The growth of the monetary base continued at the beginning of Augustdriven by the dismantling of their position of Fiscal Liquidity Letters (LEFI) by financial institutions. This is a trend that began a few days after the debut of the new instrument for regulating the liquidity of the economy that the Treasury issued to replace the passive transfers of the Central Bank. In a span of eight wheelsafter the peak reached on July 25, LEFI stock held by banks fell by $3.7 trillionWhat was the fate of those pesos?

The latest official data available shows that financial institutions had in their portfolio $8.19 trillion as of August 6. This reflects that, In just over two weeks, that stock fell $2.6 billion since the beginning of operations with the LEFIon Monday, July 22. That day, the banks had purchased $10.85 trillion, an amount equivalent to the passive repurchase agreements they had held up to that point, when the total remunerated debt in pesos of the BCRA was finally transferred to the Treasury balance sheet. The accumulated decrease in that period is equivalent to 24.5% of the initial volume.

However, The fall is greater than the peak of $11.92 billion that this instrument reached on Thursday, July 25.. In fact, during the three rounds following the debut of the new monetary scheme, the banks continued to buy LEFI. But, from that moment on, the trend turned towards a progressive disarmament: in the following eight rounds, Stock shrank by 31% ($3.7 trillion).

Monetary expansion: the causes of the disarmament of LEFI

The disarmament of LEFI coincides with a growth in the monetary base, which occurred Despite the launch of the so-called “phase 2” of the economic program that the Government characterized as “zero emissions”. As the consulting firm 1816 pointed out, the announcement of the closure of the various emission taps (Treasury financing, remunerated liabilities, puts and purchase of reserves) does not prevent the amount of money in the economy from expanding. In fact, the BCRA left a wide margin for expansion up to the self-imposed limit of $47.7 billion.

How? For example, via disarming the position that banks have in LEFI or LECAP, “something that can happen for both ‘bad reasons’, such as an increase in the perception of sovereign risk, and for ‘good reasons’, such as an increase in the demand for private credit,” said the consultancy. According to analysts, there was a combination of both issues.

Initially, it would seem that the largest portion corresponded to the demand for liquidity from financial institutions due to precautionary behavior in the face of market volatility, which led them to increase their reserve requirements.

image.png

“In recent days, The monetary base experienced a considerable increase driven by the reserve requirements. In net terms, a large part of this increase comes from the dismantling of LEFI that are transformed into reserves,” they said from Romano Group.

Specifically, between July 25 and August 2 (latest available data), the monetary base grew by $2.88 trillion to reach $23.29 trillion. The bulk of this increase was due to the rise in deposits that financial institutions have at the BCRA ($2.62 trillion). This is a process that occurred throughout July, a month in which the base expanded by 10.6% monthly at constant prices and without seasonality, according to the Central Bank’s Monetary Report.

Gabriel Caamanoan economist at the consulting firms Outlier and Ledesma, told Scope that many times at the end of the month it happens that banks have to “apply to lace the pesos to comply with the minimum requirements regulations”, although on this occasion the process continued in the first days of August. In addition, he stated that Another part could be used for loans to the private sector..

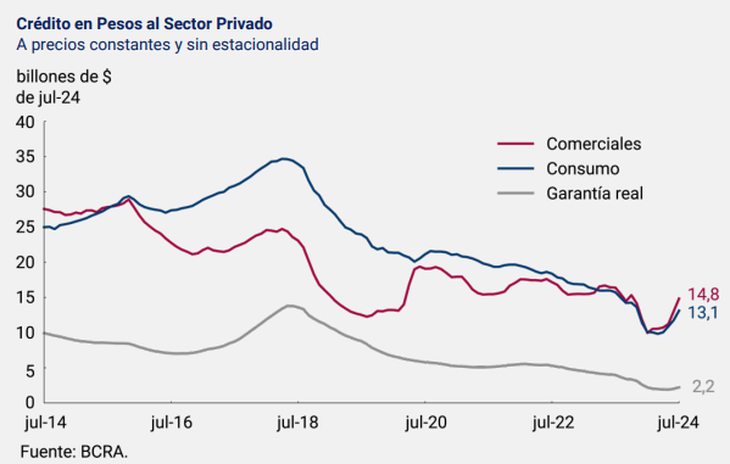

According to data from the BCRA, in July, credit in pesos to the private sector grew by 12.7% at constant prices without seasonality. This was the fourth consecutive monthly growth, although it has come from historically low levels.

image.png

In any case, the monetary expansion is part of the objective set by the entity headed by Santiago Bausili in the new Monetary Framework that was published weeks ago. There, it defined as an objective that the amount of pesos in the economy grows to the level in effect on April 30 ($47.7 billion). That is, the limit set gives a $24.5 trillion growth margin from $23.29 trillion as of August 2.

“It is a sum that could be covered by the dismantling of LEFI in the face of increased demand for credit and even by the dismantling of a portion of the amounts that the Treasury has placed in the BCRA,” said the consultancy. LCG. Although he questioned the lack of clarity of the strategy chosen by the economic team. “The limit imposed on the monetary base (BM) is a difficult goal to understand: very lax for the short term, very hard for the medium term”he said.

“Once the self-imposed limit on the BM is reached, we will see how the BCRA will resolve the contradiction that arises between zero issuance and a credit growth target (with associated endogenous issuance) and recomposition of the currency in circulation. New announcements may be required, but this time we hope that they will be more consistent,” he concluded.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.