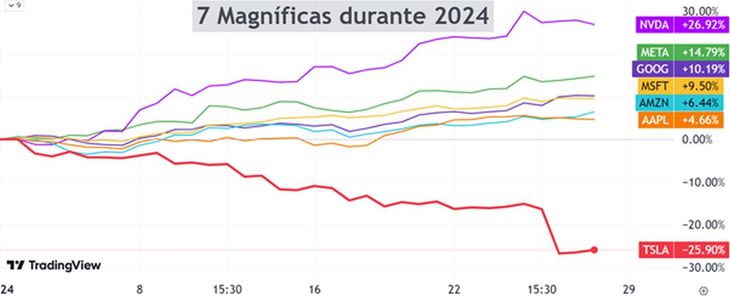

Of the famous “magnificent 7” (Apple, Microsoft, Google, Amazon, Nvidia, Meta and Tesla), Elon Musk’s company is the only one that is not celebrating so far in 2024:

boggiano 2.jpg

The outlook for tesla may be promising, with considerable growth potential on the horizon. However, the growth rate cannot be overlooked, which was the lowest in the last three years.

Furthermore, the factor China It’s fundamental. Tesla has been cutting prices for more than a year in a bid to stimulate sales, facing increasingly fierce competition from rivals in China. For example, BYD (China’s automaker) surpassed Tesla in sales for the first time during the last three months of last year

Elon Musk said that, without trade barriers, these chinese companies could significantly outperform most global auto companies. This recognition highlights the unstoppable rise of the Chinese automotive industry and raises important considerations about future competitiveness in the global electric vehicle market.

The future of tesla It is uncertain. What we do know is that the market, for now, is not happy with its results. And we can see that in the graph.

Are you interested in knowing more about these topics? I want to invite you to read a report that I prepared with the 22 best finance and investment sites. It is information that in many cases is difficult to find. You can download it at this link: https://informes.cartafinanciera.com/22sitios-inicio?utm_medium=referral&utm_source=ambito&utm_campaign=funnel_22sitios&utm_term=tsla_29_01_24&utm_content=acciones

Note: The material contained in this note should NOT be interpreted under any circumstances as investment advice or a recommendation to buy or sell a particular asset. This content is for educational purposes only and represents the opinion of the author only. In all cases it is advisable to seek advice from a professional before investing.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.