A priori, Werning He stressed that economic progress can already be seen in certain sectors and “in wages“, although these have not yet reached the levels prior to the devaluation in December. He also stressed that political support for the Government remains strong even though “there is still work to be done.”

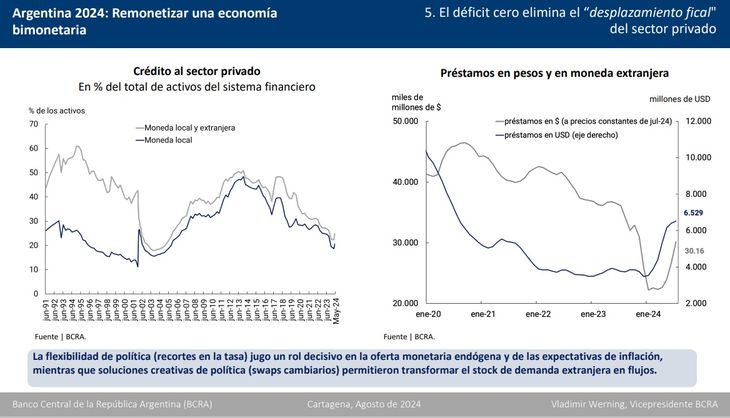

Werning He explained to a packed auditorium that the government of Javier Milei The government managed to avoid hyperinflation that seemed imminent due to the policies of the previous administration. This change of direction created a more favorable environment for the “remonetization” of an economy that has historically depended on two currencies. “Now, banks are beginning to allocate credits in both pesos and dollars to the private sector, instead of financing the State’s deficit,” he said.

And it is that, according to Werningrecent data suggests that Argentines are regaining confidence in their currency. This is despite the fact that Milei had called it “excrement” when dollarization was the basis of his government plan. From Colombia, the official emphasized the progress in the accumulation of reserves.

What Werning said about the cepo and the reserves

As for the exchange rate trap, Werning He conveyed the calm of the Government and the lack of urgency to eliminate it. He pointed out that the gradual opening will depend on the excess of pesos accumulated during years of restrictions and excessive spending being equal to the international reserves, which although recovering, are still low, he admitted.

A hasty uprising could artificially alter the exchange rate and negatively affect wages. Therefore, the removal of the cepo will be gradual and carefully planned.

BCRA Werning.jpeg

He assured that the decline in reservations in the last two months was expected and that the International Monetary Fund (IMF) I was warned since the beginning of the year. Werning The economic team believes that this movement is a transitional phase on the road to returning to the markets. The economic team is confident that if the banks buy into the BCRA’s policies, the markets will do so as well.

This process is crucial to avoid relying excessively on reserves to pay debt or implement severe fiscal adjustments that could slow economic recovery. Werningthe change of direction is underway: “The Government is showing a financial surplus and a stable dollar, and is gradually rebuilding confidence, an intangible that had been lost a long time ago,” he said from the Colombian city.

Fiscal surplus and shortage of pesos

Werning also presented an analysis of how recurring deficits in public accounts had undermined the BCRA’s objectives, outlining four phases of deterioration. In the initial stages, the bank began to lose its control instruments, then hid the deficit on its balance sheet, and finally became the lender of last resort, issuing pesos to cover the government’s needs. According to Werning, the BCRA’s lack of credibility and the insatiable demands of the treasury had seriously compromised the entity’s future.

Werning.jpeg

For the third and fourth quarters, remonetization is expected, driven by the fiscal surplus and the shortage of pesos in circulation. Credit is beginning to grow with low leverage for private companies, and the recent approval of the money laundering, together with an energy surplus, is considered to contribute positively.

The Ministry of Economy recognizes that there will always be risks. The current strategy is to use a decrease in inflation to influence economic expectations, reduce the perception of a possible sharp adjustment and close the gap between the financial and official exchange rates. The priority remains the reduction of inflation, while the cost of completely eliminating the exchange rate restriction is being questioned.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.