In this way, the monthly monetary policy rate went from 8.6% to 6.8%, while that of Fixed Term from 9% to 5.8%, assuming 70% TNA as some banks pay this Tuesday. The decision had a full impact on the savings instruments that Argentines use apart from the traditional fixed term, such as surety and Money Market funds (T+0)because as anticipated by the Consultant 1816the BCRA’s initiative was for the pesos to abandon fixed terms and T+0 and opt for fixed income FCI and CER bonds.

FCI: where savers’ pesos migrated

To understand the FCI industry in the first quarter of the year, it is necessary to differentiate two key stages, as explained to Ambit Federico Victorio Marino, co-founder of Andean Investments. It started with a very good January, which brought strong annual growth (YoY), especially towards Money Market Funds, and a interesting flow of fund subscriptions variable incomewhich they had until the first month of the year, “a great rally“.

Victorio Marino indicates that, for the second stage, which runs from February to the present, the outlook was not the best, since “the equity corrected strongly”, to which was added the sharp drop in the reference rate by the BCRA. “A combo that hit the Mutual Funds industry hard“he warns.

WhatsApp Image 2024-03-26 at 11.43.35 AM.jpeg

Graphic courtesy of Inversiones Andinas (IA).

Andean Investments (IA)

For the strategist, these outflows accelerated “especially” after the rate cut, when savers decided to aggressively abandon FCIs and “look for options that offer positive real rates” or, at least, more attractive.

From dollar linked to seek inflation coverage

As expected, the reduction in interest rates generated a rearrangement in the positioning of investors, since, in this way, exposure to foreign exchange hedge funds (dollar linked) was reduced, but increased hedge funds against inflation (inflation linked).

For Rodrigo Benitez, chief economist of MEGAQMinvestors are assigning a greater probability of occurrence to the scenario where the Central Bank maintains the pace of crawling peg at 2% monthly. Furthermore, given the new interest rates, “There was a correction in the price of CER assets, which rose sharply in the last week“, slips in statements to this medium.

Benítez explains that investors sought to capture that rise, which yields a positive flow “towards common funds that invest in assets that adjust for inflation“, despite estimates of slowing price dynamics.

The analyst reveals that, in any case, “the current photo continues to show that of the $31.1 billion pesos managed by the FCI industry, 6.3% are still allocated in dollar linked funds and 5.6% in CERs“. This makes it clear that beyond the short-term fluctuations, Investors continue to resort to these instruments in search of covering specific risks of their business.

Therefore, despite the 2% crawling peg and having accumulated a lower return than other funds, They still choose to stay crazy in dollar linked funds. “But, on the other hand, we understand that, if the crawling peg continues for a long time, given current inflation levels, at some point a greater flow may begin to be seen again in search of coverage,” warns Benítez.

Investors’ current strategy

The second quarter is the one with the highest seasonal supply of foreign currency. “For this reason, we see less appetite for currency hedging and more for look for returns that allow the value of the pesos to be maintained,” analyzes Benítez. And he warns that this is complex given the current level of rates, “that are negative in real terms (less than inflation)“.

Therefore, a greater risk appetite has been seen, with investors accepting a greater mismatch and “They look for that return in global bonds, bonars, bopreales or longer-term investments,”taking advantage of the favorable market climate,” concludes the MEGAQM analyst.

What options do investors have today in FCI?

As mentioned, the fixed rate market does not offer much. Today, the FCI T+0 they perform below inflation or, for example, the rate tendered for the LECAP (the new capitalizable letter S31E5) this week, which was 5.5%, leaves a little taste. But something is better than nothing. That is the feeling among savers and investors.

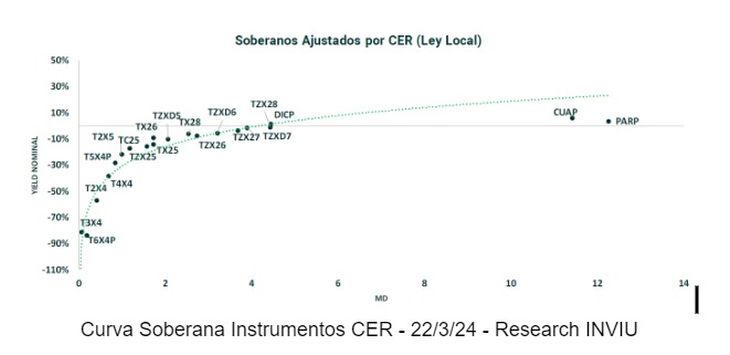

Marine Thus, he maintains that there is not much attractiveness in the CER sovereign curve in terms of rate and that a large part of the instruments yield negative. “It would only be suitable for certain specific or corporate needs and we do not consider it prudent to stretch the investment in these instruments too much. (duration)”, he slides. He even recommends “caution“with the CERs if the stocks are lifted between now and then.

For its part, in the curve dollar linked, From IA they consider that there was “excessive punishment”, but maintain that there may be some opportunity, “especially considering a possible lifting of the stocks“. The broker’s Research team analyzed some interesting scenarios and conclude that there is value in some of these instruments: “For example, some Negotiable Obligations that adjust by official exchange rate +10%“, since they look attractive when purchased with hard dollar ONs.

WhatsApp Image 2024-03-26 at 11.43.19 AM.jpeg

Graphic courtesy of Inversiones Andinas (IA).

Andean Investments (AI)

An essential driver to take into account is that the market will be looking very closely at everything that has to do with the lifting of the stocks and will seek to discount the price of many of its assets exchange rate unification. With a low gap, Marine maintains that the question is “how long until that moment“.

At the same time, investors’ search will surely be focused on beating the peso blender while the dollar-nominated bonds are trading at highs and the corporate hard dollar They perform the same as a t-bill (Treasury Bill). For this reason, IA recommends “prudence” about de-dollarize portfolios.

What to bet on with what’s coming

In conclusion, although the impact on rates was strong, but on flows, not so much. It is a reality that this fall will allow them to gain space for other investment options.

From Personal Investment Portfolio (PPI) conclude that the Money Markets, “with logic”, will continue to be attractive, given its immediate liquidity, for cash management.

This, even with negative real rates and exposed to future reduction decisions by the BCRA, something that is expected as the economy stabilizes.

However, for those seeking greater profitability and are willing to take on greater risk, it is a scenario that naturally leads to T+1 Fixed Income funds or other strategies.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.