Bitcoin rose 20% in the last week, accumulated a return of 44% in February and was close to its all-time high. Will he get over it? What reasons drove the increase?

Bitcoin surpassed the $60,000 level and the market is very expectant:

Clipboard01.jpg

This move coincides with several key developments influencing the cryptocurrency landscape. Let us remember that Bitcoin ETFs were recently approved. Despite an initial correction, the news was very positive for the industry.

The ETFs have already purchased 145,000 Bitcoins and have doubled their daily trading volume, totaling more than $7.5B.

The growing demand for Bitcoin ETFs has a favorable impact on the value of this cryptocurrency, since these funds are backed by it.

The institutions that issue ETFs (BlackRock, Grayscale, Fidelity, Invesco, VanEck, among others) are required to back the shares they offer with a real Bitcoin reserve, meaning they must own an equivalent amount of Bitcoin to back each share. On circulation.

This provides investors with a form of indirect exposure to the Bitcoin market without needing to purchase the cryptocurrency directly, which in turn can lead to an increase in demand and potentially the price of Bitcoin.

Also, let’s remember that the halving will take place in April. What is this? It is a scheduled event every 4 years where rewards for miners are halved, meaning they earn less Bitcoin for verifying new blocks. This generates a lower supply that, combined with a possible growing demand, could accelerate the price increase.

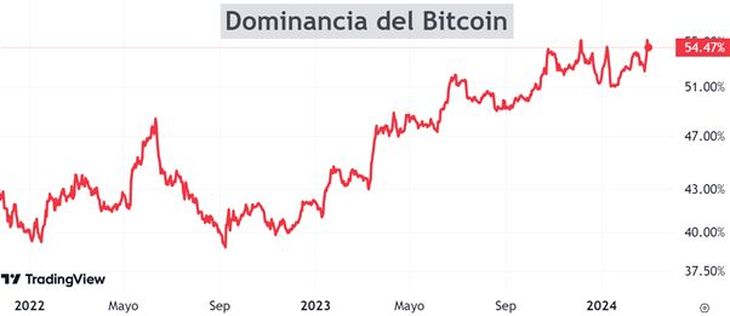

Even though the entire industry is on the rise, Bitcoin’s strength is notable. Let’s look at its dominance, which is a measure that shows the relative weight of Bitcoin in the total Market Cap of cryptocurrencies:

Clipboard02.jpg

Could it go to new highs, above $68,000?

Nobody sees the future, that’s clear. Thinking about investments in probabilistic terms, one could argue that Bitcoin’s trend is clearly bullish. Therefore, the chances of seeing a sequel are high.

In addition, there are fundamentals that support it, such as the growing demand for ETFs and the reduction in halving supply.

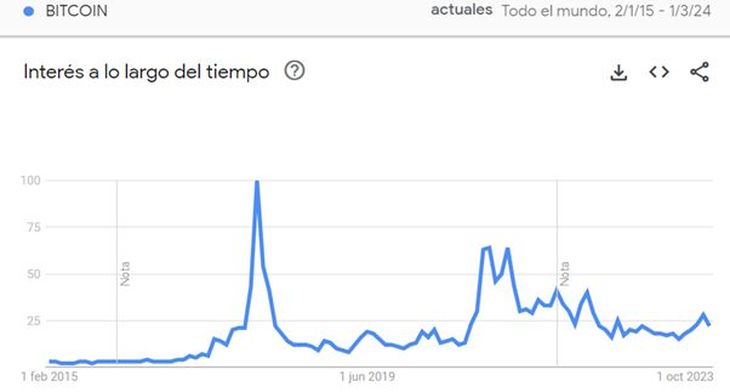

Another very interesting aspect is the current sentiment. While at the all-time high, during November 2021, everyone was talking about Bitcoin, today the situation is a little different. You don’t see extreme euphoria like before.

Let’s look at Bitcoin’s interest on Google, which reflects popularity. It is measured on a scale from 0 to 100, where 100 is the maximum popularity level:

Clipboard03.jpg

Despite the absence of extreme euphoria, the current price movement presents a clear bullish signal.

Let’s look at Bitcoin’s annual returns since 2010:

Clipboard04.jpg

Will it go to new all-time highs? Nobody knows, but the probability is in favor. Finally, it is worth noting that it continues to be an asset with a lot of volatility and risk. As always, be careful.

If you want to learn more about investments, I invite you to our website: www.clubdeinversores.com

Note: The material contained in this note should NOT be interpreted under any circumstances as investment advice or a recommendation to buy or sell a particular asset. This content is for educational purposes only and represents the opinion of the author only. In all cases it is advisable to seek advice from a professional before investing.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.