In January, the S&P Merval gained 36% in pesos. But in February expectations were blurred, what happened in the Buenos Aires stock market and what will happen in March?

S&P Merval does not define a trend in 2024, but the market is beginning to see signs: bullish or bearish?

Depositphotos

Although the Government set itself the objective clean up the accounts of the Central Bank and the Minister of Economy, Luis Caputo celebrated obtaining the primary and financial surplusthe administration of Javier Milei He came from a tough defeat in the National Congress when the omnibus law returned to zero. Thus, the markets went from an optimistic phase to have some doubts about whether The Government will or will not achieve the long-awaited stabilization plan.

The content you want to access is exclusive to subscribers.

He S&P Merval advanced in January 35.6% in pesos and 5.7% in Dollars, but as far as February It has accumulated a loss of 14.6% and in foreign currency of 2.5%. In fact, Measured in dollars, the index had exceeded 1,000 points, but adjusted its value in the middle of the month when it hit a low of almost 880, and then reach the current figure of 983.38.

During this month, all leading companies record losses, except Sociedad Comercial del Plata, which is the only one that remains with a profit of 18%. Among the papers that have accumulated the worst performance in February, the following stand out: energy, Northern Gas Carrier (-24%), Central Port (-21.9%) and Pampa Energy (-21.7%), in addition to companies in the industrial sector, Ternium and Aluar, with -21.2% and -20.2%, respectively. It is worth asking then, What could happen in March?

S&P Merval: is a bearish or bullish rally coming?

For the trader Daniel Osinaga, “The S&P Merval is at its historical average, which is 1,000 points” and regarding the analysis of the situation, he explained that “the Government is doing very well financially, but It has its economic consequences, such as the brutal adjustment to retirees“he highlighted, suggesting that social conflict also weighs on the ruling party’s political plan.

“From now on we have to see how much time society gives Javier Milei, that is the most important thing. However, I think inflation will continue to be the big winner, above the Merval, at least until the middle of the year. “I continue to see more attractiveness in bonds,” he closed his opinion.

For its part, Nicolas Rosetanalyst Cohen’s Global Markets Strategyasserted that The current outlook is ambiguous, although there are reasons to adopt an optimistic stance. “The main positive driver is the Government’s goal of achieving both a fiscal and commercial surplus by 2024. As a consequence, another fundamental factor is the end of monetary issuance by the Central Bank,” he explained.

However, he named that the weakest points of this stabilization plan are the social situation with rising poverty, a sharp drop in the level of activity and the decrease in purchasing power. Finally, he acknowledged that there are doubts in the market about how the reforms will materialize (fiscal, tax, labor, etc.), as well as the objective of a monthly single-digit inflation for the second semester.

S&P Merval: how it is currently compared to historical perspective

image.png

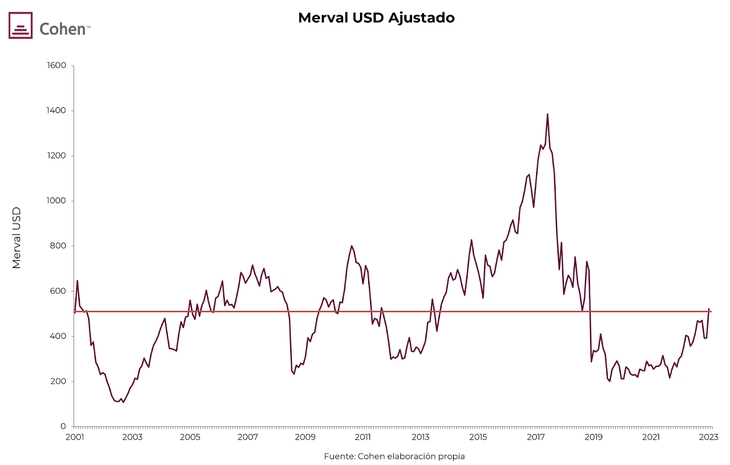

For the Cohen analyst, if we take the historical perspective and adjust for inflation, The Merval in dollars marked a recovery from its lowest point in 2021, stabilizing around US$500indicating that its valuation was aligned with its historical average.

“Considering the growth margin offered by a favorable macro context, if the changes in Milei’s government materializeit is observed that the index is still at a considerable distance from the ceiling around 1,800 points achieved in the most prosperous moments under Macri’s management,” he concluded.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.