As Ámbito learned, the New York market stopped the operation of almost 30 shares due to “volatility since the opening” and they cited a “technical problem.”

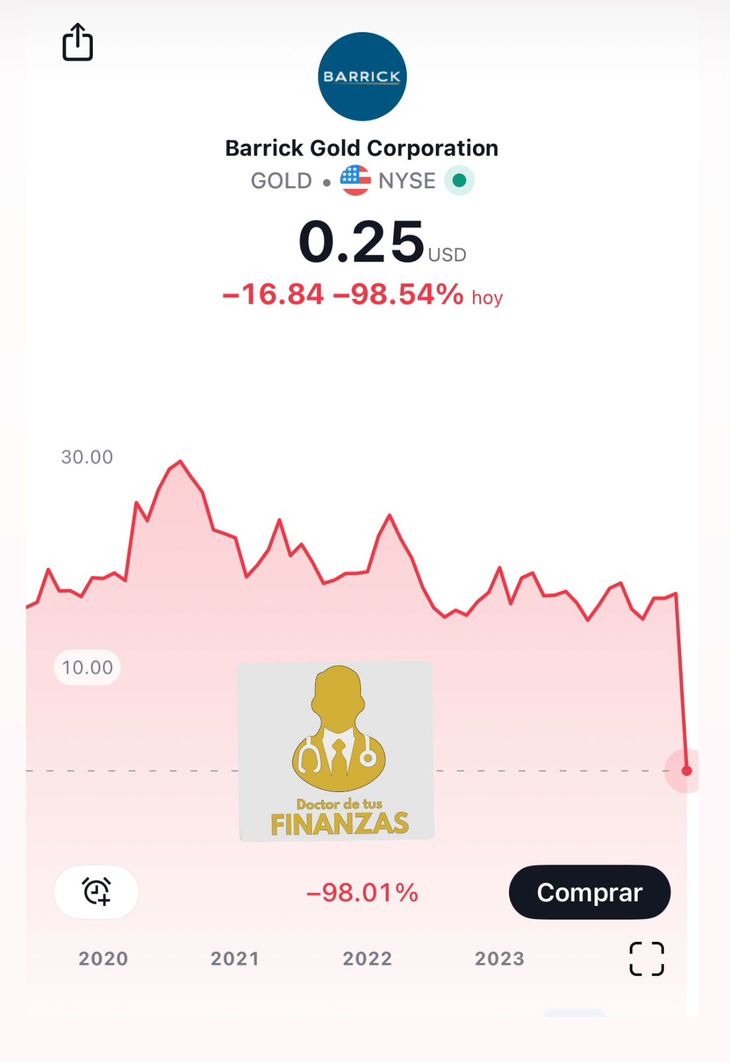

Shares such as Barrick Gold and Warren Buffett’s company were among those affected.

Reuters

The New York Stock Exchange (NYSE) is reviewing a technical problem after several stocks were paused after falling almost 100%. The authorities of the square are investigating a technical problem, according to the American press, which led to the suspension of the negotiation of Berkshire Hathaway and various other actions.

The content you want to access is exclusive to subscribers.

Actions like Barrick Gold and Warren Buffett’s company fwere those affected. Berkshire’s Class A share is shown trading at just $185.10, implying a staggering 99.97% loss, according to Refinitiv.

WhatsApp Image 2024-06-03 at 11.26.14.jpeg

Barrick Gold Quote, courtesy of the Doctor of Your Finances at Ámbito.

In this context, the investment advisor, Gaston Lentini He pointed out that this is “a mistake in the US market” and that it will soon be solved, in order to bring calm to investors who had a good scare. “It is a platform problem in the New York market,” says the strategist, “because although it can be negotiated at a normal price, in many graphers it was seen -98%“he warns.

Wall Street: what’s behind it

As he was able to know Ambit, The New York market stopped the operation of almost 30 shares due to “volatility since the opening” and cited a “technical problem.” On social media, users are talking about GameStop “breaking the market” with a meteoric rise of more than 70%.

gamestop.jpg

It turns out, after “Roaring Kitty” Keith Gill, the stock influencer behind of the 2021 retail rush, returned to Reddit with a post showing a $116 million bet on the troubled video game retailer. The video game retailer’s stock soared.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.