This is how it arises from the SME Retail Sales Index of the Argentine Confederation of CAME, prepared based on a monthly survey of 1,276 retail businesses in the country, conducted from July 1 to 5.

The measures that the SME sector expects

The most important measure that the SME businesses is the tax reduction, which accounts for 40.7% of the responses, followed by the stimulus to domestic demand by 17%. This suggests that, in the current context, Traders prioritize direct interventions that can improve their competitiveness and operational efficiency over more favorable financing options. Taken together, the chart underscores the need for policies that reduce the tax burden and encourage domestic consumption to revitalize businesses.

In addition, The biggest challenges identified by merchants are lack of salesrepresenting 57.6% of the responses, and high production and logistics costs, which constitute 23.4%. These two factors stand out as the most significant obstacles to the growth and stability of SME businesses.

The markets They valued the greater stability in prices, but expressed concern about the amounts being paid for energy consumption. In a context of such low demand, 35% of the businesses surveyed were reducing operating costs, while another 26.5% were diversifying products to make up for the lack of sales.

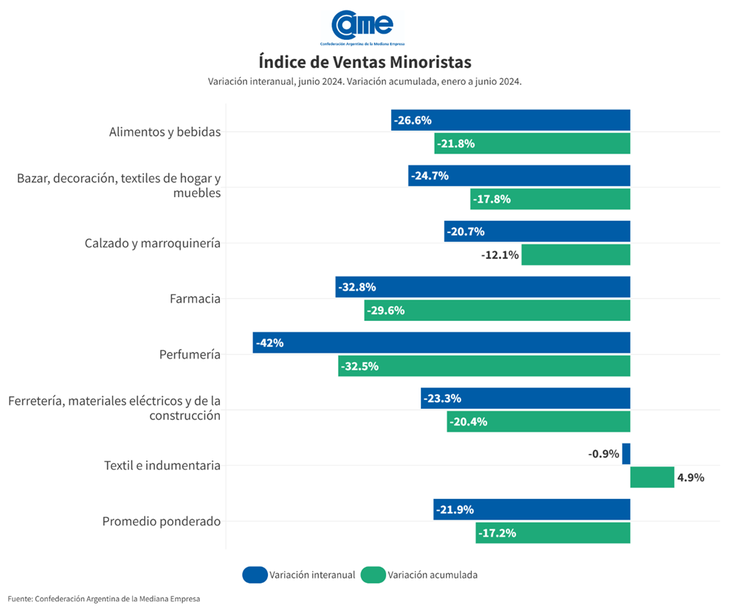

Retail Sales SMEs JUNE CAME.png

All sectors registered a fall in June

In June, All seven sectors recorded year-on-year declines in their sales. The largest annual declines were detected in Perfumeries (-42%) and Pharmacies (-32.8%). This is the breakdown sector by sector:

Food and drinks

Food and drink, the Sales fell 26.6% annually in Juneat constant prices and accumulated a fall of 21.8% in the first half of the year compared to the same period in 2023. In the month-on-month comparison, they rose by 1.8%. People buy smaller quantities, very selectively, stick to the necessary products, change first brands for second and third, and take advantage of offers as much as possible. The general opinion of the businesses surveyed is that we are going through a critical situation, with more stable prices, but with a very delicate financial situation.

“People have little money and reduced their expenses. In addition, the electricity bill has increased four times more than what we were paying before, and so has the rent,” said a shop in Mar del Plata, province of Buenos Aires. “We are in a difficult situation, we are increasingly reducing our bills,” said a shopkeeper from Godoy Cruz, Mendoza.

Bazaar, decoration, home textiles and furniture

Regarding the Bazaar, decoration, home textiles and furniture sector, it was reported that Sales fell 24.7% year-on-year in June, at constant prices, and have accumulated a drop of 17.8% in the first six months of the year compared to the same period in 2023. In the inter-monthly comparison, they fell by 0.4%.

Sales in this area had one of the worst months of the year, with little people consulting, even on Father’s Day week. Cheap products were sold in stores that offered installments. In the rest, only very cheap goods were sold, with average prices of less than 10 thousand pesos.

“In June, another business in the area that was competing closed down and that meant that our sales have not dropped as much, because we incorporated the products they sold to attract their public,” reported a business in the City of Buenos Aires. “There were more sales with the Cuota Simple program and the prices of supplies went down. That was the good news, but we are having a hard time,” according to a business in the city of Rosario, Santa Fe.

Falling Items July CAME.png

Footwear and leather goods

In footwear, Sales fell 20.7% annually in June, at constant prices, and have accumulated a drop of 12.1% in the first half of the year compared to the same period in 2023. In the month-on-month comparison, they grew by 1.3%. Father’s Day generated better sales than in previous months, and more stable prices gave peace of mind to the trade, but sales did not pick up. Sports shoes sold better and formal shoes very little. In the leather goods sector, stores reported that buyers disappeared, with zero sales days.

“It was noticed a slight improvement over April and May for Father’s Day, “But not in relation to June of last year,” said a shoe store in the city of Salta. “Not even Father’s Day helped us. We need new measures to stimulate the market,” said a business in the city of Córdoba.

Pharmacy

In pharmacies, Sales fell 32.8% year-on-year in June, at constant prices, and have accumulated a 29.6% drop in the first six months of the year compared to the same period in 2023. In the month-on-month comparison, they grew by 1.5%. Pharmacies are going through a very mixed situation. Among purely pharmaceutical products, sales are falling more moderately than in perfumery. In medicines, people ask for the cheapest brand, split pills when possible and choose pharmacies that accept credit cards.

“In the Dermo-cosmetic products we sold many fewer units than last yearbut in terms of medications we remain the same,” according to a pharmacy in the city of La Rioja.

“People are buying medicines with credit cards in three and six installments without interest, something that did not happen before,” said a pharmacist from San Salvador de Jujuy.

Perfumery

In the perfumery sector, Sales fell 42% annually in June, at constant prices, and have accumulated a drop of 32.5% in the first six months of the year compared to the same period in 2023. In the inter-monthly comparison, the decrease was 0.3%. It is the category that has fallen the most because these are products that are generally expensive and can be dispensed with. Perfumeries consulted say that people are buying many products of this category in supermarkets or stores, regardless of the lower quality they receive.

“We pay a lot of taxes, both municipal and provincial, which complicate our sales and the operation of our business. With sales so low, it is becoming noticeable” (perfumery in the town of San Martín, province of Buenos Aires).

“People are very interested in price and perfumeries have a lot of competition, both from pharmacies and supermarkets and stores, which usually have better payment options” (perfumery in the City of Buenos Aires).

Hardware, electrical materials and construction materials

For the hardware, electrical and construction materials segment, Sales fell 23.3% year-on-year in June, at constant prices, and have accumulated a fall of 20.4% in the first six months of the year compared to the same period in 2023. In the month-on-month comparison, they rose by 1.4%. Although sales linked to public works rebounded, the same did not happen with residential sales. People continue to postpone decisions on more expensive purchases, even when there are installment options. The businesses surveyed expect a better second half of the year.

“Sales have been falling significantly for months. Public works are at a standstill and private works are scarce,” said a shop in the city of Resistencia, Chaco. “The cost structure has increased and sales have fallen. If the situation does not change, we will lose our jobs.”We’re going to have to fire people“, they warned in one of the cities of Formosa.

Textile and clothing

The textile sector reports that Sales fell 0.9% year-on-year in June, at constant prices, and accumulated an increase of 4.9% in the first six months of the year compared to the same period in 2023. In the month-on-month comparison, they rose by 0.7%. Retailers turned to sales and big offers to get rid of excess stock and obtain liquidity. Father’s Day helped, especially for sports and casual clothing. But then sales slowed down.

“I have cut down on all possible expenses“And if we don’t make super offers, nothing will sell,” said a business in the city of Paraná, Entre Ríos. “June was quite good for us in terms of sales, with Father’s Day helping. But we are facing very high costs and prices that, if we raise them, we won’t sell,” reported one from Río Gallegos, Santa Cruz.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.