The Ministry of The economy will carry out a new exchange of peso debt bonds this Thursday which, in this case, will be intended exclusively for banks that agreed to terminate liquidity insurance on public securities (known as puts) that the Central Bank had sold them. As anticipated AmbitThe measure was expected in the City and, in fact, was part of the conversations prior to the launch of the repurchase of the puts by the BCRA.

However, many welcomed it with surprise the fact that, for the most part, The bonds offered in exchange are longerSome traders had hoped that, as a reward for agreeing to part with the puts, the banks would receive instruments shorter than the securities they had secured until a few weeks ago. BCRA but not anymore.

With the proposal on the table, In the market they believe that, although the offer is not attractive in itself, it could still have good acceptance.. Some for technical reasons, but others, who consider that the operation worsens the situation of the banks, relate it to the possibility that it was part of the more political negotiation between the Government and the entities that allowed the cancellation of the puts. However, another factor appears as a background: the seeking to “discipline” the banks that decided not to hand over their insurance and keep it in their possession.

The details of the exchange

The Secretariat of Finance will exchange inflation-linked bonds (BONCER) for other securities also indexed to the CPI and a fixed-rate bill. Only banks that have rescinded their puts will be eligible to participate. in the operation carried out by the BCRA on July 18 and may only submit bids for the securities they had insured “up to the sum of the nominal value involved in said operation,” the Ministry of the Economy clarified in the call. The reception of bids for the conversion will begin at 11 a.m. and end at 2 p.m. this Thursday, and will be settled next Monday.

Eligible securities are nine BONCERs and in exchange it offers four BONCERs and one LECAP (fixed rate bill). Holders of the TX25 bonds (as of November 2025), TZXD5 (as of December 2025) and TZXM6 (as of March 2026) will be able to exchange them for the TZXD6 (as of December 2026). Holders of the TZX26 (as of June 2026) and the TZXM7 (as of March 2027) will be able to exchange them for the TZXD7 (as of December 2027). Holders of the T3X5 (as of June 2025) would receive the TZX25 (also as of June 2025). Holders of T4X4 (as of October 2024) and T2X5 (as of February 2025) will be able to exchange them for TZXD5 (as of December 2025). And holders of T2X5 (as of February 2025) will be able to obtain LECAP S31M5 (as of March 2025).

A report from the consulting firm Romano Groupbased on secondary market quotes and the technical value at which eligible securities are taken, calculated that the offer presents “a certain premium” over the market value for those who decide to participate in the conversion. The firm’s estimated “earnings per price” averages 0.56%“Although by extending duration an average yield of 5% is obtained, said yield can also be obtained in the market due to how the curve is quoted (at prices of July 30, said yield averages 3%),” added the report prepared for its clients.

image.png

If the Government obtains a significant number of subscribers to the operation, it will obtain a certain extension of the average life of its debt at the cost of maintaining the indexation of the securities, except in the last of the exchange options.

Romano Group also highlighted that “this is an operation that seeks to consolidate holdings and at the same time a move towards more liquid instrumentsAs an example of the latter, he pointed out that the T3X5 bond has not been traded on the secondary market screens since February of this year.

Swap: the analysts’ view

“I don’t see any great incentives in the exchange, although I believe it is something agreed upon with the banks”said the economist Salvador Vitellihead of research at Romano Group, in conversation with Ámbito. And he considered that “Between liquidity and price gains, they will probably come in.”

The financial analyst Christian Buteler He analyzed it like this: “For the Government it is always positive to extend duration, but for the banks it seems to me that it worsens their situation.. We understood that the purpose of this operation was to give banks an instrument to reduce the gap with deposits that was generated by not having the puts. The puts gave them the possibility of exercising them in case of a fall in the value of the securities or of needing the funds to supply a greater demand for money that they might have from their clients. Now they do not have that and with this operation that risk is not being reduced.”

“The delivery of the puts was not an operation that suited the banks. It was something that was done more than anything through political negotiation with the banks, not economic. If this swap falls into the same category, they could enter. Now, from an economic point of view, it is not convenient. There were two risks here: mismatch and exposure to sovereign debt. With this swap, there will be a greater mismatch and the same overexposure“Buteler warned in conversation with this media.

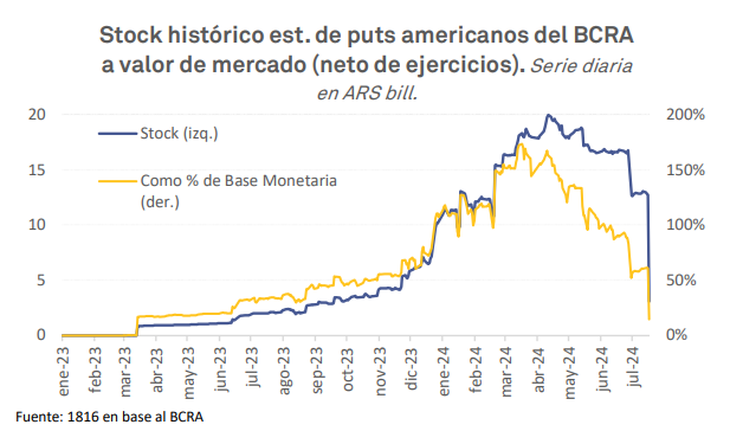

After a long negotiation, on July 18 the BCRA carried out an operation through which it got the banks to agree to cancel 78% of the liquidity insurance on public securities they held (the equivalent of $13.17 billion). For the officials, this was a key operation in view of the launch of what they called the “phase 2 of zero emission” of the economic program.

image.png

These puts represented a latent debt for the Central Bank, which at that time amounted to $17.7 billion (of which the vast majority were “American” style puts, which can be exercised at any time). These were contracts, issued both during the administration of Alberto Fernández and during that of Javier Milei, which allowed the banks that had bought them to execute them whenever they wanted to get rid of the insured securities and forced the BCRA to acquire them through monetary issuance. That is why they constituted a threat to the official plan to dry up the market for pesos.

According to calculations by the consultant 1816today A $3.1 trillion US put remnant remains in effect that the holding banks decided to retain in their possession and, therefore, did not agree to cancel them in the operation carried out by the monetary authority.

In that sense, Ramiro Tosiformer Undersecretary of Financing and current director of the consulting firm Suramericana Visión, said that The exchange announced by the Ministry of Economy “is a way to ‘corner’ those who were left with the puts” and leave them with an instrument of which they themselves will be the almost sole holders.” In conversation with Ámbito, he said: “That reduces the risk of the put being exercisable since there would be no market price since the title is rarely listed. I wouldn’t be surprised if another tender for the termination of puts comes later for those ‘dissidents’ who kept them.”.

If so, the strategy of arm-wrestling with certain entities would not be new. For example, when weeks ago Banco Macro decided to exercise puts it held for $2 billion, Javier Milei publicly accused it of trying to destabilize his government despite the fact that these were contracts that the BCRA itself had sold to it.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.