image.png

One of the manifestations of the fact that the City does not finish buying Caputo’s roadmap is that, despite accumulating six consecutive months of financial surplus (always celebrated by creditors), country risk remained firm above 1,550 basis points during July and Last Friday it jumped to 1,612 units in line with the collapse of international markets.

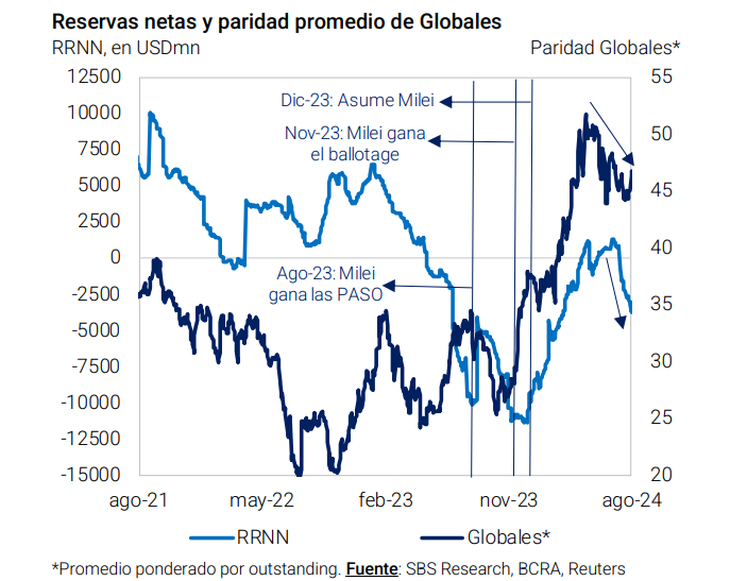

Reserves in the red: the big concern

“In the short term, the market’s eye is focused on the dynamics of external accounts, more precisely on net reserves.. These deepened their downward trend in July, with a market that shows impatience regarding the removal of exchange controls, one of the main obstacles to a virtuous dynamic in the Argentine macroeconomy,” said the SBS Group in a report sent to its clients.

And he warned: “The accumulation of reserves is essential to clear up ghosts regarding payments in dollars, which led the Government to try to give signals regarding the payment of January 2025. However, in the meantime, Net reserves continue to decline, which could eventually lead to tension in the foreign exchange marketrisking cutting disinflation in the underlying measures. Can the whole government balance it?”

image.png

According to SBS calculations, the net international holdings fell more than US$4 billion in July. A report from the Economic Studies Department of the Bank province estimated that the monthly drop was US$4.6 billion and thus, they remained at negative US$4,000 million, according to the IMF methodology.

Two reports circulating on City tables this Friday estimated that lNet reserves are already negative by around US$5 billion. These are reports prepared by the consultants 1816 and LCGFor its part, Portfolio Personal Investments (PPI) places them at more than US$6,000 million in the red.

At the meeting with Clearing and Settlement Agents (ALyC), Bausili He estimated that the deterioration of the coffers of the entity he leads would be reversed from the end of August due to a decrease in payments for energy imports. However, analysts see different scenarios. factors that could play against of that possibility.

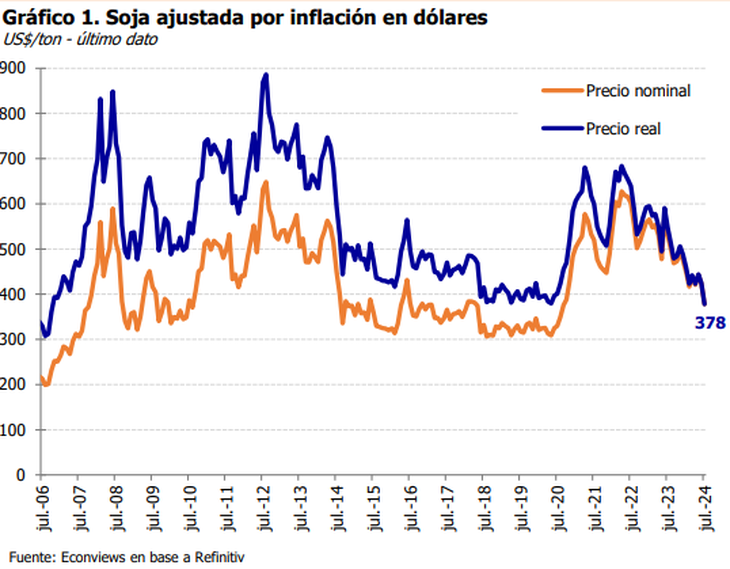

“On Thursday the race began easing of import payments (from four to two installments), which will add more pressure on reserves. In addition, exports, affected by low seasonality, suffer from the loss of attractiveness of the dollar blend (due to the reduction of the CCL) and the sustained fall in commodity prices (In particular, soybeans lost USD/tonne 50 in the last month and are at their lowest level in the last four years),” he said. LCG as part of those factors, to which he added BOPREAL maturities and the intervention of the BCRA to contain the gap (he estimated that the Central Bank has already allocated US$300 million for that purpose).

In that line, from 1816 Two pieces of bad news stood out: “The price of soybeans, which fell by more than US$100 million per ton during the Milei erawhich is equivalent to US$5 billion less in annual exports in a normal year, and the Demand for dollars from tourism “The foreign exchange rate appears to have risen again in July (winter holiday effect) based on foreign currency credit card debt balances.”

On this last point, the consultancy led by Adrián Rozanski, Mariano Skladnik and Martín Defilippo added: “Tourism numbers look especially ugly: The sector is very unbalanced at an exchange rate of $1,300 (considering that today credit cards are paid in MEP dollars and do not generate an impact on reserves), which suggests that in a unification closer to the official exchange rate, as the Ministry of Economy would intend, the outflow of foreign currency through this route would be immense.”

In this context, a report from the Center for Political and Economic Studies (CEPEC), founded by Leonardo Anzalone, considered that the latest measures “significantly decreased the level of reserves, generating Concerns about debt sustainability and negatively affecting the parity of the bonds.” Thus, he stated that the Government’s promises to reaffirm its payment commitment were initially received positively by the market but that “doubts have since returned.”

LCGfor its part, raised doubts regarding the objective of accumulating foreign currency. “The goal committed to the IMF assumes the accumulation of US$8.7 billion by September 30. As of yesterday (Thursday) it had accumulated US$5.8 billion, so, in the context that we described above, Compliance looks challenging. The Government is betting on the entry of US$1.2 billion from Organizations (this week it announced a US$650 million loan from the IDB) and the last disbursement from the IMF (which in net terms will be qualified by the payment of interest for US$780 million next week),” warned the firm founded by Martín Lousteau and directed by Javier Okseniuk.

In the medium term, the search for a Political wink from Donald Trump His victory in the US elections appears to be the Government’s big bet to obtain the US$10 billion in additional debt that Caputo intends to obtain from the Fund.

But one Trump adviser (although he does not speak on behalf of the Republican candidate) tempered expectations: “The policy of buying time by thinking that with Trump you will get more money from the Fund is an illusion, it is illogical and it will lead to failure.. Because first it doesn’t work that way. And second, Milei and Trump still don’t have a relationship,” he said. Mauricio Claver Caronethe former US representative in the organization who, at the time, acknowledged that the multi-million dollar loan to Mauricio Macri in 2018 was actually a failed electoral support for Together for Change.

image.png

Two well-regarded firms in the City warned about the “global headwind” which adds problems to the Government’s plan. Quantum, by Daniel Marx, He noted that “some changes in “International conditions do not favor Argentina.” He also mentioned the widening of interest rate spreads on emerging countries’ bonds, the appreciation of the dollar against other currencies and a 10% drop in the country’s terms of trade.

For its part, Econviews, by Miguel Kiguellisted: the fall of Wall Street and emerging currencies, soybeans at US$380 and devaluation in Brazil, in a context of relative local exchange rate lag and difficulty in accumulating reserves. “In general, external shocks are followed by exchange rate correction, but today that is a bad word because all eyes are focused on lowering inflation. The issue is that, although the headwind is not the fault of the economic team, reality is what it is. In Chile, when copper goes down, the peso goes down. Pretending that nothing is happening outside leaves you more vulnerable”Econviews stated.

Priority given to inflation, to the detriment of reserves and activity

The announcements included in the so-called “phase 2” reflected how the Government ended up clearly leaning towards supporting the continuity of what it sees as its main political support: the slowdown of the consumer price index (CPI). And that in pursuit of this priority objective it clings to a progressive exchange rate appreciation, gives up reserves through intervention in the CCL and prolongs the recessionary scenario with monetary tightening.

“Looking ahead to the second half of the year, there is a dilemma between two objectives that, in the eyes of the government, appear antagonistic: continue with the process of accumulating dollars or keep inflation low”the consultancy firm said Vectorial in his latest report. And he stated that the intervention in the CCL shows that he is now leaning towards the second.

For Vectorial, this strategy exhibits a “dynamic inconsistency.” “The more dollars are ‘burned’ to intervene, the market could perceive that there is less and less ammunition left, which would increase the questions going forward and the gaps would not necessarily decrease.. “Each dollar used to tame the gap would have less power than the previous dollar,” he argued. In addition, the scheme is “incompatible with a solid recovery of activity,” which could lead to “even further deterioration of social indicators.”

Thus, the consultancy led by Eduardo Hecker and Haroldo Montagu He asked: “With economic activity at rock bottom, unemployment on the rise and no reserves in sight, is the stabilization scheme being implemented by the government socially tolerable and sustainable?”

The monetary scheme, another source of uncertainty

Beyond the reservations, the monetary program reported by the BCRA after a succession of measures that were announced in a disorderly manner by the President and Caputo did not end up providing clarity to economic agents. “It is ambiguous, we believe intentionally,” 1816 said.. Milei and the minister spoke of ending all issuance “in line with the President’s idea of ’endogenous dollarization’,” said the consultancy, but the Central Bank in its Monetary Framework set the goal of increasing the monetary base from the current $21 trillion to $47.7 trillion by 2026 “without it being very clear through which issuance channel.”

image.png

LCG He also focused on this point: “Despite the strong gestures for a ‘zero emission’, the truth is that the monetary base could more than double to reach the self-imposed limit, which makes it a difficult goal to understand: very lax for the short term, very hard for the medium term. If we add to this the difficulties in understanding where this process leads (currency competition? defined how? end of the currency exchange rate? endogenous dollarization?) New announcements may be required, hoping this time that they will be more consistentwhich will promote an update of the agreement with the IMF and provide a larger dollar cushion to manage the transition.”

For 1816The announcement suggests that “there has not yet been a complete definition by the authorities regarding the future monetary regime,” which could imply the need for a “balance between what Milei always proposed (dollarization) and what the Fund’s Staff technicians should demand.” “If the market had doubts about monetary policy for 2025, these were not answered by the new BCRA framework”he concluded.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.