While the market is focusing on a red in net reserves that prevents a reduction in country risk and is still looking with uncertainty at the new monetary framework announced by the economic team, analysts are also focusing on the Treasury peso debtwhich increased after the migration of liabilities from the Central Bank. By the end of the year, the Government will face maturities of more than $34 billion. Once this debt handrail is completed, the magnifying glass moves to the “roll over” of these commitments and sheds light on a financial program whose fate for now seems to remain tied to the continuity of the exchange rate restrictions.

The Ministry of The economy will announce this Monday the conditions for the first tender of debt in pesos in Augustwhich will take place on Wednesday. There, according to data from the Congressional Budget Officemust renew maturities for just over $1.2 trillion. Towards the end of the month, it will hold another auction, which will concentrate commitments worth around $4 billion.

As already pointed out Scope On repeated occasions, the strategy of eliminating the remunerated liabilities of the BCRA to end the endogenous issuance associated with the payment of interest for overnight repurchase agreements and replacing them with Treasury debt had as a correlate a greater concentration of short-term maturities for the driving portfolio Luis Caputowhich would not by itself clear up the conditions for removing the restriction (even less so in times of deterioration of reserves).

Initially, a large portion of the BCRA’s bulging stock of remunerated liabilities in pesos held by the banks migrated to public securities, especially to LECAP (fixed rate bills), driven by the economic team. The transition was completed on July 22, with the suspension of passive swap operations and their replacement by the new ones. Liquidity Tax Letters (LEFI) at one year, issued by the Treasury (which now takes charge of paying the interest with a greater adjustment) but managed daily by the BCRA.

As a result, the profile of short-term maturities that the Finance Secretariat will have to face was overloaded, Pablo Quirno. Between August and December, commitments amount to $34.7 billion (net of temporary advances from the Central Bank), according to estimates by the consulting firm Eco Go based on official data. According to these calculations, Almost all ($33.2 trillion) is in the hands of the private sectorwithin which banks are the main player with their LECAP holdings.

image.png

In detail, $5.41 trillion will mature in August; $14.07 trillion in September; $5.15 trillion in October; $5.67 trillion in November; and $4.39 trillion in December. Over the next few years, there are commitments in pesos for $111 trillion in 2025, $80 trillion in 2026, and $54 trillion in 2027, although in these cases the proportion will be in the hands of public bodies.

While officials and the president himself Javier Milei identified, at the time, the elimination of the remunerated liabilities of the BCRA as a key condition for the lifting of the exchange rate restriction (to which others were later added), the truth is that the transfer of that mass of pesos to the Treasury balance sheet does not prevent the counterpart of the public securities acquired by the banks from continuing to have the deposits of the savers as their counterpart. And, in a context of negative net reserves At around US$6 billion, the need to renew these maturities continues to be a limitation when considering removing exchange controls.

Debt maturities and foreign exchange restrictions

Eco Go, the consultancy run by Marina Dal Poggettoestimated that the concentration of Debt maturities in pesos for the remainder of the year reach 5 percentage points of GDPwhich results ten times higher than the remaining primary surplus included in the Government’s objectives (0.5% of GDP, consistent with the target of 1.7% of GDP for the year). To which we must add the maturities in dollars.

“Given the stock of inherited debt (that of the BCRA and that of the Treasury), fiscal consolidation is not sufficient to ensure the disappearance of fiscal dominance. Transferring the debt from the BCRA to the Treasury is useless if the country risk does not collapse and if the Treasury cannot put together a financial program that does not depend on the currency controls to refinance the largest debt maturities.“, Eco Go warned in its latest monthly report.

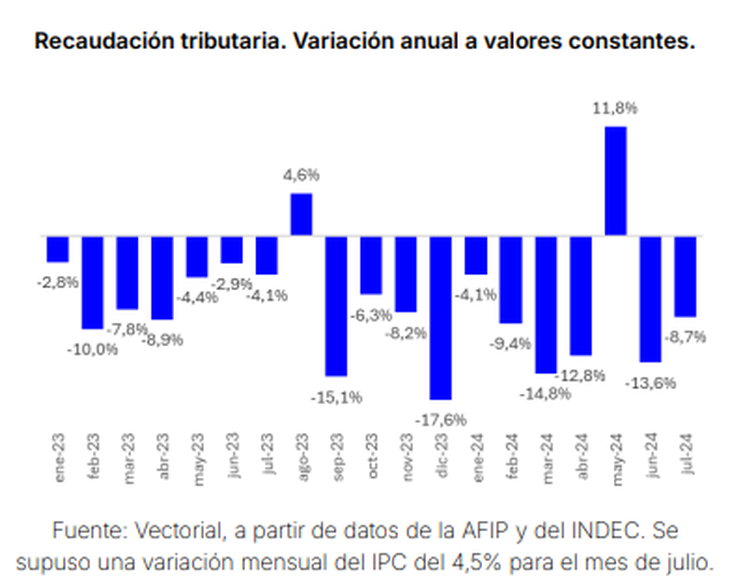

Furthermore, this fiscal consolidation, which is one of the main banners of the Government, is not free from doubts given the fall in revenue and the reversal of the PAIS tax rate to 7.5% that the Government anticipated.

This is how the consulting firm put it Vectorialdirected by Eduardo Hecker: “The government’s fiscal situation would be aggravated by the elimination of taxes that in 2024 will have been those that support tax collection (in the context of real falls that will have been around 10%). In turn, this tax cut could be offset by the reinstatement of the income tax, reduction in subsidies for public services and, if that is not enough, appealing to the probable but insufficient economic growth.” And he maintained that “we are still very far from knowing the final result of that account that will determine the movement (or not) of the fiscal anchor in 2025.”

image.png

Meanwhile, Country risk remains above 1,550 basis points and shows that investors are not buying Luis Caputo’s roadmap. “At the moment, the debt maturities in dollars are still being paid with reserves that are still scarce, with a BCRA that stopped buying dollars in June. The debt maturities in pesos, mostly within the balance sheets of the banks, are refinanced within the currency exchange control,” said Eco Go.

And he added: “Seven months after the program began and despite having transformed the inherited primary deficit of 2.7% of GDP into a surplus of 1.2% of GDP, via an adjustment of public spending of 5.7 percentage points of GDP while maintaining social consensus, “dependence on the cepo remains intact”.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.