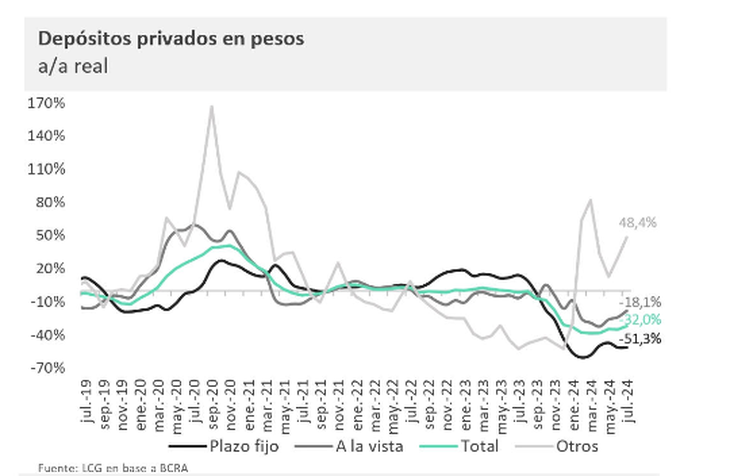

A consulting firm highlighted that in July all deposits in pesos showed real growth, an event that had not occurred since March 2020.

The placements in fixed term made a 360-degree turn in July compared to what had been happening the previous month. After the decline in June, grew although at a slower rate than the rest of the deposits (+1.8% real monthly). However, they show the worst year-on-year drop (51.3% real).

The content you want to access is exclusive for subscribers.

However, the remunerated deposits held by FCIgrew again by 7.9% monthly in real terms and is the only one that continues to grow in annual terms, climbing this month to 48.4% in real terms, according to LCG data.

others.png

The item “others” represents the FCI

On the other hand, the consultancy highlights that in July all the deposits in pesos They showed real growth, an event that had not occurred since March 2020. Demand deposits, for their part, achieved their third consecutive month of growth, at a real monthly rate of 6.8%, strongly affected by the 10.7% monthly growth of Savings Banks. The positive variation of demand deposits explains 75% of the monthly growth.

Finally, the foreign currency deposits increased by 4.3% monthly measured at the end of the month (+768 M), the largest increase of the year and totaling US$18.7 MM.

Fixed terms: points to consider

1. According to LCG, despite the growth, individuals continued to reduce the average placement time: 49.7 days (vs. 51 in June 2024).

2. In real terms, the stock of fixed-term deposits remains at historic lows, at the level of early 2023, being less than half of what it was a year ago. However, after the collapse in February 2024, a recovery of 26% was achieved.

Fixed term: what is expected in the medium term

According to analysts, individuals and companies are encouraged to leave savings balances in the banking sector “although at low or zero nominal rates, and always for short terms.” On the other hand, they point out that lower inflation and credits are consolidating a lukewarm recovery in deposits.

As regards rates, they say there are still doubts. “We think it is likely that the noise about the value of the dollar could temporarily affect the recovery. However, ultimately, everything will depend on the demand for credit and economic activity.”

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.