In Argentina, we went from an environment of very high nominal value and uncertainty to one of exchange stability, partly recovering confidence. The loss of purchasing power of our currency with respect to the rest of the goods ran at great speed throughout 2023, where the dollar took the lead. Financial dollars ran around 200%, while so far this year they only ran around 10%.

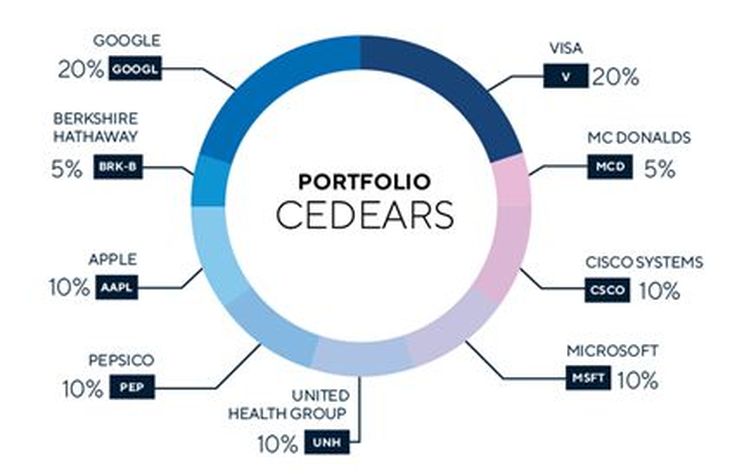

In that environment, where the weight race gave no respite, choosing a The correct Cedears portfolio not only served to diversify our savings from the ups and downs of the domestic economy, while taking advantage of global opportunities, but also provided protection against the rise in the financial exchange rate, as it is an instrument in dollars, but also negotiable in pesos.

When we look at the profitability in pesos of the Cedears, the sources derive from the behavior of the underlying asset, that is, from the stock listed on global markets and also the behavior of the financial or cash exchange rate with settlement. In that environment of very high uncertainty and very high nominal value, participating in the race with this instrument was a great alternative that protected our savings at the speed with which financial dollars flowed.

But in the new environment of the Milei era, with exchange rate stability for the moment, and in the face of a notable change in expectations, Cedears also regained their true appeal: the generation of value by the underlying in international stock markets. In Creole, its true source of value. Furthermore, they continue to be an option to dollarize our savings, given the exchange restrictions still in force, being insurance against the possible loss of exchange stability, although today it seems unlikely.

Cedears: global opportunities

Regardless of the local environment, Cedears are an attractive instrument for domestic investors to diversify their savings from Argentine risk, generating long-term value. The exchange rate stability observed over the course of Javier Milei’s management leads us to focus on the risks and opportunities presented by international markets.

Short-term expectations move in step with decisions and signals from the Federal Reserve led by Jerome Powell, while inflation and economic activity data arrive. And in the long term, due to the boost that the increase in productivity in the economy could achieve due to the Artificial Intelligence revolution.

Cedears: short-term at the pace of the Fed

At the beginning of this month the Federal Reserve held its monetary policy meeting and, in line with what was expected, maintained its reference rate in the range of 5.25%-5.50% for the sixth consecutive meeting, The last increase being in July of last year. In his usual statement, it was highlighted that in the first quarter of the year no progress was seen in terms of the evolution of inflation. But after three consecutive months of higher-than-expected inflation, the United States CPI showed inflation for the month of April below expectations, although still far from the Fed’s objective.

However, these data added to certain signs of slight slowdown in the level of economic activity, that although they show a solid economy based on a robust labor market, they suggest that Inflationary dynamics may be lower than in the first quarter of the year. Let us also remember that the Fed made it clear that a new rate increase would not be necessary, as the current level was sufficiently restrictive, suggesting that will keep rates at the current level perhaps longer, with a rate cut most likely being its next move.

In this way, after the favorable inflation data, the market reacted with a strong compression of rates along the entire curve. The 10-year Treasury bond rate, considered the “risk-free rate” after having reached peaks in April, touching 4.7%, fell again to 4.3%.generating a new momentum in the stock market.

This continues to be the most important short-term “catalyst” for markets when pricing global risk assets. Let us remember that when the “risk-free rate” is considered the “floor” rate to be discounted in stock valuation models, it is evident that The signals to lower rates sent by the Fed are received positively by investors, which are further fueled by good inflation data. Thus, a lower rate would imply a lesser penalty to expected future cash flows.

The short-term catalyst

criteria 1.jpg

Source: Bloomberg

The year that began with good arguments for stay aggressive in our Cedears portfoliorewarded us with the main US stock indices at historical highs, in nominal terms. The S&P 500 surpassed 5,000 points for the first time in its history on February 9, currently standing around 5,300 points.and just three months and a few days later he did it the Dow Jones, which surpassed 40,000 points for the first time in its history on May 16.

Cedears: long term, Is a new impulse unleashed in the markets?

Putting our eye on the long term, in light of the revolution that AI promises, a favorable scenario for the rest of the decade cannot be ruled out. Despite higher rates, the economy maintains its long-term growth level and if investment causes increases in productivity, inflation can be kept at bay. In this way, a context similar to that observed in the United States between 1994 and 2000, a period characterized by a notable increase in productivity thanks to the Internet. This also caused an excellent performance for the shares at that time, as a result of the growth in corporate profits.

The boom in Artificial Intelligence is motivating a strong push for technology companies, within the growth and large capitalization sector. Beyond the speculative factor that always exists around a new technology, the emergence of AI is supported by improvements in work productivity, with a jump registered after fifteen years of stagnation.

At the same time, the notable increase in the valuation of companies that promote the development of AI does not occur without support, but is tied to palpable improvements in profits in the immediate future. In this sense, the episode does not resemble the “dotcom” bubble at the beginning of this millennium, but rather looks much more solid from a business perspective.

The good results exceed expectations in the balance season: Google, Apple and Microsoft support our thesis

These three technological giants that are part of the Cedears Criteria Recommended Portfoliothey surprised again with their good quarterly results. In this environment, these investment alternatives could be driven by both “short” and “long” term catalysts. In the short term, a decrease in the risk-free rate would boost the valuations of those stocks whose cash flows are expected to be largely distant in time., this being the case of these growth and large capitalization technology companies. Also due to the long-term boost that AI could generate in their valuations, as they are a priori the ones most likely to monetize the impact of greater productivity on the economy.

- Microsoft reported excellent results on April 25 where profits increased by 17%, operating income by 23%, and both net income and earnings per share by 20% year-on-year. Management highlighted opportunities in AI and cloud revenue, where Microsoft Copilot and Copilot Stack are driving a new era of AI transformation. To understand the company’s value potential, Microsoft ended the quarter with $80 billion in cash and short-term investments, surpassing its $65.4 billion debt. Operating cash flow in the nine months ended March 31 increased to $81.4 billion from $58.8 billion, with free cash flow of $50.7 billion. Thus, its strong adoption of AI and increase in operating cash flow highlight it as one of the best investment options in this environment.

- Manzana For its part, it reported better-than-expected results in the first days of the current month. Revenue was $90.8 billion and earnings per share were above consensus. Additionally, it increased its dividend and launched a massive share buyback program, reporting an all-time record revenue in Services and launched Apple Vision Pro, showing its potential. In turn, it shows a rebound in iPhone sales, despite competition in China that led to a new earnings per share record for the quarter.

- While Google (Alphabet) also achieved results that exceeded expectations in terms of its revenue and profits. Earnings per share came in at $1.89, down from $1.17 in the year-ago quarter and well above consensus. Management highlighted strong performance in areas such as its “search” service, YouTube and the cloud, also indicating strong momentum across the company thanks to its leadership in AI research and infrastructure.

criteria 2.jpg

It is probably still premature to know if AI will bring the great benefits that are predicted for the global economy, as well as the changes proposed by Milei for the stability of the local economy. However, there are signs that have led the American stock market to revalue aggressively, while allowing us to better diversify the risk of our portfolios. In this context, the good performance of this segment could continue, beyond the decisions of policy makers.where it seems convenient to be invested.

Asset Management Criteria

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.