The Central Bank (BCRA) concluded this week the uploading of the monetary data corresponding to the last day of last month. These data reveal that it was authorized a monetary expansion of $1,316 trillionthus raising the total of the monetary base to almost $11 billion. During the last two months, the BCRA injected about $2 billion into the system, adding more than $3.69 billion since last November. This situation shows the magnitude of the monetary challenge currently faced by the new Government.

Despite this, the liquefaction of peso holdings is considerable, manifesting itself not only in the constant decrease of the Base in real terms, estimated at more than 15% during the last quarter, but also in the other monetary aggregates. This phenomenon is nothing more than the result of the implementation of the weight blender adopted by the Government and the continuous flight of money by economic agents, in line with high inflation rates.

According to the organization’s monetary report, In January, the average balance of the monetary base was $10.2 trillionwhich implied a monthly expansion of $1.0 trillion (11.1%) at current prices. It should be noted that the Monetary Base presented positive seasonality in January, so if this effect is corrected and it is measured at constant prices, it would have actually exhibited a contraction of 12.1% in the month. “In the year-on-year comparison, it would have accumulated a drop of around 50% and, as a GDP ratio, it would currently be at 2.9%,” adds the organism.

Weight Vacuum Cleaner

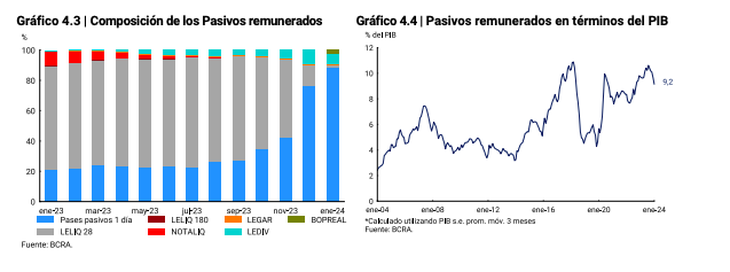

Thus, the restriction on direct and indirect financial support to the Treasury, the remunerated liabilities of the Central Bank and the auctions of the Bond for the Reconstruction of a Free Argentina (Bopreal) marked the epicenter of a monetary shock during the first month of the year.

Screenshot 2024-02-08 at 08.17.23.png

These movements are part of the strategy outlined by the duo made up of Luis Caputo in the Ministry of Economy and Santiago Bausili at the head of the Central Bank, who, since December 12, have sought to trigger a monetary absorption process.

The initiative, explained as a necessary response to counteract both the excessive issuance during the electoral campaign and the internal creation of money through the interests of the remunerated liabilities of the Central Bank, popularly known as the “Leliq bomb.”

The average balance for January reflected a contraction of approximately 50% compared to the same month of the previous year, and as a proportion of the Gross Domestic Product (GDP), it was estimated at 2.9%. In just two months of government management, the Leliq disappeared, giving way to a series of mechanisms designed to sterilize the liquidity generated.

Without attending the Treasury

As a result of these actions, in January there was a decrease of 12.2% in the Monetary Base, as reported by the Central Bank. The Base average reached $10.2 billion, with a monthly expansion of $1 billion (11.1%) at current prices. Furthermore, it was established that these operations, excluding those related to Non-transferable Bills, had a net contractionary effect of around $2.5 billion, or $1.2 billion considering the Non-transferable Bills.

Screenshot 2024-02-08 at 08.21.32.png

Thus, with data at the end of the month, 88.7% of paid liabilities were made up of 1-day passive repos. The rest corresponded mainly to LEDIV and BOPREAL. As a percentage of GDP, paid liabilities would be 9.2% of GDP, 0.5 pp less than in December

In the last review of the program with the IMF, a monetary goal was agreed for 2024 with zero financing to the Treasury, including various financial operations. This approach marks a significant change in monetary policy, oriented towards monetary stability and the reduction of inflationthrough the simultaneous elimination of direct and indirect financial support for the fiscal deficit and the quasi-fiscal deficit of the Central Bank.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.