Argentines’ expenses generated abroad can be cheaper or more expensive, depending on the financial decision they choose. With the rates that coexist, they can save up to 13%.

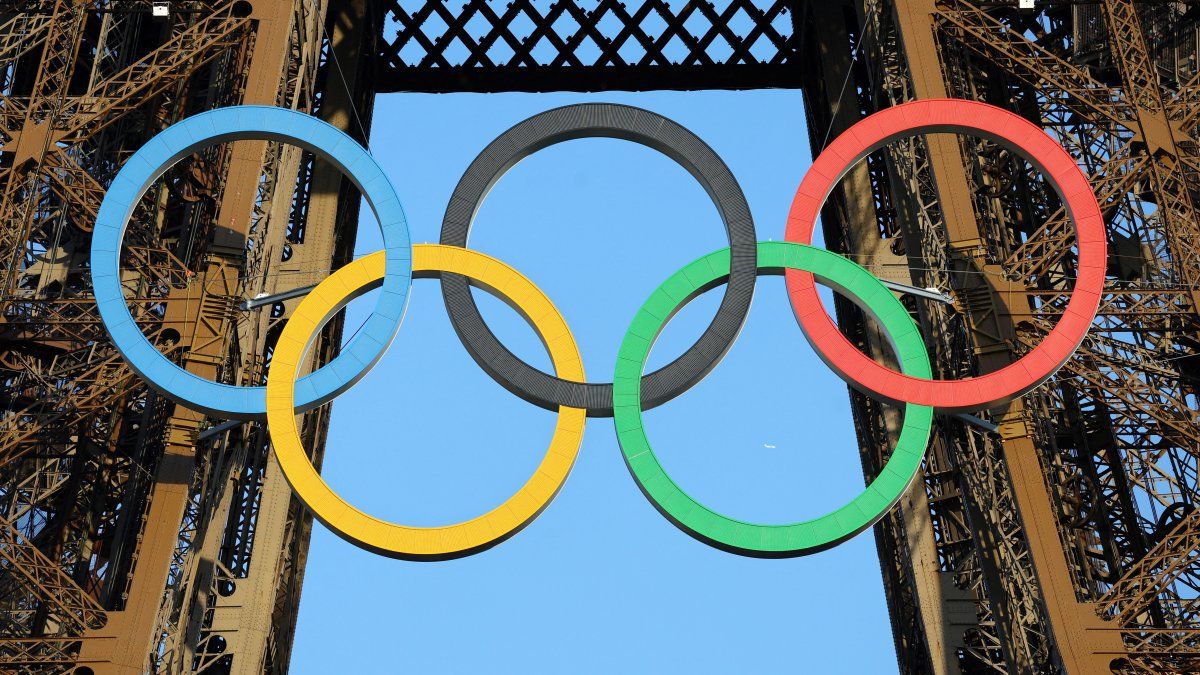

The Argentines traveling to Paris within the framework of the Olympic Games 2024 They should organize their finances well, as it can be an experience more expensive either more economicaldepending on the financial decision that the tourist takes. In Argentina there is more than one exchange rate and this means that, depending on the payment method chosen, each euro spent is more expensive or cheaper.

The content you want to access is exclusive for subscribers.

The most expensive exchange rate, in this context, is the so-called “dollar card” which is located at $1,515.20. This quote applies to purchases made with a card in foreign currency.and which includes the official retail price plus the 30% of the PAIS tax and other 30% on account of Profits.

Meanwhile, the dollar blue is positioned in $1,445 and is located more than $100 above the MEP. Therefore, tourists are advised to pay the expenses in Paris in cash or with the dollars that are kept in the accountobtained obtained with the quote MEPsince they are a 13.4% cheaper.

Olympic Games 2024: how to pay for your expenses with a card

In case of credit card consumption It is also convenient to pay the summary with dollar billsprior to maturity, in order to avoid imputing the 30% of the PAIS tax and the 30% advance on profits.

2024 Olympic Games: step by step to buy MEP dollar

To buy MEP dollar or dollar bag the following steps must be followed:

- Open an account with a local broker: To obtain the dollar stock exchange, it is necessary to open an investment account in a local stock exchange or brokerage firm. To operate, you must open an account in one of the intermediary companies, which is free and remote. To do so, you must complete a few simple forms and verify your identity.

- Deposit funds: Once the investment account is opened, it is necessary to deposit the amount of money that the person wants to exchange from a bank account of the same holder. Before operating, the CBU of the dollar bank account must be enabled to deposit the money there.

- Buy the GD30 or AL30 bond: To acquire the MEP dollar, you must buy an asset that is traded in pesos and in the US currency with immediate cash settlement (IC). For this, most investors use the GD30 bond because it has a high trading volume and its price is more stable.

- Wait one business day with the asset in your portfolio: The interested party must complete one business day of parking, which consists of a waiting period established by the National Securities Commission (CNV) that the person must go through in order for the money to actually be available in the account.

- Sell the bonds in dollars: Once the parking period has passed, the person can sell the assets. To do so, they must select the “Immediate Cash” option with the AL30D/GD30D label. There they must determine the number of bonds they want to sell and choose the market price. Once the transaction has been carried out, the liquid dollars will be available on the broker’s platform ready to be transferred to the bank account.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.