July is full of news for the fixed-income market, with maturities for sovereign Treasury bonds and also for BCRA bonds with the first amortization of Bopreal 2025.

The investor must take into account the cut-off dates when buying/selling these instruments in order not to be left out of payments.

Depositphotos

The payment schedule Negotiable Obligations (ONs) July is looking busy. The seventh month of the year brings a lot of news for the fixed-income market, not only for corporate debt, but also for the Sovereign bondsboth the issued by the Treasury (AL/AE/GD) like those of central bank (BCRA), given that the first amortization of Bopreales 2025 (BPJ25).

The content you want to access is exclusive to subscribers.

The ONs are debt financial instruments issued by companies to raise funds from the capital market. They function in a similar way to sovereign bonds and can be offered to both institutional and individual investors. And, in this way, the Major Argentine companies obtain funds which are allocated to investment in their respective activities.

The ONs, with some ups and downs in recent years, have been one of the preferred investments for Argentines, since they allowed them to make their pesos and dollars work. Throughout the year, these titles make rent payments and capital amortization both for bonds issued in local and foreign currency.

From Andean Investments shared with Ambit the expiration calendar for the month of July, as well as some “hacks” that are essential when investing in instruments of fixed rent.

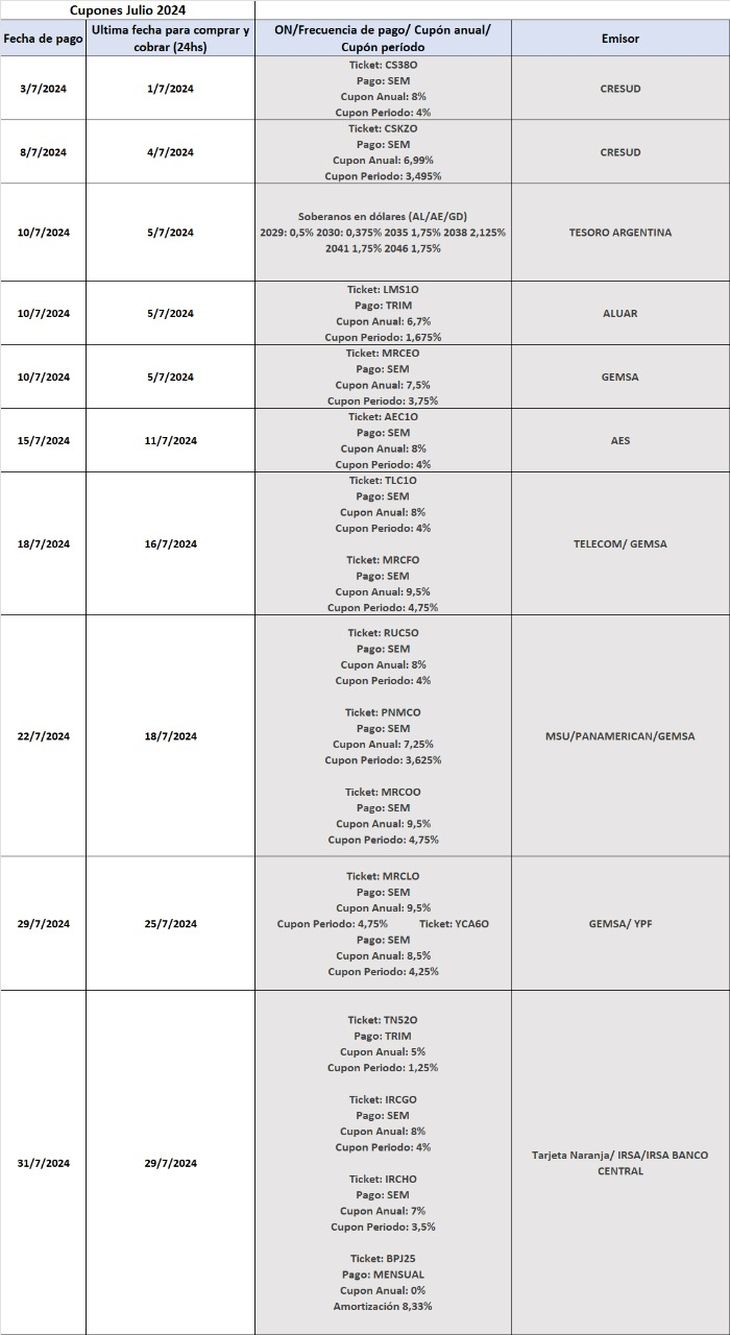

Coupons July 2024

As can be seen in the following table, the seventh month of the year has, In addition to the sovereignvarious corporate and company debt maturities and you can see the payment dates as well as the coupon to be collected for each instrument:

July Coupons – Andean Investments.jpeg

Coupon payment calendar for July – courtesy of Inversiones Andinas.

It is worth highlighting the maturities of corporate debt and companies such as:

- YPF -(YCA6O)

- Telecom – (TLC1O)

- IRSA– (IRCHO – IRCGO)

- ALUAR (LMS1O)

- GEMSA (MRCEO – MRCFO – MRCOO – MRCLO)

- CRESUD (CS38O – CSKZO)

Hacks for investing in fixed-income instruments

From the aforementioned broker in the city of Buenos Aires, they recommend taking these into account 4 keys When investing in fixed income instruments:

- These instruments allow us to know precisely the amount to be collected and the performance to be obtainedwith which the destination of that money can be planned with time and certainty based on the flows of funds, whether its reinvestment or withdrawal.

- Remember that there is no benefit to purchasing two days before the coupon, but there is no harm either.

- The investor has to take into account cut-off dates when buying/selling these instruments to avoid being left out of payments.

- Payments take about 48 or 72 hours to be settled after the coupon is cut and are automatically received by the clients.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.