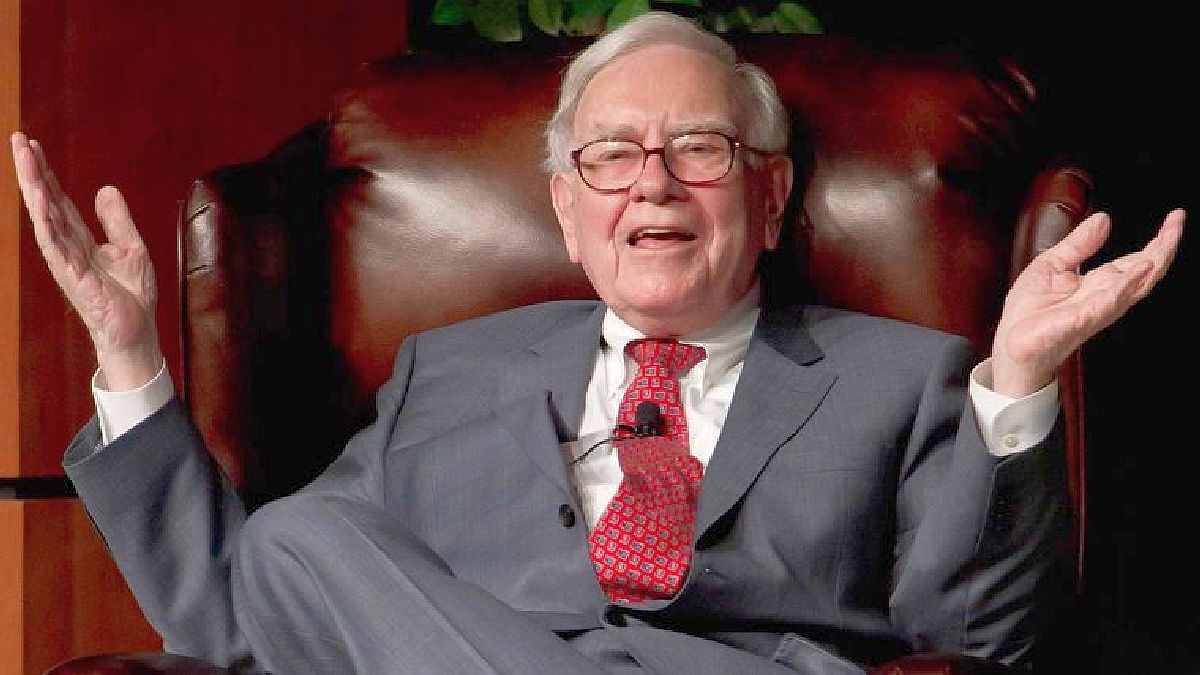

Days ago, as established by regulations in the US, the fund Berkshire Hathaway of the famous Warren Buffett He submitted, at the last minute like most of his colleagues, the traditional 13F form to the Securities and Exchange Commission (SEC), revealing, perhaps, one of his most secret investments in recent times.

It is worth noting that The 13F is a quarterly report that since 1975, when Congress created it, all institutional investors with a portfolio of more than US$100 million must present. Its objective was to provide the general public with an insight into the holdings of the country’s largest investors, as a way of showing what the so-called “smart money”. Thus, the 13F reveals capital holdings and since it must be filed within 45 days after the last day of the calendar quarter, most wait until the end to hide their investment strategy.

What emerged in the case of Berkshire?, which explains why a particular stock was rising on Wall Street days ago. The name appeared Chubba Swiss insurer that climbed, not only on Wall Street, but in Warren’s fund portfolio to ninth position.

The presentation of 13F revealed that Berkshire had purchased almost 26 million shares of the Swiss company worth $6.7 billion, which is approximately 6.4% of the insurer..

Chubb, one of the largest listed insurers in the world, is led by Evan Greenbergundoubtedly a high-ranking surname in the global insurance business since he is the son of the former CEO of American International Group (AIG), Maurice “Hank” Greenberg, one of the protagonists of the 2008 global financial collapse.

Before the presentation of 13F, Chubb had made headlines again for being the insurer of the collapsed Francis Scott Key Bridge in Baltimore hit by a container ship. It is worth remembering that insurer Ace Limited had purchased the original Chubb in 2016 for almost $30 billion in cash and shares, and the combined company adopted the Chubb name.

It must be taken into account that the insurance business is one of the main ones of Berkshire, which owns the automobile insurer Geico and other insurance companies, such as the reinsurance giant, General Reand a series of home and life insurance services, in addition to the fact that in 2022 it acquired the insurer Alleghany for almost US$12,000 million. Therefore, it is not surprising that in his last letter to shareholders, Buffet pointed out that property insurance was the core of Berkshire’s well-being and growth.

A bet that was kept secret in the SEC

Both Buffett and the fund itself tried to keep the bet on the Swiss insurer secret for two consecutive quarters, a prerogative that, according to the CNBC channel, the SEC granted Berkshire. Thus he obtained the option of giving confidential treatment to keep secret the details of one or more of his shareholdings.

According to the most insidious knowledgeable of the actions of the Oracle of Omaha It is unusual for Berkshire to request such treatment from the SEC. Recent history shows that the last time it kept a purchase confidential was when it bought Chevron and Verizon in 2020. Analysts explain that one of the reasons investors may request to keep a position private is that showing it would reveal a buying program or sale in progress.

In the halls of the NYSE, there was speculation that Buffett’s mysterious purchase could be a banking sector action since holdings in “banking, insurance and finance” had increased almost $1.5 billion in the first quarter after growing about US$3.6 billion in the second half of 2023.

Chubb stock recently climbed above $265 when it was barely trading at $185 a year ago. after hitting highs of 223 last November after a post-pandemic rally that took the insurer’s price from $100 to above $200 at the beginning of 2022. Since the 13F presentation, the stock has climbed from $260 to more of 275, and now operates around 265 dollars.

The successor of the Oracle of Omaha

The 13F presentation came after Berkshire’s annual meeting in Omaha where Buffett took the opportunity to explain some of his latest investment decisions, such as cutting his stake in Apple and where he reported that he will give more power to Greg Abelwho will take over the reins of the conglomerate once he is not present.

In this regard, it is worth remembering that Warren’s right-hand man, Charlie Munger, died last year, creating uncertainty about the successor to the Oracle of Omaha. According to Buffett, the responsibility should fall entirely on Greg once he is gone for capital allocation decisions, given that he understands business very well.

Buffett had said that the responsibility has been his and that he had outsourced some of it, but he used to think differently about how that would be handled, but he believes the responsibility should be the CEO’s.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.