Fed funds futures trading indicates an 86% chance that the central bank will cut rates by 25 basis points at its September meeting.

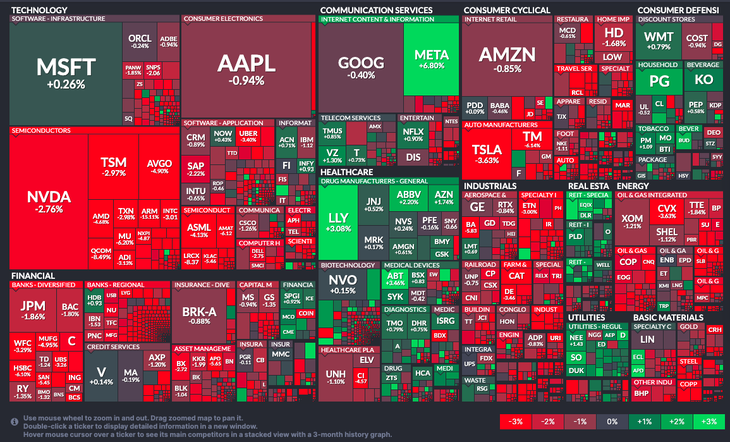

Wall Street falls in all its indices on Thursday as new data fueled market concerns about the state of the U.S. economy.

The content you want to access is exclusive for subscribers.

The Dow Jones Industrial Average is down more than 400 points, or 1.5%. The S&P 500 is down 1.5%, while the Nasdaq Composite is down 2.4%. The Russell 2000 is down 3.7%.

Initial jobless claims rose to 249,000 in the week ending July 27, beating the Dow Jones forecast of 235,000. The technology sector as a whole fell 2.1%, with the industrial sector following suit.

Wall Street: What the market is analyzing

The data follows the Federal Reserve’s decision to keep rates unchanged and comments from the president Jerome Powellsignaling that a September adjustment is under consideration. Yields fell Thursday as investors digest Powell’s comments, with the 10-year Treasury yield hitting its lowest level since Feb. 2.

“Economic data continues to point in the direction of a slowdown, if not a recession, this morning,” said Chris Rupkey, chief economist at FWDBONDS.The stock market doesn’t know whether to laugh or cry because, although three rate cuts are expected from the Fed this year and 10-year bond yields are falling below 4.00%, the winds of recession are approaching with force.”

Wall Street.png

Source: Financial visualizations.

Trading in Fed funds futures indicates an 86% chance that the central bank will cut rates by 25 basis points at its September meeting, according to the CME Group’s FedWatch tool.

Shares started the day on a positive note, with Meta Platforms up about 7% on stronger-than-expected second-quarter results and upbeat guidance.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.